The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Valmet Oyj (HEL:VALMT) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Valmet Oyj

How Much Debt Does Valmet Oyj Carry?

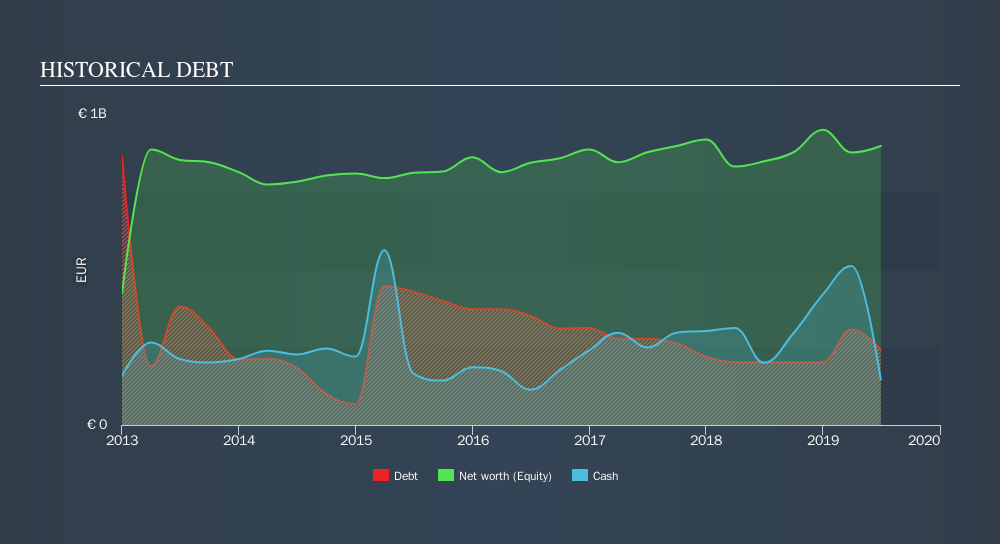

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Valmet Oyj had €242.0m of debt, an increase on €202.0m, over one year. However, because it has a cash reserve of €146.0m, its net debt is less, at about €96.0m.

How Healthy Is Valmet Oyj's Balance Sheet?

We can see from the most recent balance sheet that Valmet Oyj had liabilities of €1.77b falling due within a year, and liabilities of €504.0m due beyond that. Offsetting these obligations, it had cash of €146.0m as well as receivables valued at €958.0m due within 12 months. So it has liabilities totalling €1.17b more than its cash and near-term receivables, combined.

Valmet Oyj has a market capitalization of €2.73b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Valmet Oyj has a low net debt to EBITDA ratio of only 0.29. And its EBIT easily covers its interest expense, being 88.7 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. On top of that, Valmet Oyj grew its EBIT by 39% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Valmet Oyj can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Valmet Oyj recorded free cash flow worth a fulsome 90% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Valmet Oyj's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Looking at the bigger picture, we think Valmet Oyj's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Valmet Oyj's dividend history, without delay!

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives