- Canada

- /

- Energy Services

- /

- TSX:TOT

Top TSX Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As the Canadian market navigates an environment of improving labour productivity and contained unit labour costs, investors are keenly watching how these factors might influence consumer spending and economic stability. With corporate earnings showing robust growth, particularly in sectors like communications and technology, dividend stocks on the TSX present a compelling opportunity for those seeking stable income amidst a backdrop of mixed bond yields and potential interest rate adjustments by the Bank of Canada.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.43% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.25% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.32% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.29% | ★★★★★☆ |

| North West (TSX:NWC) | 3.27% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.19% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 5.71% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.85% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 4.18% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGM Financial Inc. operates in the asset management industry in Canada, with a market cap of CA$11.23 billion.

Operations: IGM Financial Inc. generates its revenue primarily from two segments: Asset Management, contributing CA$1.30 billion, and Wealth Management, which accounts for CA$2.57 billion.

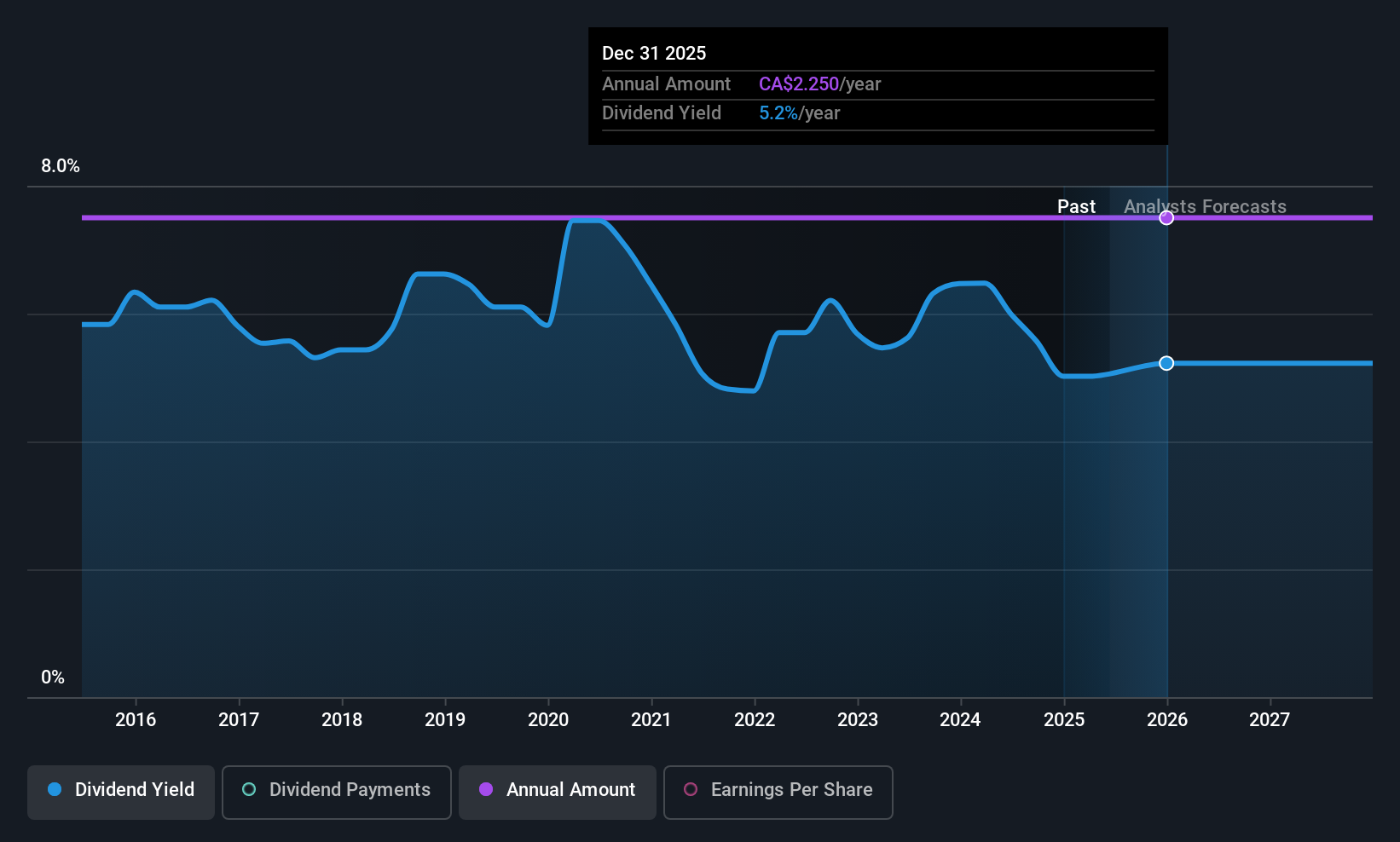

Dividend Yield: 4.7%

IGM Financial's dividend payments are supported by a reasonable payout ratio of 54.7% and cash flow coverage of 56.5%, ensuring sustainability despite the lack of growth over the past decade. The dividend yield, at 4.67%, is below the top tier in Canada, yet remains reliable and stable without increase or volatility in recent years. Recent earnings growth and revenue increases reflect financial stability, with Q2 revenue at C$892.72 million and net income at C$246.71 million.

- Delve into the full analysis dividend report here for a deeper understanding of IGM Financial.

- Upon reviewing our latest valuation report, IGM Financial's share price might be too pessimistic.

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada is a diversified financial services company operating globally with a market cap of approximately CA$259.36 billion.

Operations: Royal Bank of Canada generates revenue from several segments, including Insurance (CA$1.31 billion), Capital Markets (CA$12.56 billion), Personal Banking (CA$16.75 billion), Wealth Management (CA$20.96 billion), and Commercial Banking (CA$6.91 billion).

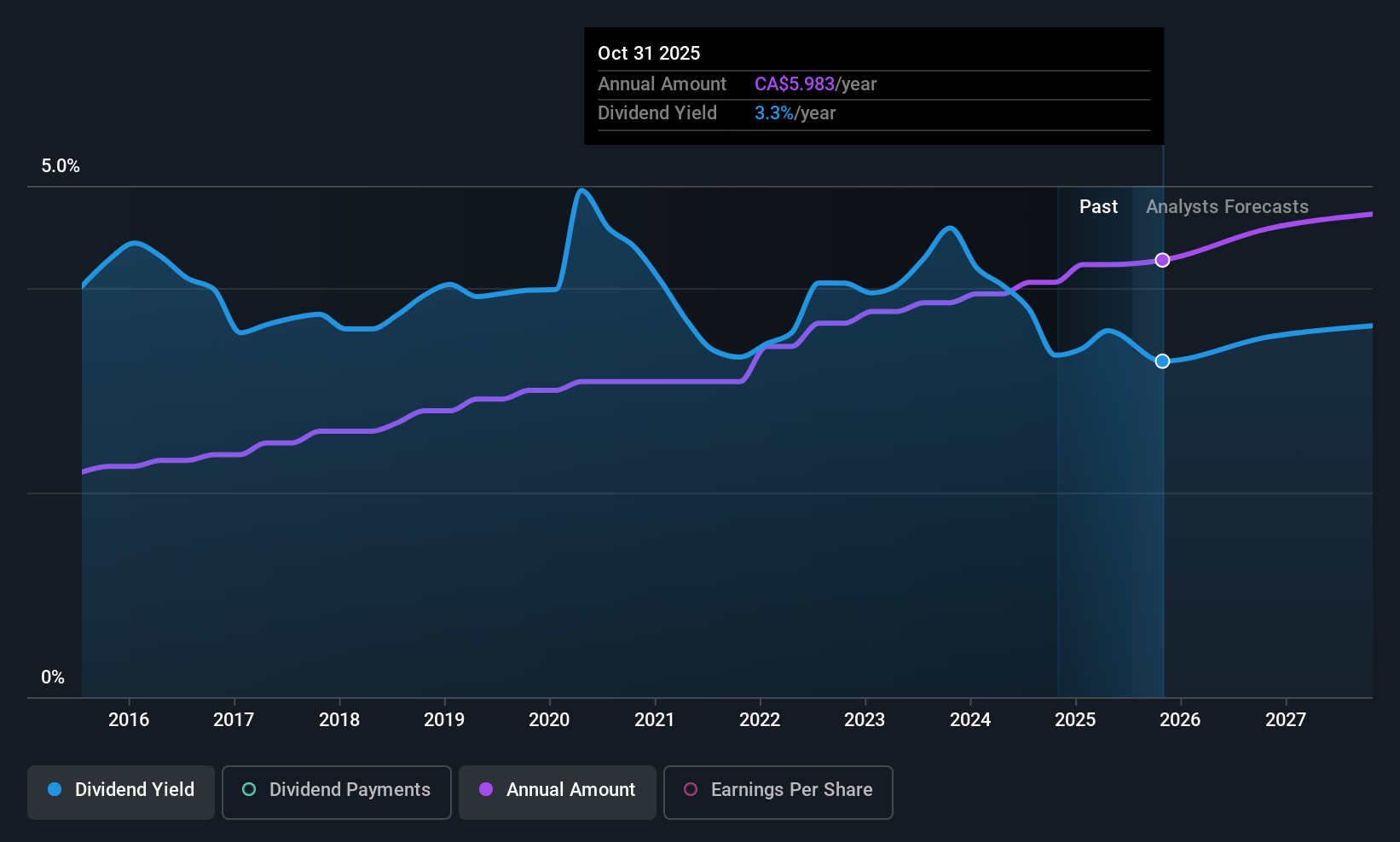

Dividend Yield: 3.3%

Royal Bank of Canada's dividends are well-covered with a payout ratio of 46.1%, ensuring reliability over the past decade. Despite offering a dividend yield of 3.32%, which is lower than Canada's top-tier payers, the bank's consistent earnings growth and strategic initiatives, like its recent fixed-income offerings and collaboration with BDC, underline its financial stability. The recent dividend increase to C$1.54 per share further highlights RBC's commitment to shareholder returns amidst a robust capital management strategy including share buybacks.

- Dive into the specifics of Royal Bank of Canada here with our thorough dividend report.

- The analysis detailed in our Royal Bank of Canada valuation report hints at an inflated share price compared to its estimated value.

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating primarily in Canada, the United States, Australia, and internationally with a market cap of CA$454.41 million.

Operations: Total Energy Services Inc. generates revenue through four main segments: Well Servicing (CA$114.23 million), Contract Drilling Services (CA$332.82 million), Compression and Process Services (CA$466.41 million), and Rentals and Transportation Services (CA$77.62 million).

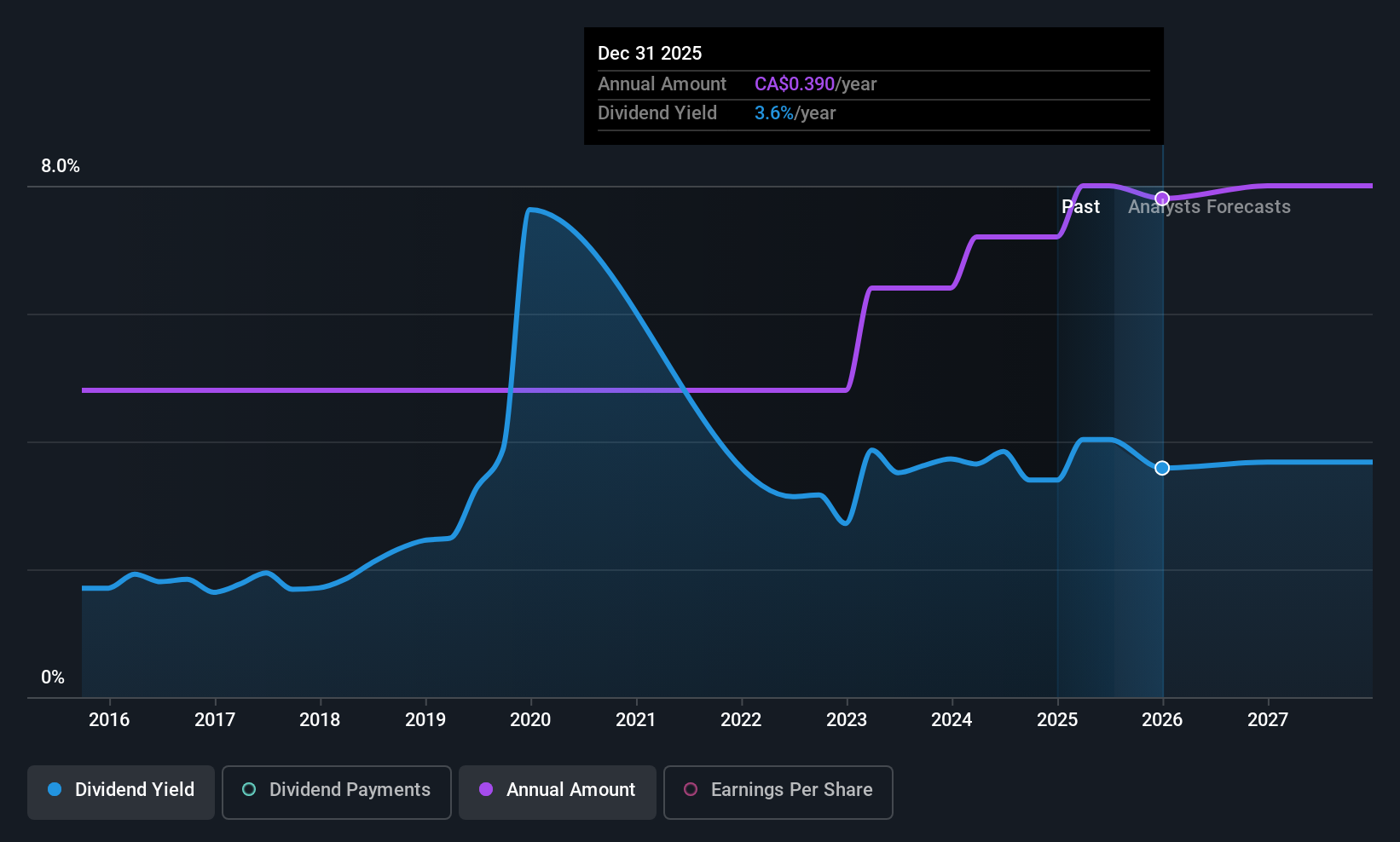

Dividend Yield: 3.2%

Total Energy Services' dividends are supported by a low payout ratio of 21.9%, indicating strong coverage by earnings and cash flows, with a cash payout ratio of 18.8%. Despite this, the company's dividend history shows volatility over the past decade, marked by significant annual drops. The recent quarterly dividend was C$0.10 per share as of June 30, 2025. While trading below estimated fair value and showing substantial earnings growth recently, its yield remains lower than top-tier Canadian payers at 3.17%.

- Click here to discover the nuances of Total Energy Services with our detailed analytical dividend report.

- The analysis detailed in our Total Energy Services valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 18 Top TSX Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Total Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOT

Total Energy Services

Operates as an energy services company primarily in Canada, the United States, Australia, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives