The St. Modwen Properties (LON:SMP) Share Price Is Up 48% And Shareholders Are Holding On

By buying an index fund, investors can approximate the average market return. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, St. Modwen Properties PLC (LON:SMP) shareholders have seen the share price rise 48% over three years, well in excess of the market return (6.1%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 13% , including dividends .

See our latest analysis for St. Modwen Properties

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, St. Modwen Properties failed to grow earnings per share, which fell 5.7% (annualized). This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

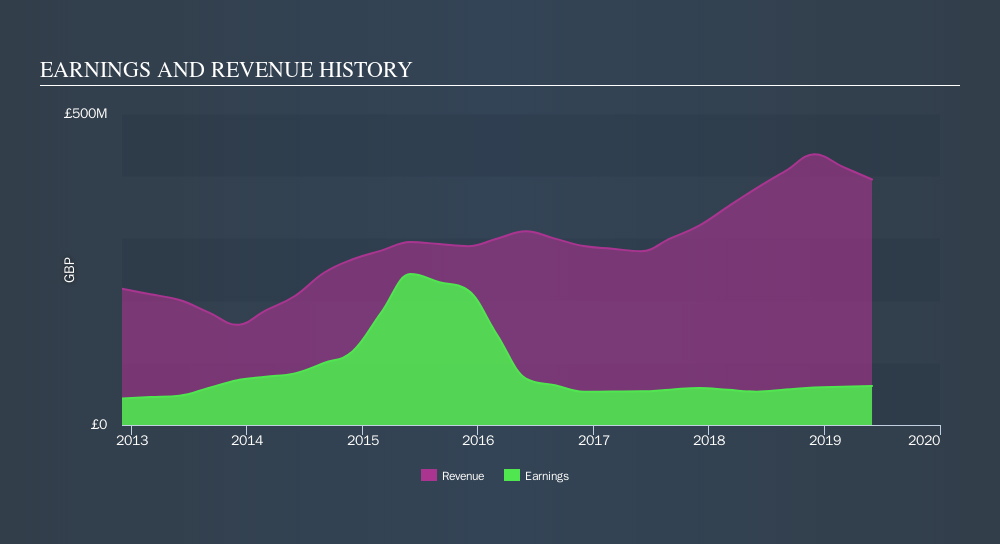

The modest 1.6% dividend yield is unlikely to be propping up the share price. It could be that the revenue growth of 15% per year is viewed as evidence that St. Modwen Properties is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

You can see how revenue has changed over time in the image below.

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think St. Modwen Properties will earn in the future (free profit forecasts).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, St. Modwen Properties's TSR for the last 3 years was 57%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that St. Modwen Properties shareholders have received a total shareholder return of 13% over one year. Of course, that includes the dividend. That's better than the annualised return of 5.1% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

St. Modwen Properties is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives