- Hong Kong

- /

- Metals and Mining

- /

- SEHK:581

Volatility 101: Should China Oriental Group (HKG:581) Shares Have Dropped 48%?

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in China Oriental Group Company Limited (HKG:581) have tasted that bitter downside in the last year, as the share price dropped 48%. That contrasts poorly with the market return of -6.9%. China Oriental Group may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 30% in the last three months.

See our latest analysis for China Oriental Group

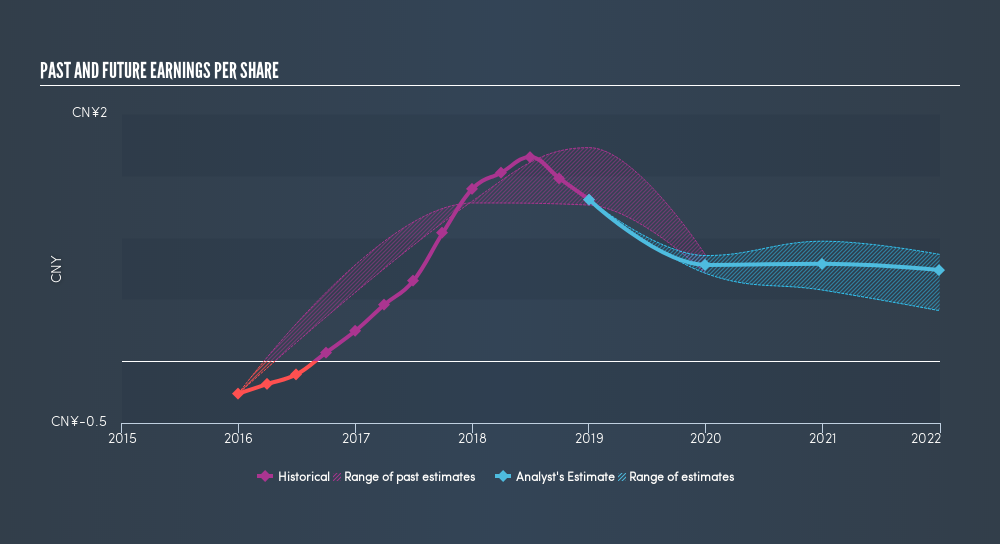

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unhappily, China Oriental Group had to report a 6.2% decline in EPS over the last year. The share price decline of 48% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The less favorable sentiment is reflected in its current P/E ratio of 2.13.

We know that China Oriental Group has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on China Oriental Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of China Oriental Group, it has a TSR of -44% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

China Oriental Group shareholders are down 44% for the year (even including dividends), even worse than the market loss of 6.9%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 30%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Keeping this in mind, a solid next step might be to take a look at China Oriental Group's dividend track record. This free interactive graph is a great place to start.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:581

China Oriental Group

Manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives