- Sweden

- /

- Medical Equipment

- /

- OM:ARCOMA

The Arcoma (STO:ARCOMA) Share Price Is Up 207% And Shareholders Are Boasting About It

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. To wit, the Arcoma AB (STO:ARCOMA) share price has flown 207% in the last three years. How nice for those who held the stock! Also pleasing for shareholders was the 47% gain in the last three months. But this could be related to the strong market, which is up 26% in the last three months.

See our latest analysis for Arcoma

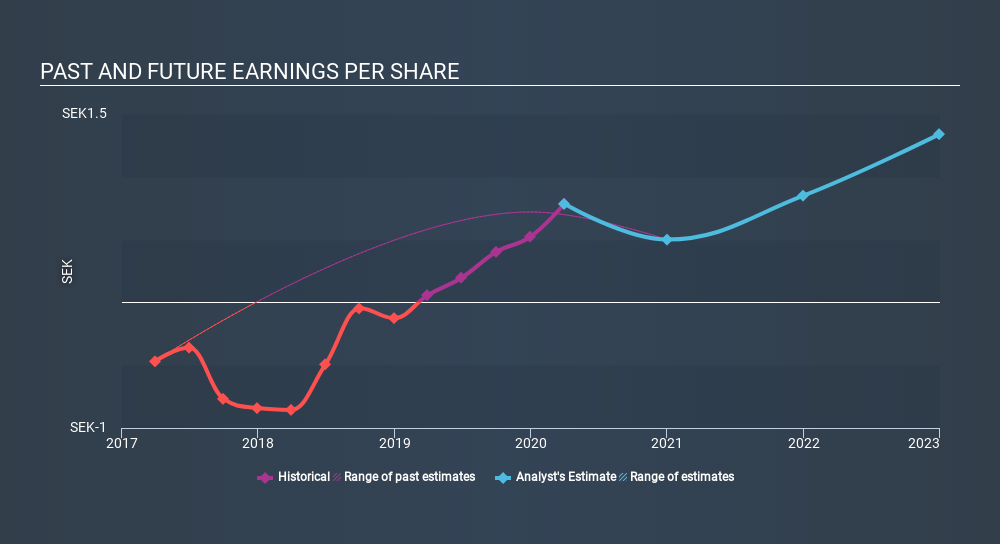

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Arcoma moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Arcoma has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Arcoma stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Arcoma's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arcoma hasn't been paying dividends, but its TSR of 207% exceeds its share price return of 207%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Arcoma had a tough year, with a total loss of 12%, against a market gain of about 3.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Arcoma has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OM:ARCOMA

Arcoma

Develops, produces, and provides radiology solutions and digital x-ray systems worldwide.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives