- United States

- /

- Capital Markets

- /

- NasdaqGS:CME

What Can We Learn About CME Group's (NASDAQ:CME) CEO Compensation?

Terry Duffy became the CEO of CME Group Inc. (NASDAQ:CME) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for CME Group.

View our latest analysis for CME Group

Comparing CME Group Inc.'s CEO Compensation With the industry

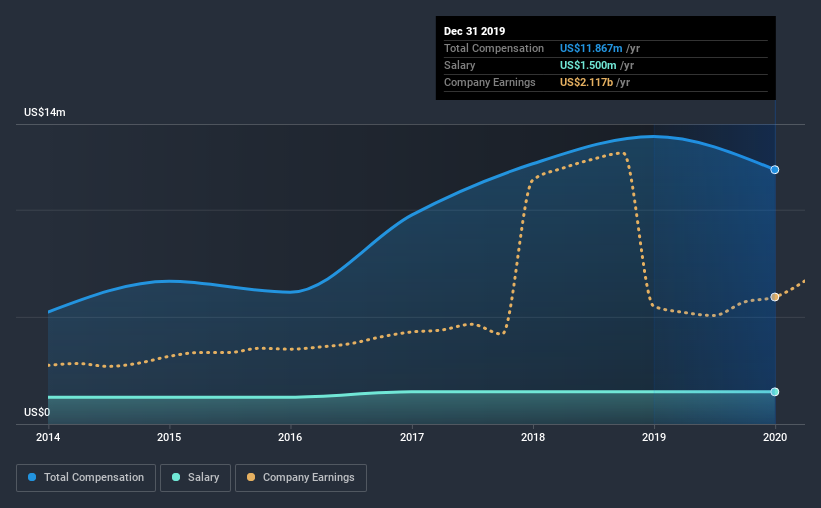

According to our data, CME Group Inc. has a market capitalization of US$60b, and paid its CEO total annual compensation worth US$12m over the year to December 2019. We note that's a decrease of 12% compared to last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$1.5m.

For comparison, other companies in the industry with market capitalizations above US$8.0b, reported a median total CEO compensation of US$12m. This suggests that CME Group remunerates its CEO largely in line with the industry average. Furthermore, Terry Duffy directly owns US$11m worth of shares in the company, implying that they are deeply invested in the company's success.

On an industry level, around 13% of total compensation represents salary and 87% is other remuneration. Our data reveals that CME Group allocates salary more or less in line with the wider market. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at CME Group Inc.'s Growth Numbers

Over the past three years, CME Group Inc. has seen its earnings per share (EPS) grow by 13% per year. Its revenue is up 19% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has CME Group Inc. Been A Good Investment?

Most shareholders would probably be pleased with CME Group Inc. for providing a total return of 50% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we noted earlier, CME Group pays its CEO in line with similar-sized companies belonging to the same industry. The company is growing earnings per share and total shareholder returns have been pleasing. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for CME Group that you should be aware of before investing.

Important note: CME Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade CME Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:CME

CME Group

Operates contract markets for the trading of futures and options on futures contracts worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.