- United States

- /

- Healthtech

- /

- OTCPK:HTGM.Q

The HTG Molecular Diagnostics (NASDAQ:HTGM) Share Price Is Down 75% So Some Shareholders Are Rather Upset

As every investor would know, you don't hit a homerun every time you swing. But it should be a priority to avoid stomach churning catastrophes, wherever possible. It must have been painful to be a HTG Molecular Diagnostics, Inc. (NASDAQ:HTGM) shareholder over the last year, since the stock price plummeted 75% in that time. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We note that it has not been easy for shareholders over three years, either; the share price is down 68% in that time. The falls have accelerated recently, with the share price down 41% in the last three months.

See our latest analysis for HTG Molecular Diagnostics

HTG Molecular Diagnostics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

HTG Molecular Diagnostics grew its revenue by 2.1% over the last year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the 75% share price implosion is unexpected.. Clearly the market was expecting better, and this may blow out projections of profitability. If and only if this company is still likely to succeed, just a little slower, this could be a good opportunity.

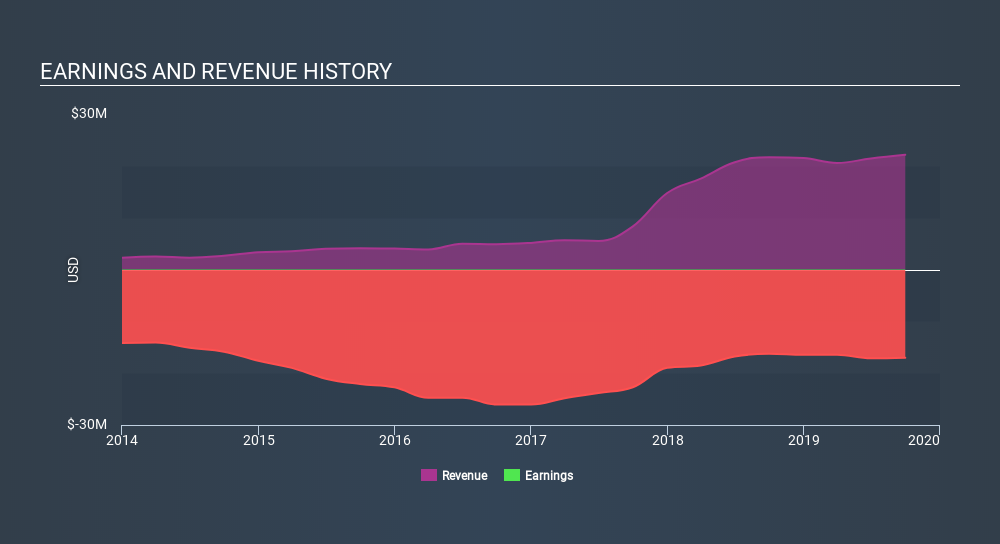

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

The last twelve months weren't great for HTG Molecular Diagnostics shares, which cost holders 75%, while the market was up about 22%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 31% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand HTG Molecular Diagnostics better, we need to consider many other factors. For example, we've discovered 4 warning signs for HTG Molecular Diagnostics that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:HTGM.Q

HTG Molecular Diagnostics

A life sciences company, focuses on the precision medicine.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives