Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Kingbo Strike (HKG:1421) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for Kingbo Strike

Does Kingbo Strike Have A Long Cash Runway?

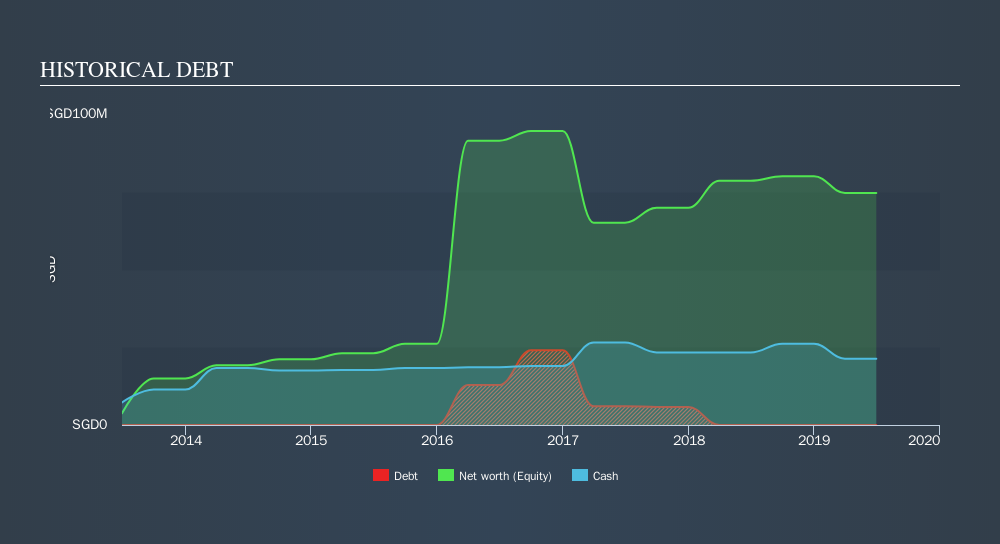

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2019, Kingbo Strike had cash of S$21m and no debt. Importantly, its cash burn was S$4.5m over the trailing twelve months. So it had a cash runway of about 4.7 years from June 2019. A runway of this length affords the company the time and space it needs to develop the business. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Kingbo Strike Growing?

Kingbo Strike managed to reduce its cash burn by 74% over the last twelve months, which suggests it's on the right flight path. And while hardly exciting, it was still good to see revenue growth of 20% during that time. It seems to be growing nicely. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Kingbo Strike is building its business over time.

Can Kingbo Strike Raise More Cash Easily?

We are certainly impressed with the progress Kingbo Strike has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash to drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of HK$250m, Kingbo Strike's S$4.5m in cash burn equates to about 10% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Kingbo Strike's Cash Burn?

As you can probably tell by now, we're not too worried about Kingbo Strike's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! Looking at all the measures in this article, together, we're not worried about its rate of cash burn, which seems to be under control. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Kingbo Strike insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1421

Prosperity Group International

An investment holding company, engages in the supply and installation of solar photovoltaic parts and equipment in the People's Republic of China.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives