- India

- /

- Healthcare Services

- /

- NSEI:SASTASUNDR

Update: Sastasundar Ventures (NSE:SASTASUNDR) Stock Gained 47% In The Last Five Years

Stock pickers are generally looking for stocks that will outperform the broader market. Buying under-rated businesses is one path to excess returns. To wit, the Sastasundar Ventures share price has climbed 47% in five years, easily topping the market return of 38% (ignoring dividends).

Check out our latest analysis for Sastasundar Ventures

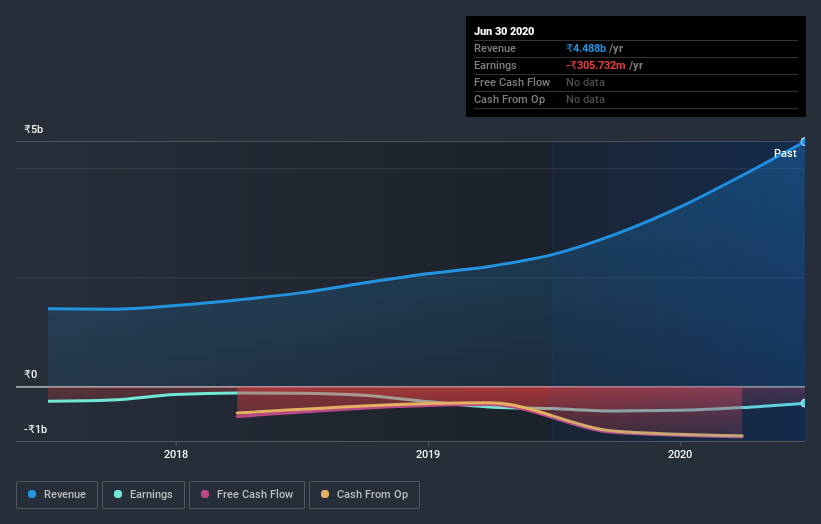

Sastasundar Ventures isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Sastasundar Ventures can boast revenue growth at a rate of 34% per year. That's well above most pre-profit companies. While the compound gain of 8% per year is good, it's not unreasonable given the strong revenue growth. If you think there could be more growth to come, now might be the time to take a close look at Sastasundar Ventures. Opportunity lies where the market hasn't fully priced growth in the underlying business.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Sastasundar Ventures' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Sastasundar Ventures has rewarded shareholders with a total shareholder return of 43% in the last twelve months. That's better than the annualised return of 8% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Sastasundar Ventures better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Sastasundar Ventures (of which 2 are significant!) you should know about.

Of course Sastasundar Ventures may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Sastasundar Ventures or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SASTASUNDR

Sastasundar Ventures

Operates a digital network of healthcare and portfolio management services in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives