- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (NasdaqGM:TTD) Integrates Bell Media's First-Party Data Into Kokai Platform

Reviewed by Simply Wall St

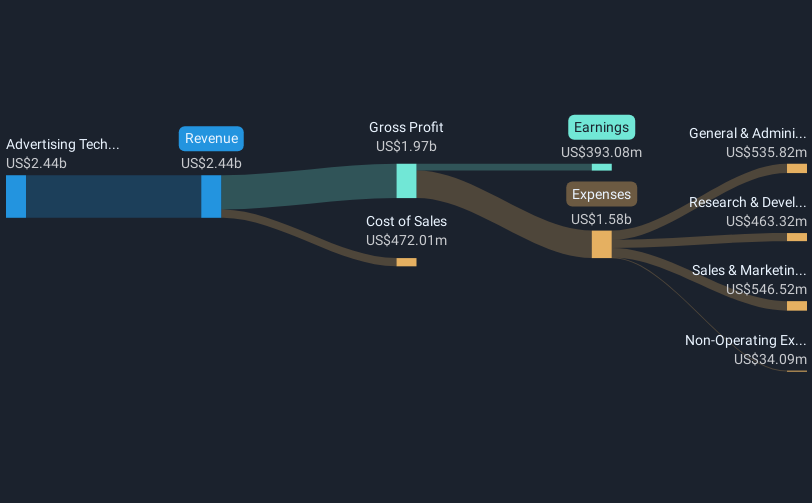

In June 2025, the integration of Bell Media's marketing tools into The Trade Desk's (NasdaqGM:TTD) Kokai platform offered advertisers advanced data and audience-building features, with support for privacy-conscious targeting using UID2. This collaboration likely contributed positively to the firm's 28% price increase over the past month. Along with the robust integration news, The Trade Desk's positive first-quarter earnings and forward guidance announcements provided additional fundamental strength. The broader market also showed resilience, as evidenced by the S&P 500 reaching 6,000, indicating a supportive environment for the stock's upward trajectory.

Buy, Hold or Sell Trade Desk? View our complete analysis and fair value estimate and you decide.

The integration of Bell Media's tools into The Trade Desk's Kokai platform not only contributed to a recent 28% share price increase, it also underscores the company's strategic push toward AI and privacy-conscious advertising solutions. This initiative aligns with its broader goals of improving operational efficiency and deepening client relationships. Over the last five years, The Trade Desk delivered an impressive total return of 104.61%, highlighting its potential for long-term growth, although it recently underperformed the US media industry by showing 104.7% earnings growth compared to the industry's negative returns.

The company's focus on AI and structural reorganization suggests a promising outlook for revenue and earnings enhancement. With analysts forecasting revenue growth of 17.8% annually and a profit margin increase from 16.1% to 20.4% over the next three years, the recent platform upgrades could act as a catalyst for achieving these targets. However, the company's current share price of US$55.63 remains at a 21.4% discount to the consensus price target of US$86.32, reflecting mixed analyst confidence and potential future uncertainties. Investors should weigh these forecasts against current market conditions to assess if the recent developments can sustain the company's favorable growth trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives