As October draws to a close, Canadian markets have managed to maintain their momentum, closing near record highs despite global economic uncertainties and cautious central bank policies. In this climate, investors are increasingly looking for opportunities that balance potential growth with financial stability. Penny stocks, often representing smaller or newer companies, continue to offer intriguing possibilities for those willing to explore beyond the mainstream. By focusing on those with strong fundamentals and solid balance sheets, investors can uncover hidden gems that may provide both stability and upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.53 | CA$65.48M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.42 | CA$238.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.395 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.385 | CA$56.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.05 | CA$705.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.05 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.00 | CA$149.22M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.115 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

DIRTT Environmental Solutions (TSX:DRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DIRTT Environmental Solutions Ltd. operates as an interior construction company in Canada with a market cap of CA$189.91 million.

Operations: The company generates revenue through its Building Products segment, which totaled $172.48 million.

Market Cap: CA$189.91M

DIRTT Environmental Solutions, with a market cap of CA$189.91 million, is trading significantly below its estimated fair value, suggesting potential undervaluation. The company has become profitable recently and forecasts indicate strong earnings growth ahead. DIRTT's financial position shows short-term assets comfortably covering liabilities and satisfactory net debt levels. However, the increase in debt to equity ratio over five years warrants attention. Recent project awards, including a $3.5 million contract with Google and a $16 million healthcare project with Allina Health, highlight commercial momentum across sectors despite low return on equity at 11.2%.

- Dive into the specifics of DIRTT Environmental Solutions here with our thorough balance sheet health report.

- Understand DIRTT Environmental Solutions' earnings outlook by examining our growth report.

Tantalus Systems Holding (TSX:GRID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tantalus Systems Holding Inc. is a technology company that offers smart grid solutions in Canada and the United States, with a market cap of CA$230.94 million.

Operations: The company generates revenue through two main segments: Connected Devices and Infrastructure, which contributes $31.51 million, and Utility Software Applications and Services, accounting for $17.66 million.

Market Cap: CA$230.94M

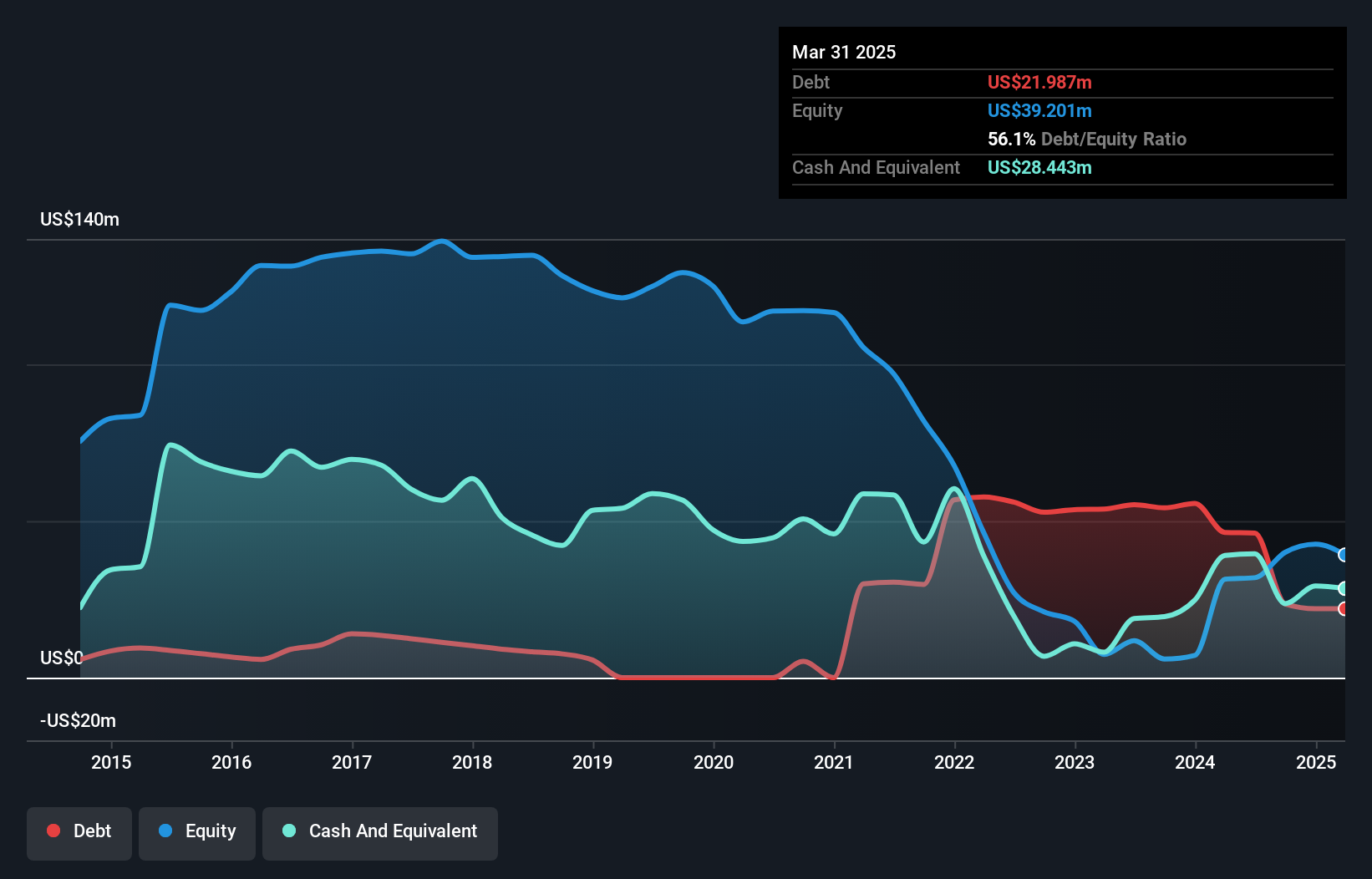

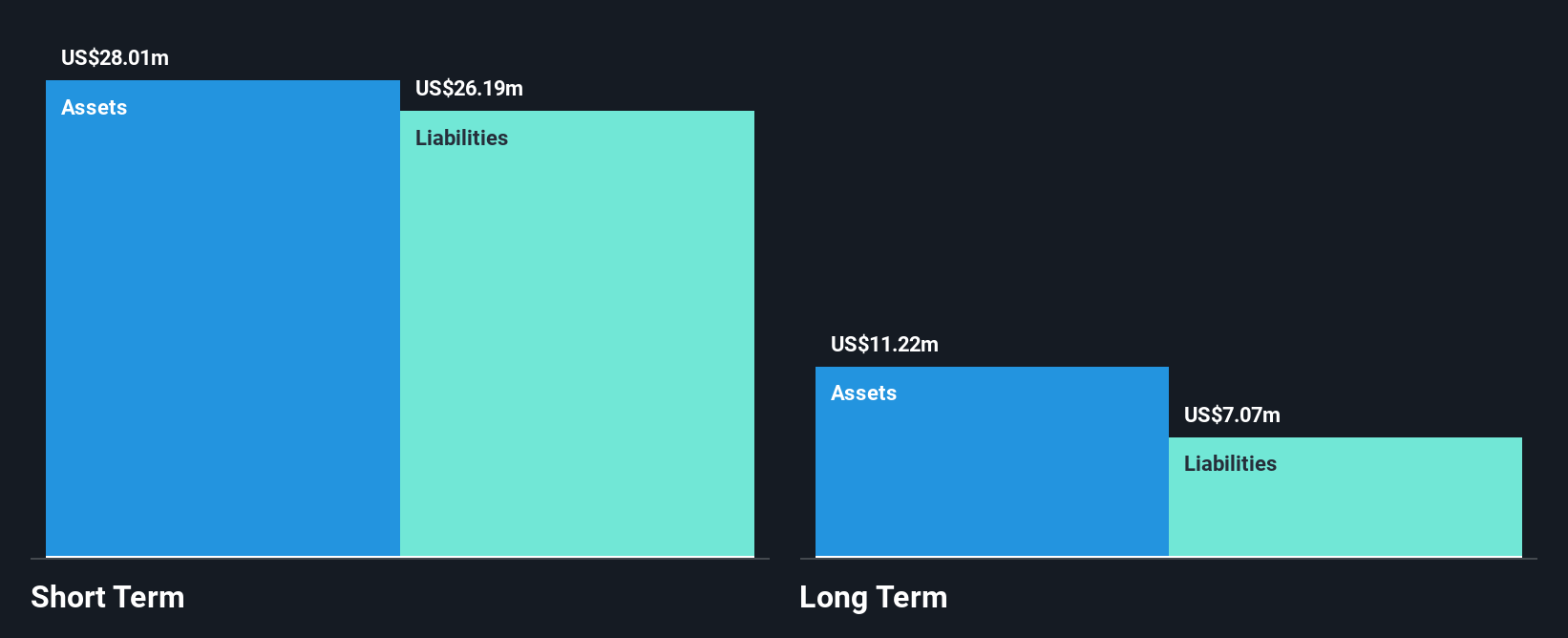

Tantalus Systems Holding, with a market cap of CA$230.94 million, operates in the smart grid solutions sector and is currently unprofitable. Despite this, it has shown resilience by reducing losses over five years and maintaining a stable weekly volatility of 8%. The company reported second-quarter sales of US$13.09 million, an increase from the previous year. Tantalus holds more cash than its total debt and has sufficient cash runway for over three years due to positive free cash flow growth. Its management team and board are experienced, with average tenures of 4.3 and 8.1 years respectively.

- Click to explore a detailed breakdown of our findings in Tantalus Systems Holding's financial health report.

- Evaluate Tantalus Systems Holding's prospects by accessing our earnings growth report.

Leading Edge Materials (TSXV:LEM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Leading Edge Materials Corp. focuses on the exploration and development of resource properties in Sweden and Romania, with a market cap of CA$72.51 million.

Operations: Leading Edge Materials Corp. does not report any revenue segments.

Market Cap: CA$72.51M

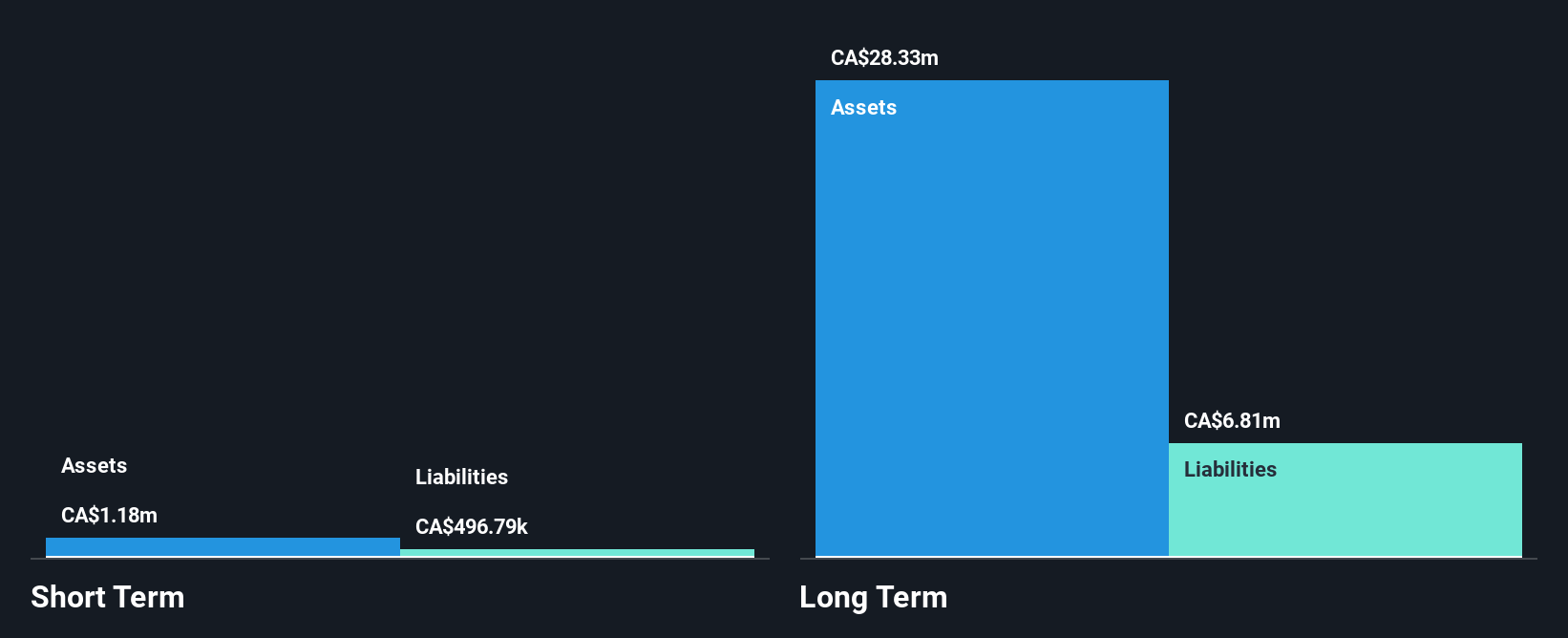

Leading Edge Materials Corp., with a market cap of CA$72.51 million, is pre-revenue and focuses on resource properties in Sweden and Romania. The company recently submitted supplementary information for a 25-year mining lease application for the Norra Karr Heavy Rare Earth Elements Project, crucial due to Europe's reliance on China for HREEs. Despite being unprofitable, it has reduced losses over five years by 8.4% annually. Short-term assets cover short-term liabilities but not long-term ones; however, the company remains debt-free and recently raised CA$2.84 million through a private placement to extend its cash runway slightly beyond three months.

- Click here to discover the nuances of Leading Edge Materials with our detailed analytical financial health report.

- Gain insights into Leading Edge Materials' past trends and performance with our report on the company's historical track record.

Next Steps

- Discover the full array of 410 TSX Penny Stocks right here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tantalus Systems Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRID

Tantalus Systems Holding

A technology company, provides smart grid solutions in Canada and the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives