Stock Analysis

- India

- /

- Electrical

- /

- NSEI:TRITURBINE

Triveni Turbine's (NSE:TRITURBINE) Stock Price Has Reduced 44% In The Past Three Years

Triveni Turbine Limited (NSE:TRITURBINE) shareholders should be happy to see the share price up 19% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 44% in the last three years, falling well short of the market return.

Check out our latest analysis for Triveni Turbine

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Triveni Turbine actually saw its earnings per share (EPS) improve by 3.3% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. But it's possible a look at other metrics will be enlightening.

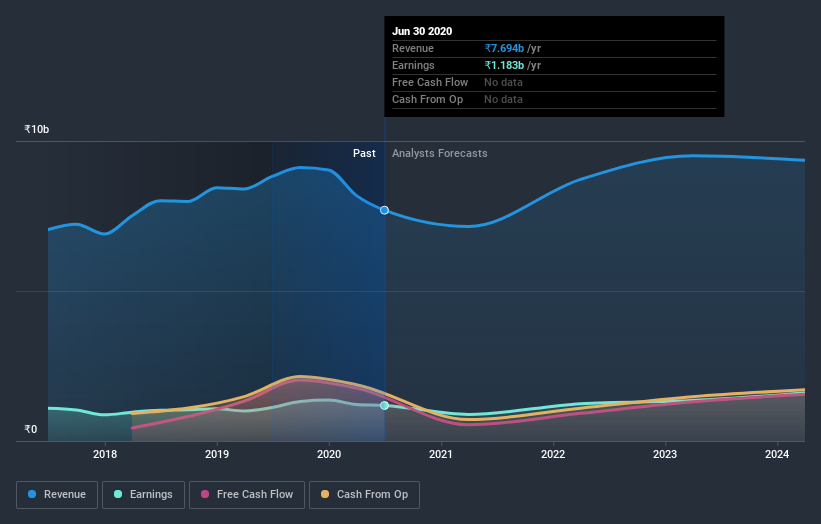

With a rather small yield of just 0.6% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 6.6% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Triveni Turbine further; while we may be missing something on this analysis, there might also be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Triveni Turbine stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Triveni Turbine's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Triveni Turbine's TSR of was a loss of 43% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Triveni Turbine shareholders are down 17% for the year (even including dividends), but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Triveni Turbine better, we need to consider many other factors. For example, we've discovered 1 warning sign for Triveni Turbine that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Triveni Turbine or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Triveni Turbine is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TRITURBINE

Triveni Turbine

Engages in the manufacture and supply of power generating equipment and solutions in India.

Flawless balance sheet with solid track record and pays a dividend.