- Hong Kong

- /

- Infrastructure

- /

- SEHK:995

Volatility 101: Should Anhui Expressway (HKG:995) Shares Have Dropped 21%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Anhui Expressway Company Limited (HKG:995) shareholders have had that experience, with the share price dropping 21% in three years, versus a market return of about 31%. Furthermore, it's down 12% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 6.7% in the same timeframe.

Check out our latest analysis for Anhui Expressway

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

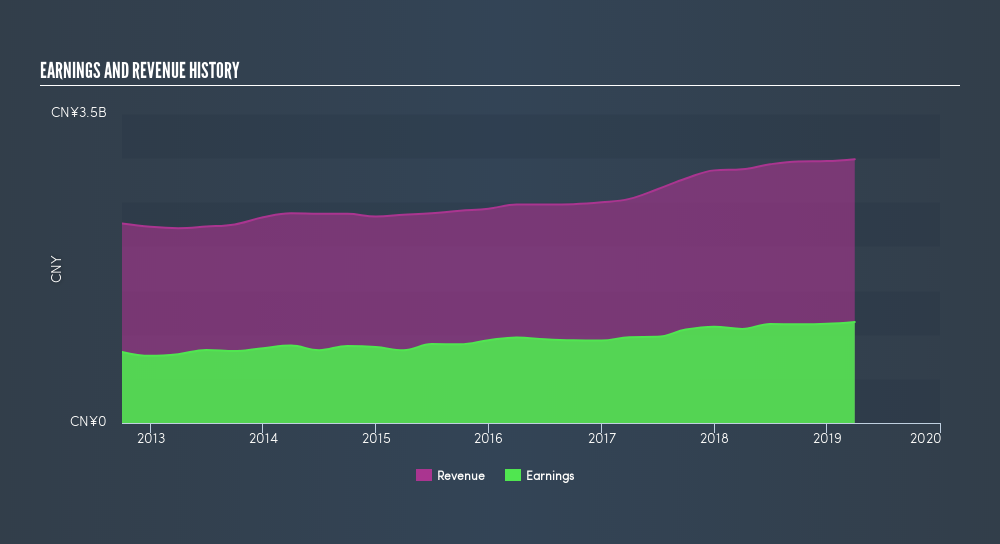

Although the share price is down over three years, Anhui Expressway actually managed to grow EPS by 5.7% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. We like that Anhui Expressway has actually grown its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Anhui Expressway the TSR over the last 3 years was -7.8%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Anhui Expressway has rewarded shareholders with a total shareholder return of 8.4% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 5.6%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before forming an opinion on Anhui Expressway you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:995

Anhui Expressway

Engages in the construction, operation, management, and development of the toll roads and associated service sections in the People's Republic of China.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives