David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Vimta Labs Limited (NSE:VIMTALABS) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View 4 warning signs we detected for Vimta Labs

How Much Debt Does Vimta Labs Carry?

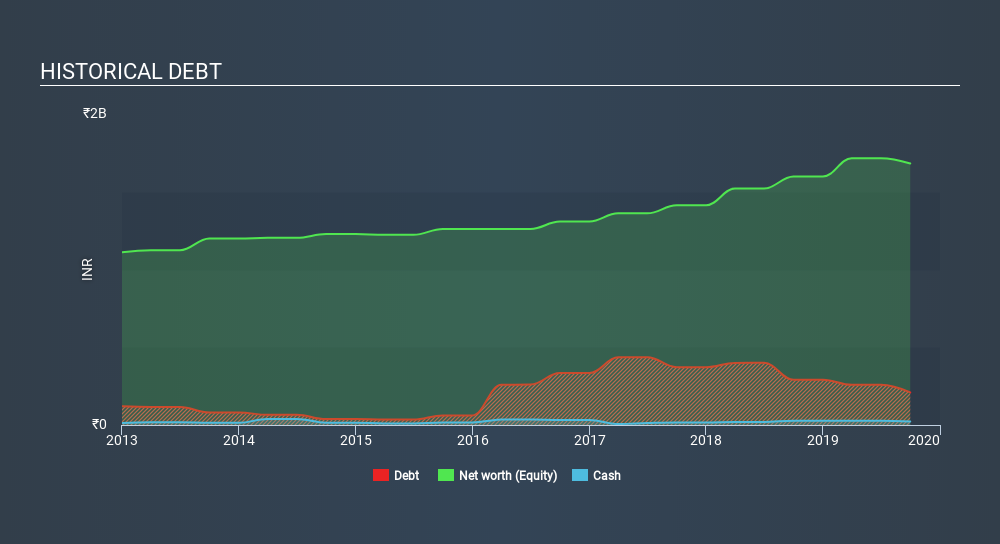

The image below, which you can click on for greater detail, shows that Vimta Labs had debt of ₹209.5m at the end of September 2019, a reduction from ₹291.2m over a year. On the flip side, it has ₹22.9m in cash leading to net debt of about ₹186.6m.

How Healthy Is Vimta Labs's Balance Sheet?

The latest balance sheet data shows that Vimta Labs had liabilities of ₹518.7m due within a year, and liabilities of ₹172.2m falling due after that. Offsetting these obligations, it had cash of ₹22.9m as well as receivables valued at ₹614.4m due within 12 months. So its liabilities total ₹53.5m more than the combination of its cash and short-term receivables.

Since publicly traded Vimta Labs shares are worth a total of ₹1.98b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Vimta Labs's net debt is only 0.45 times its EBITDA. And its EBIT covers its interest expense a whopping 147 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The modesty of its debt load may become crucial for Vimta Labs if management cannot prevent a repeat of the 46% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Vimta Labs will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Vimta Labs's free cash flow amounted to 31% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Vimta Labs's EBIT growth rate was a real negative on this analysis, although the other factors we considered were considerably better There's no doubt that its ability to to cover its interest expense with its EBIT is pretty flash. When we consider all the factors mentioned above, we do feel a bit cautious about Vimta Labs's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 4 warning signs for Vimta Labs which any shareholder or potential investor should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:VIMTALABS

Vimta Labs

Provides contract research and testing services in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives