- United States

- /

- Biotech

- /

- NasdaqCM:TLSA

Tiziana Life Sciences Leads A Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with the S&P 500 and Nasdaq reaching new all-time highs, investors are on the lookout for opportunities that align with current economic trends. Penny stocks, a term that may seem outdated but still relevant, represent smaller or less-established companies that could offer significant value under these conditions. By focusing on those with strong financial health and potential for growth, investors can uncover promising opportunities within this niche segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.11 | $452.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.94 | $701.63M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.25 | $213.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.42 | $222.64M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.85 | $23M | ✅ 4 ⚠️ 2 View Analysis > |

| Koil Energy Solutions (KLNG) | $2.31 | $30.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.76 | $22.08M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9501 | $6.9M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $86.55M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 375 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Tiziana Life Sciences (TLSA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tiziana Life Sciences Ltd is a biotechnology company focused on developing transformative therapies for neurodegenerative and lung diseases in the United States, with a market cap of $202.86 million.

Operations: Tiziana Life Sciences Ltd does not report any revenue segments.

Market Cap: $202.86M

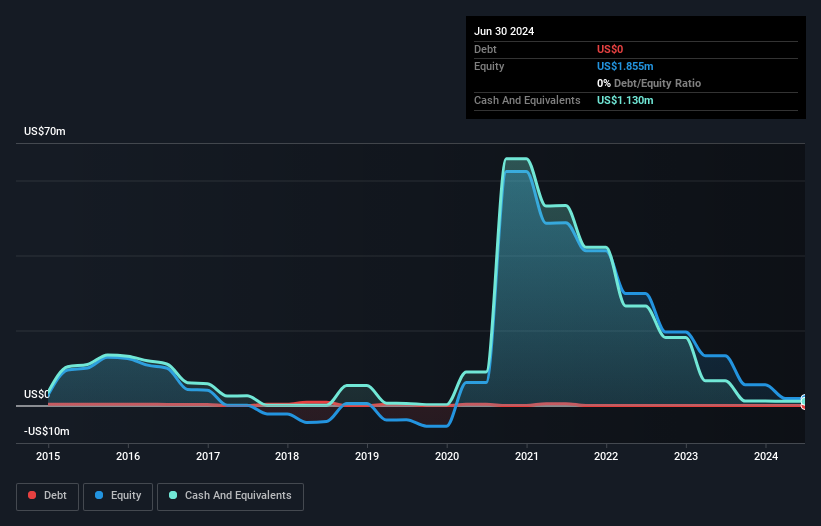

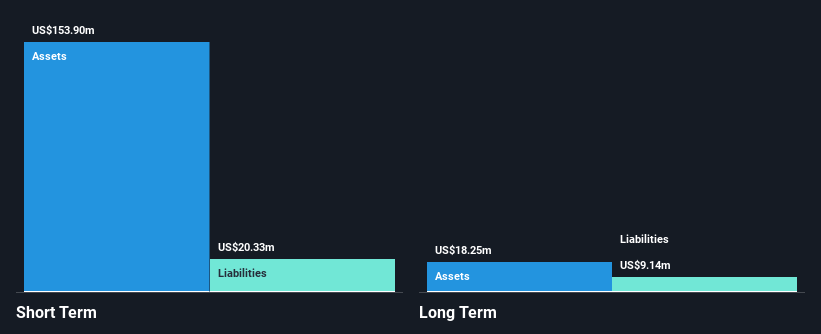

Tiziana Life Sciences, a pre-revenue biotechnology firm with a market cap of US$202.86 million, is focused on innovative therapies for neurodegenerative and lung diseases. Recent developments include a U.S. Department of Defense grant to study intranasal anti-CD3 therapy for spinal cord injury, highlighting its potential in unmet medical needs. Despite high volatility and unprofitability, Tiziana has no debt and sufficient cash runway after recent capital raising efforts. The management team is relatively new but supported by an experienced board. Ongoing trials in multiple conditions underscore the company's commitment to advancing transformative treatments despite current financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Tiziana Life Sciences.

- Explore Tiziana Life Sciences' analyst forecasts in our growth report.

Vuzix (VUZI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Vuzix Corporation designs, manufactures, and markets AI-powered smart glasses, waveguides, and AR technologies globally with a market cap of approximately $198.77 million.

Operations: The company's revenue is primarily derived from its video eyewear products, totaling $5.53 million.

Market Cap: $198.77M

Vuzix Corporation, with a market cap of US$198.77 million, is navigating the competitive AR landscape with strategic moves like its recent collaboration with Saphlux for advanced optical solutions in AI/AR glasses. The company reported revenue of US$2.88 million for the first half of 2025 but remains unprofitable, facing increased losses over five years. Despite this, Vuzix's debt-free status and substantial short-term assets offer a financial cushion. Leadership changes bring seasoned expertise to drive enterprise growth and product innovation, positioning Vuzix to leverage its technology in expanding markets despite cash runway challenges and volatility concerns.

- Unlock comprehensive insights into our analysis of Vuzix stock in this financial health report.

- Understand Vuzix's earnings outlook by examining our growth report.

Valens Semiconductor (VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd. develops semiconductor products for the audio-video and automotive sectors across various international markets, with a market cap of approximately $198.81 million.

Operations: The company's revenue is primarily derived from two segments: Automotive, contributing $20.97 million, and Cross Industry Business (CIB), generating $45.62 million.

Market Cap: $198.81M

Valens Semiconductor, with a market cap of approximately US$198.81 million, is strategically positioned in the semiconductor sector through its partnerships and product offerings. Despite being unprofitable with a negative return on equity of -28.47%, it has no debt and maintains a solid cash runway exceeding three years. Recent collaborations, such as with Samsung for MIPI A-PHY products, highlight its focus on high-speed automotive connectivity solutions. The company's revenue guidance for 2025 suggests growth despite tariff challenges, while recent board changes bring experienced leadership to navigate industry demands and drive innovation in automotive-grade applications.

- Dive into the specifics of Valens Semiconductor here with our thorough balance sheet health report.

- Evaluate Valens Semiconductor's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Discover the full array of 375 US Penny Stocks right here.

- Looking For Alternative Opportunities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiziana Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TLSA

Tiziana Life Sciences

A biotechnology company, engages in the development of transformative therapies for neurodegenerative and lung diseases in the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives