Stock Analysis

What Did Time Technoplast's (NSE:TIMETECHNO) CEO Take Home Last Year?

The CEO of Time Technoplast Limited (NSE:TIMETECHNO) is Anil Jain, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Time Technoplast

How Does Total Compensation For Anil Jain Compare With Other Companies In The Industry?

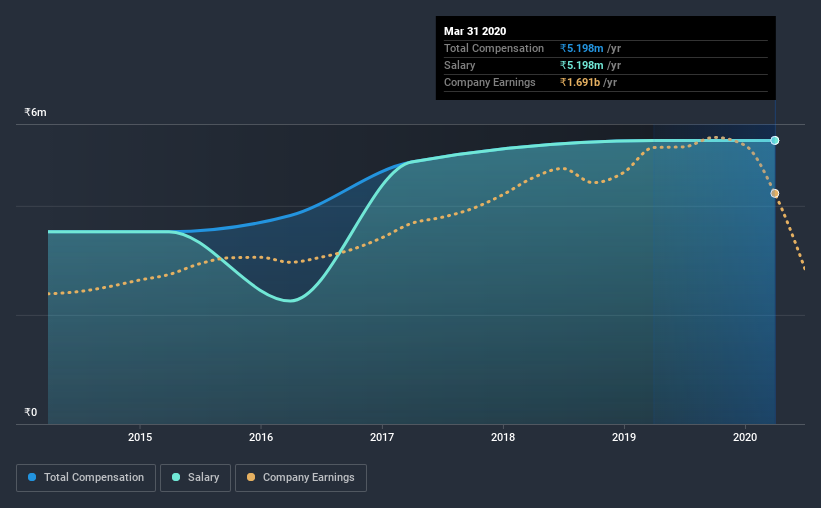

At the time of writing, our data shows that Time Technoplast Limited has a market capitalization of ₹9.4b, and reported total annual CEO compensation of ₹5.2m for the year to March 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹5.2m.

On comparing similar-sized companies in the industry with market capitalizations below ₹15b, we found that the median total CEO compensation was ₹4.4m. So it looks like Time Technoplast compensates Anil Jain in line with the median for the industry. Furthermore, Anil Jain directly owns ₹149m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹5.2m | ₹5.2m | 100% |

| Other | - | - | - |

| Total Compensation | ₹5.2m | ₹5.2m | 100% |

Talking in terms of the industry, salary represented approximately 100% of total compensation out of all the companies we analyzed, while other remuneration made up 0.3% of the pie. On a company level, Time Technoplast prefers to reward its CEO through a salary, opting not to pay Anil Jain through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Time Technoplast Limited's Growth

Over the last three years, Time Technoplast Limited has shrunk its earnings per share by 10% per year. Its revenue is down 13% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Time Technoplast Limited Been A Good Investment?

With a three year total loss of 77% for the shareholders, Time Technoplast Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Time Technoplast pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As previously discussed, Anil is compensated close to the median for companies of its size, and which belong to the same industry. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in Time Technoplast we think you should know about.

Switching gears from Time Technoplast, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Time Technoplast, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Time Technoplast is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TIMETECHNO

Time Technoplast

Engages in manufacture and sale of a range of technology-based polymer and composite products in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.