As we head into the second half of 2025, the Canadian market is closely watching developments in tariff and trade negotiations, particularly between the U.S. and China, which could influence economic growth and inflation. In this context of evolving global trade dynamics, investors might consider exploring opportunities beyond well-known stocks. Penny stocks—though an older term—remain relevant as they often represent smaller or newer companies with potential for growth; when backed by strong financial health, these stocks can offer surprising value and stability amidst broader market uncertainties.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.70 | CA$640.27M | ✅ 3 ⚠️ 4 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.26 | CA$692.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.49 | CA$190.13M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$532.24M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.88 | CA$20.61M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.29 | CA$96.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.19 | CA$119.51M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$184.07M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.99 | CA$5.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 889 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Canaf Investments (TSXV:CAF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Canaf Investments Inc., with a market cap of CA$16.60 million, owns and operates a coal processing business in South Africa.

Operations: Canaf Investments Inc. does not report any distinct revenue segments.

Market Cap: CA$16.6M

Canaf Investments Inc., with a market cap of CA$16.60 million, demonstrates financial stability through its short-term assets (CA$14.1M) exceeding both short-term liabilities (CA$3.4M) and long-term liabilities (CA$8.5K). The company is debt-free, reducing financial risk, and has shown consistent earnings growth over the past five years at 29.3% annually, although recent growth slowed to 1.6%. Despite this deceleration, net profit margins improved from 6.7% to 7.6%. Trading significantly below estimated fair value suggests potential undervaluation, while stable weekly volatility indicates manageable risk levels for investors in penny stocks.

- Navigate through the intricacies of Canaf Investments with our comprehensive balance sheet health report here.

- Evaluate Canaf Investments' historical performance by accessing our past performance report.

Thermal Energy International (TSXV:TMG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thermal Energy International Inc. develops, engineers, and supplies pollution control products, heat recovery systems, and condensate return solutions across North America, Europe, and internationally with a market cap of CA$24.24 million.

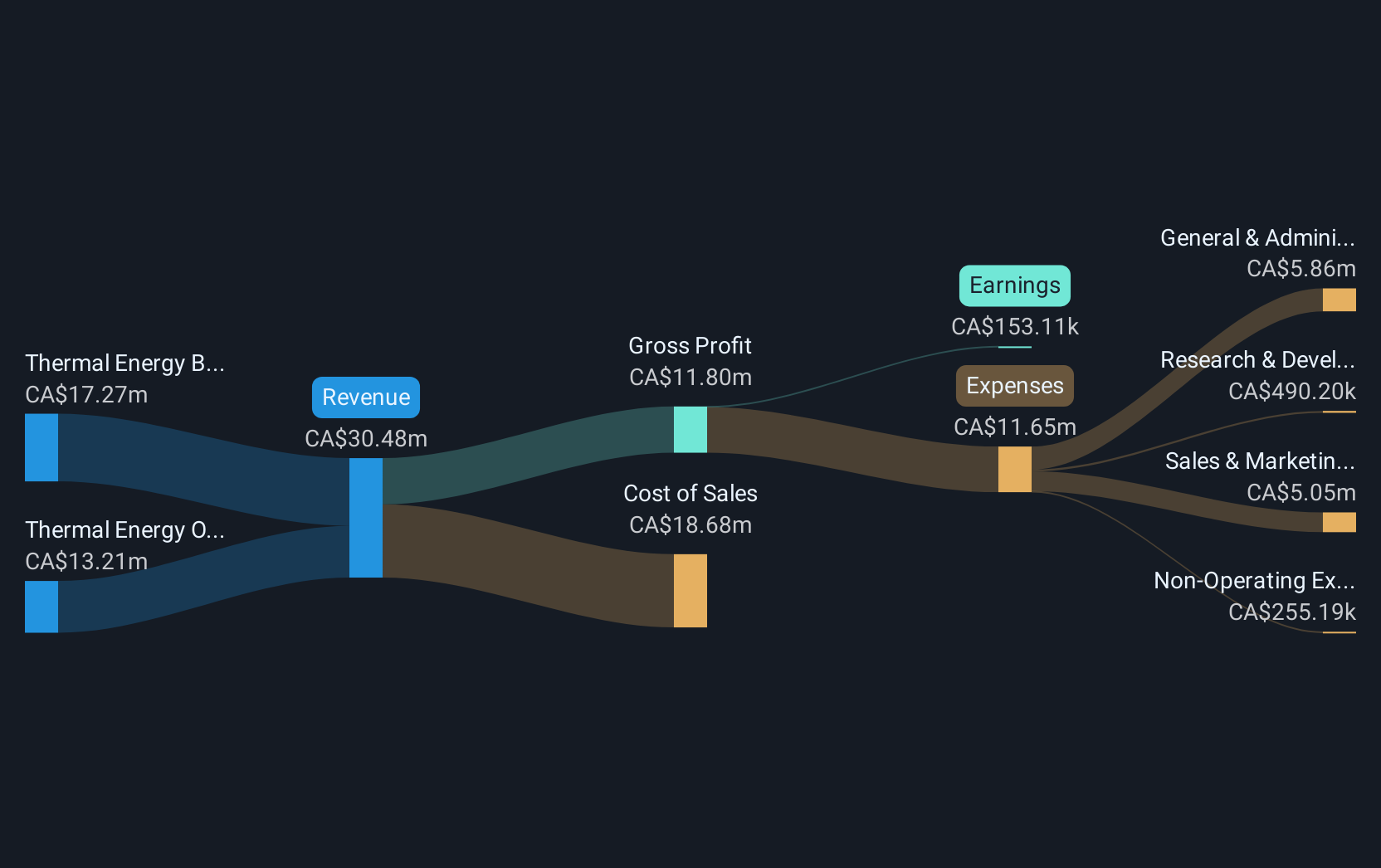

Operations: The company's revenue is derived from its operations in Ottawa, generating CA$13.21 million, and Bristol, contributing CA$17.27 million.

Market Cap: CA$24.24M

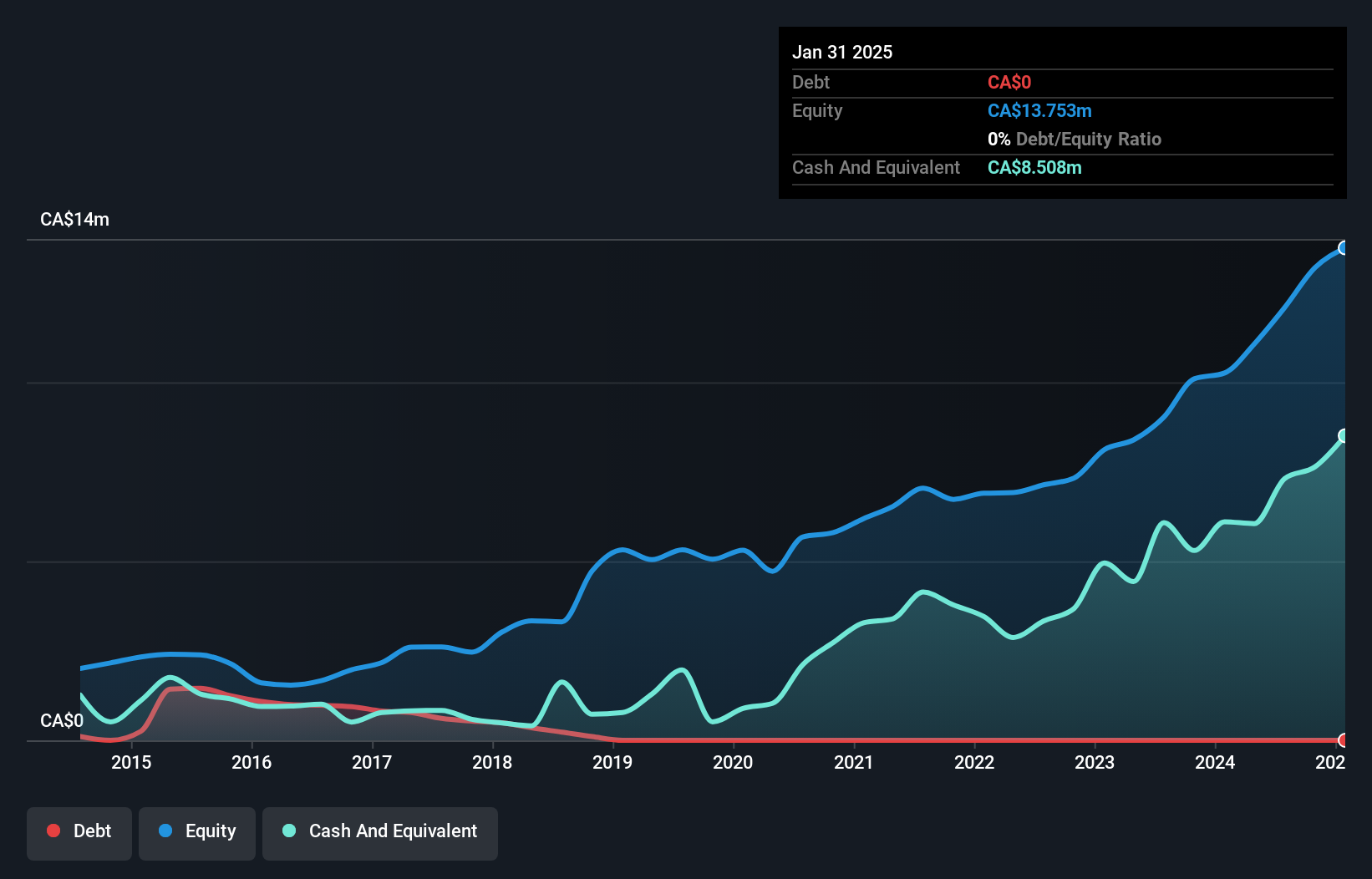

Thermal Energy International Inc., with a market cap of CA$24.24 million, shows mixed financial health. The company has more cash than debt, but its interest payments aren't well-covered by EBIT. Recent earnings indicate a net loss for the third quarter despite increased sales over nine months to CA$22.96 million from CA$18.35 million last year. The firm secured significant orders, including a CA$930,000 GEM order and a CAD 1 million heat recovery expansion project, indicating potential revenue growth. Trading at good value compared to peers and industry suggests possible undervaluation for penny stock investors seeking opportunities in sustainable technologies.

- Get an in-depth perspective on Thermal Energy International's performance by reading our balance sheet health report here.

- Learn about Thermal Energy International's future growth trajectory here.

Westport Fuel Systems (TSX:WPRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westport Fuel Systems Inc. specializes in engineering, manufacturing, and supplying alternative fuel systems and components for transportation applications globally, with a market cap of CA$69.31 million.

Operations: Westport Fuel Systems generates revenue primarily from its Light-duty segment at $263.08 million, followed by Heavy-duty OEM at $24.82 million, and High-pressure Controls & Systems contributing $7.80 million.

Market Cap: CA$69.31M

Westport Fuel Systems Inc., with a market cap of CA$69.31 million, faces challenges typical of penny stocks, including ongoing unprofitability and concerns about its ability to continue as a going concern. Despite generating significant revenue from its Light-duty segment at $263.08 million, the company reported declining sales in recent earnings results—USD 70.96 million for Q1 2025 compared to USD 77.57 million a year ago—and reduced net losses from USD 13.65 million to USD 2.45 million year-over-year for the same period. While short-term assets exceed liabilities, long-term profitability remains uncertain amidst forecasted earnings declines and auditor doubts.

- Click here to discover the nuances of Westport Fuel Systems with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Westport Fuel Systems' future.

Next Steps

- Explore the 889 names from our TSX Penny Stocks screener here.

- Seeking Other Investments? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westport Fuel Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WPRT

Westport Fuel Systems

Engages in the engineering, manufacturing, and supplying alternative fuel systems and components for use in transportation applications in Europe, Asia, North America, South America, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives