As Gulf stocks show gains amid expectations of U.S. Federal Reserve interest rate cuts, the Middle Eastern market is navigating mixed corporate earnings and fluctuating oil prices. In this dynamic environment, dividend stocks can offer investors a measure of stability and income, making them an attractive option for those looking to capitalize on the region's evolving economic landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi National Bank (SASE:1180) | 5.52% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.29% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.25% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.31% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.82% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.51% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.12% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.52% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.10% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.69% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

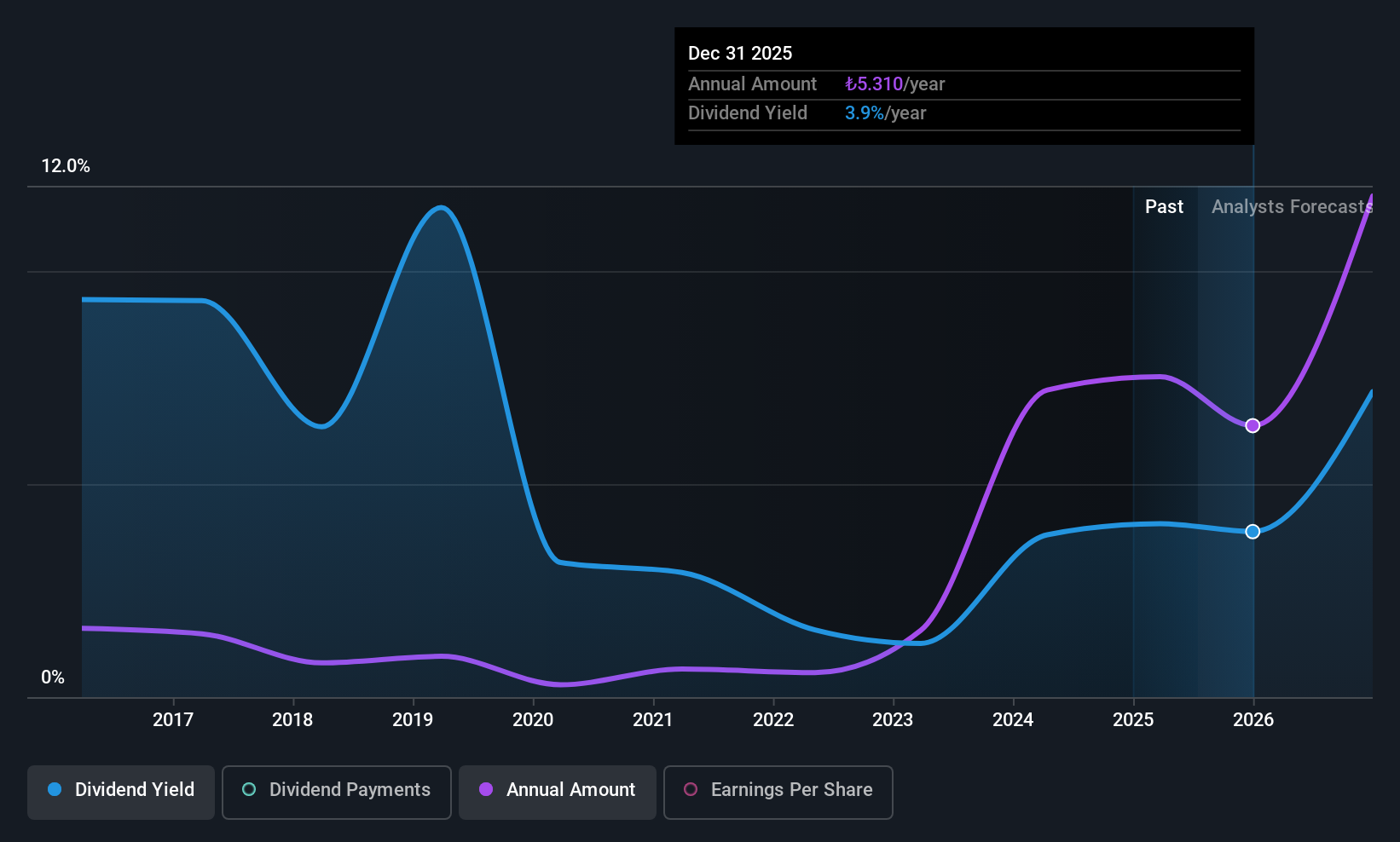

Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi (IBSE:AKCNS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi, along with its subsidiaries, is engaged in the manufacturing and sale of cement, clinker, ready-mix concrete, and aggregates both in Turkey and internationally, with a market cap of TRY27.76 billion.

Operations: Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi generates revenue primarily from its cement segment, which accounts for TRY9.03 billion, and its ready-mix concrete segment, contributing TRY6.53 billion.

Dividend Yield: 4.3%

Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi offers a dividend yield of 4.32%, placing it in the top 25% of dividend payers in the Turkish market. While its dividends are well-covered by earnings (payout ratio: 80.4%) and cash flows (cash payout ratio: 45.9%), the company's dividend history has been volatile with significant annual drops, raising concerns about reliability despite recent growth over the past decade. Its price-to-earnings ratio is attractively below the market average at 18.6x, suggesting potential value for investors seeking income and growth prospects amidst an unstable track record.

- Dive into the specifics of Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi here with our thorough dividend report.

- Our valuation report unveils the possibility Akçansa Çimento Sanayi ve Ticaret Anonim Sirketi's shares may be trading at a premium.

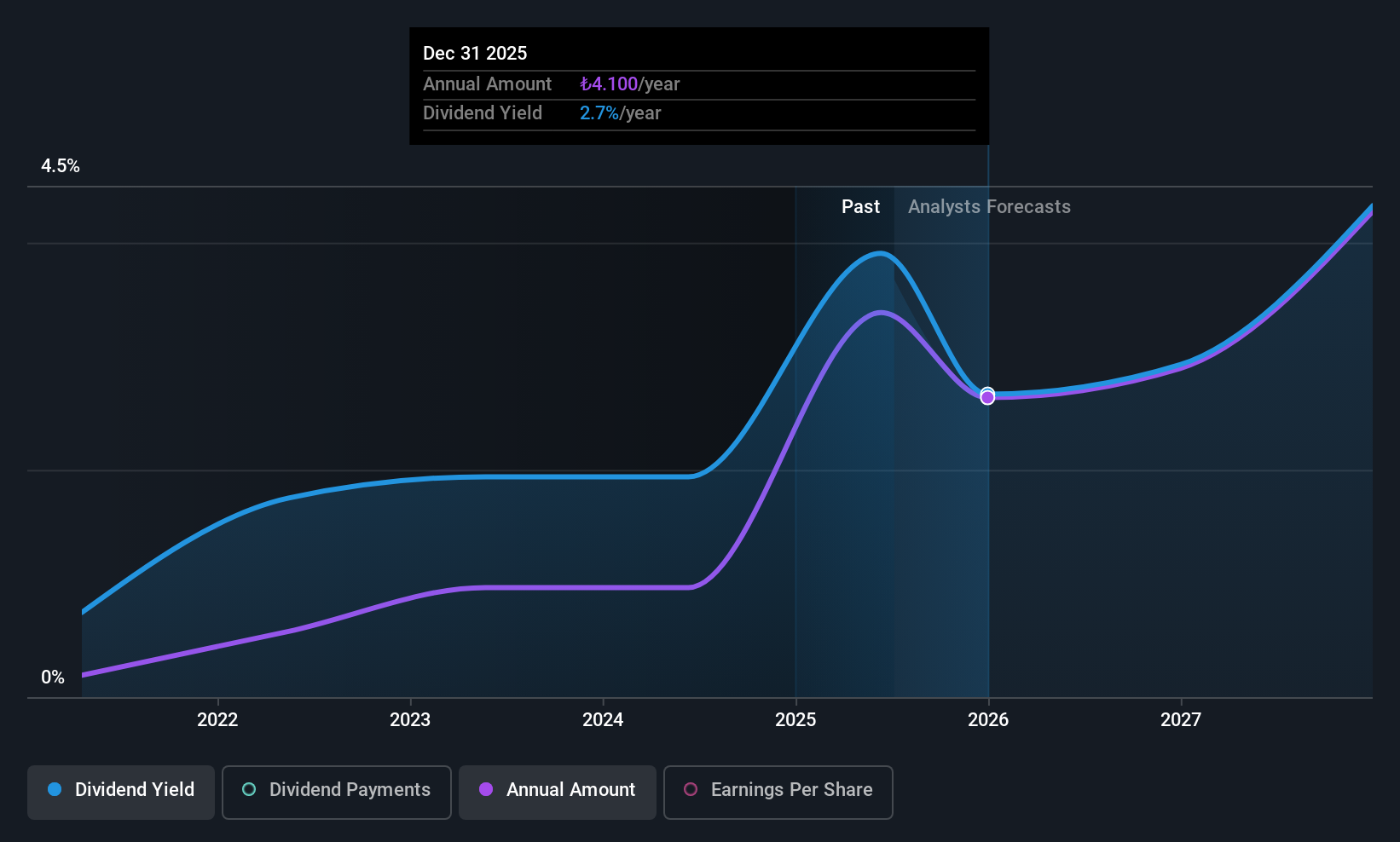

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logo Yazilim Sanayi ve Ticaret A.S. develops and markets software solutions in Turkey and internationally, with a market cap of TRY15.87 billion.

Operations: Logo Yazilim Sanayi ve Ticaret A.S. generates revenue primarily from the software industry, amounting to TRY4.20 billion.

Dividend Yield: 3.1%

Logo Yazilim Sanayi ve Ticaret's dividend yield of 3.15% ranks it among the top 25% of Turkish dividend payers. The company's dividends are well-supported by earnings (payout ratio: 45.4%) and cash flows (cash payout ratio: 25%). Although its dividend history is relatively short at four years, payments have been stable and growing. Recent earnings improvement, with Q1 net income rising to TRY 730.21 million from a loss, enhances its financial robustness for sustaining dividends.

- Navigate through the intricacies of Logo Yazilim Sanayi ve Ticaret with our comprehensive dividend report here.

- Our expertly prepared valuation report Logo Yazilim Sanayi ve Ticaret implies its share price may be too high.

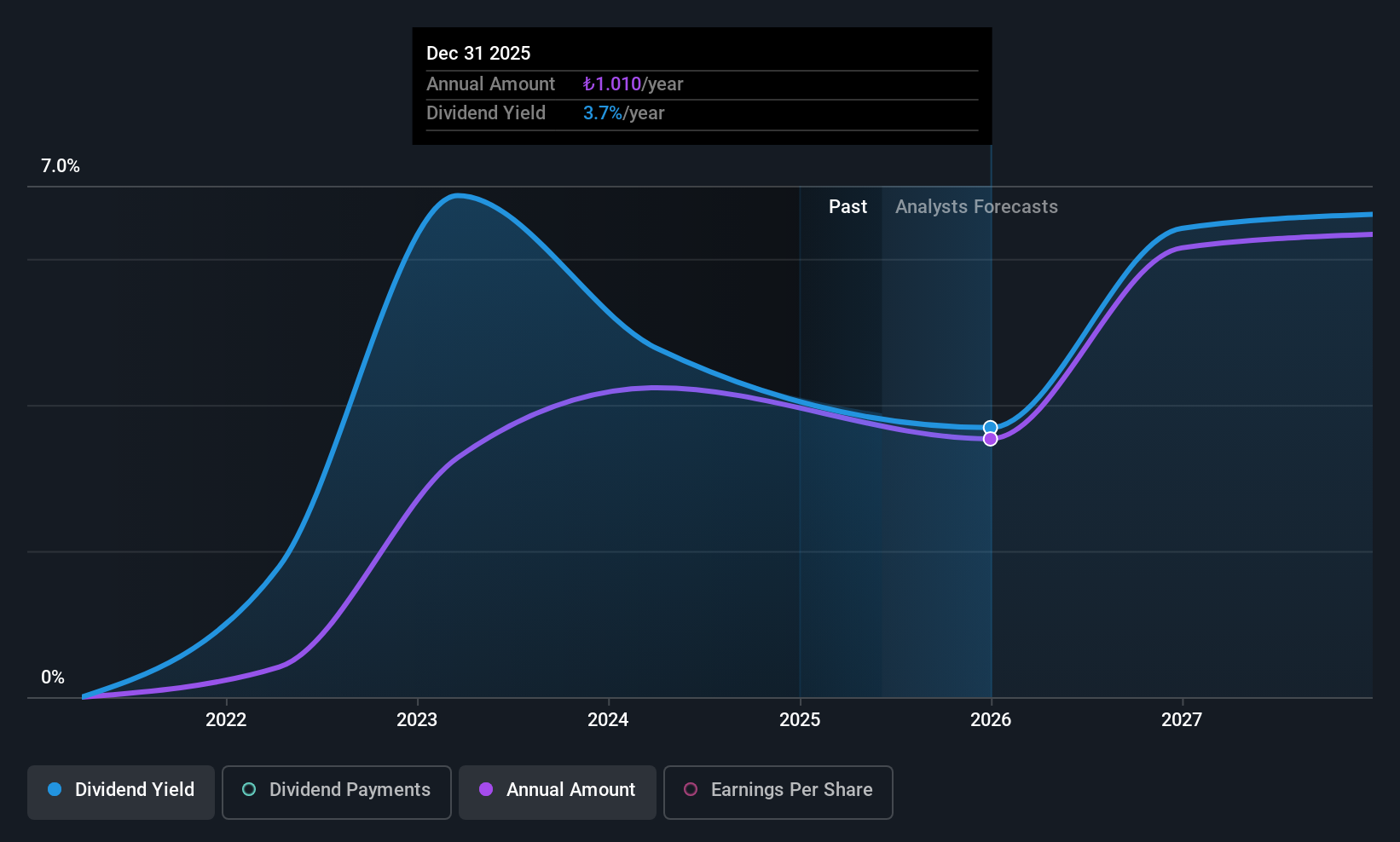

Yapi ve Kredi Bankasi (IBSE:YKBNK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yapi ve Kredi Bankasi A.S., along with its subsidiaries, offers commercial banking and financial products and services in Turkey and internationally, with a market cap of TRY287.37 billion.

Operations: Yapi ve Kredi Bankasi generates revenue through several segments, including Corporate Banking (TRY21.27 billion), Other Foreign Operations (TRY5.79 billion), Other Domestic Operations (TRY16.09 billion), Commercial and SME Banking (TRY55.87 billion), Treasury, Asset Liability Management and Other (TRY66.96 billion), and Retail Banking, which includes Private Banking and Wealth Management (TRY97.20 billion).

Dividend Yield: 3.6%

Yapi ve Kredi Bankasi's dividend yield of 3.56% places it in the top quartile of Turkish dividend payers, with a low payout ratio of 24.5%, indicating strong coverage by earnings. Despite an unstable dividend history, recent earnings growth and solid net interest income (TRY 35.41 billion for Q2) bolster its capacity to maintain dividends. However, the bank's high level of bad loans (3.2%) remains a concern for long-term sustainability.

- Click here to discover the nuances of Yapi ve Kredi Bankasi with our detailed analytical dividend report.

- According our valuation report, there's an indication that Yapi ve Kredi Bankasi's share price might be on the expensive side.

Where To Now?

- Take a closer look at our Top Middle Eastern Dividend Stocks list of 75 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:YKBNK

Yapi ve Kredi Bankasi

Provides commercial banking and financial products and services in Turkey and internationally.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives