- Hong Kong

- /

- Construction

- /

- SEHK:8535

Volatility 101: Should Vistar Holdings (HKG:8535) Shares Have Dropped 31%?

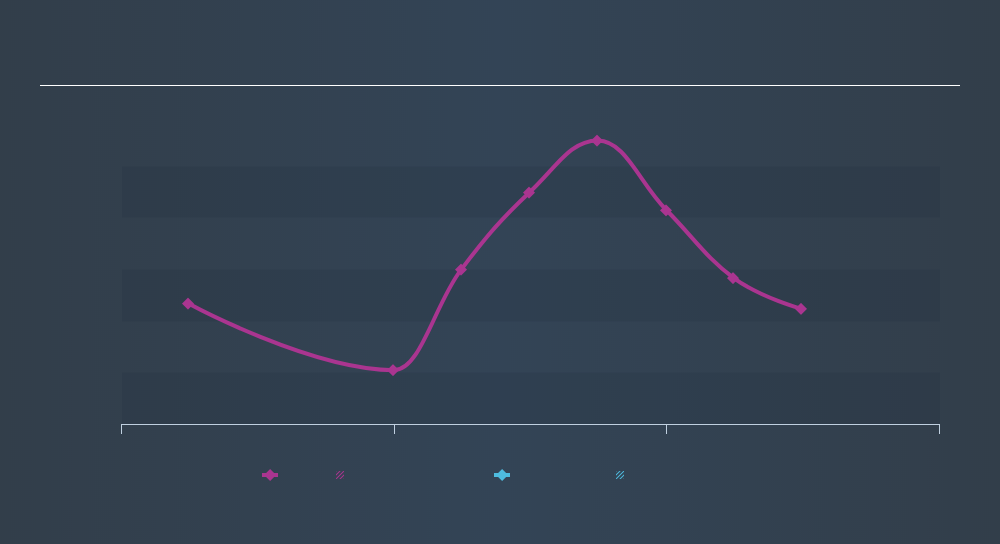

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Investors in Vistar Holdings Limited (HKG:8535) have tasted that bitter downside in the last year, as the share price dropped 31%. That's disappointing when you consider the market returned -4.7%. Vistar Holdings may have better days ahead, of course; we've only looked at a one year period. In the last ninety days we've seen the share price slide 49%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for Vistar Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, Vistar Holdings had to report a 41% decline in EPS over the last year. This fall in the EPS is significantly worse than the 31% the share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

Dive deeper into Vistar Holdings's key metrics by checking this interactive graph of Vistar Holdings's earnings, revenue and cash flow.

A Different Perspective

We doubt Vistar Holdings shareholders are happy with the loss of 31% over twelve months. That falls short of the market, which lost 4.7%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. Notably, the loss over the last year isn't as bad as the 49% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Vistar Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:8535

Vistar Holdings

An investment holding company, provides electrical and mechanical engineering services in Hong Kong.

Excellent balance sheet moderate.

Market Insights

Community Narratives