Volatility 101: Should B.R.A.I.N. Biotechnology Research and Information Network (ETR:BNN) Shares Have Dropped 42%?

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term B.R.A.I.N. Biotechnology Research and Information Network AG (ETR:BNN) shareholders, since the share price is down 42% in the last three years, falling well short of the market return of around 16%. Unhappily, the share price slid 2.3% in the last week.

View our latest analysis for B.R.A.I.N. Biotechnology Research and Information Network

B.R.A.I.N. Biotechnology Research and Information Network wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, B.R.A.I.N. Biotechnology Research and Information Network saw its revenue grow by 17% per year, compound. That's a fairly respectable growth rate. Shareholders have seen the share price fall at 17% per year, for three years. This implies the market had higher expectations of B.R.A.I.N. Biotechnology Research and Information Network. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

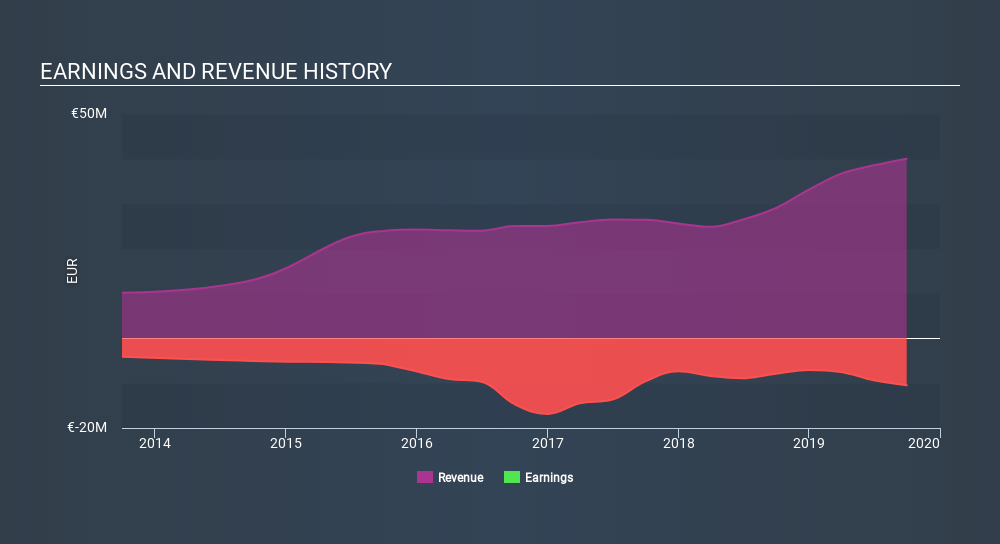

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, B.R.A.I.N. Biotechnology Research and Information Network shareholders took a loss of 7.2%. In contrast the market gained about 16%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Unfortunately, the longer term story isn't pretty, with investment losses running at 17% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. You could get a better understanding of B.R.A.I.N. Biotechnology Research and Information Network's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives