Treasury Wine Estates Limited (ASX:TWE) is a company with exceptional fundamental characteristics. Upon building up an investment case for a stock, we should look at various aspects. In the case of TWE, it is a company with great financial health as well as a a strong history of performance. Below is a brief commentary on these key aspects. For those interested in digging a bit deeper into my commentary, read the full report on Treasury Wine Estates here.

Excellent balance sheet with proven track record

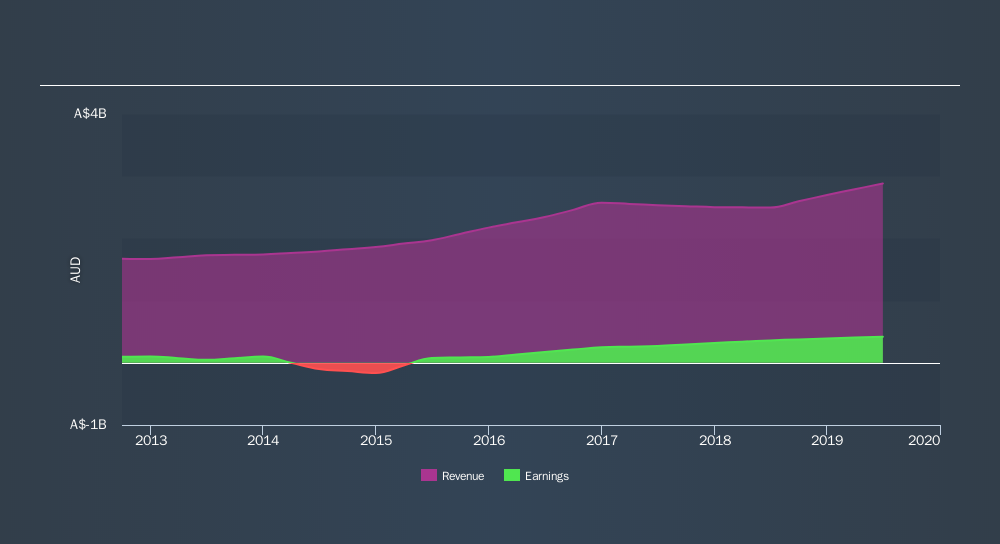

Over the past few years, TWE has demonstrated a proven ability to generate robust returns of 7.9% Unsurprisingly, TWE surpassed the industry return of 5.9%, which gives us more confidence of the company's capacity to drive earnings going forward. TWE's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This implies that TWE manages its cash and cost levels well, which is a crucial insight into the health of the company. TWE seems to have put its debt to good use, generating operating cash levels of 0.36x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows.

Next Steps:

For Treasury Wine Estates, there are three fundamental factors you should further examine:

- Future Outlook: What are well-informed industry analysts predicting for TWE’s future growth? Take a look at our free research report of analyst consensus for TWE’s outlook.

- Valuation: What is TWE worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether TWE is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of TWE? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:TWE

Treasury Wine Estates

Operates as a wine company in Australia, the United States, the United Kingdom, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.