Stock Analysis

- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

Further weakness as BioLife Solutions (NASDAQ:BLFS) drops 7.3% this week, taking three-year losses to 52%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the last three years have been particularly tough on longer term BioLife Solutions, Inc. (NASDAQ:BLFS) shareholders. Sadly for them, the share price is down 52% in that time. Even worse, it's down 10% in about a month, which isn't fun at all.

Since BioLife Solutions has shed US$56m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for BioLife Solutions

BioLife Solutions wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, BioLife Solutions grew revenue at 31% per year. That's well above most other pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

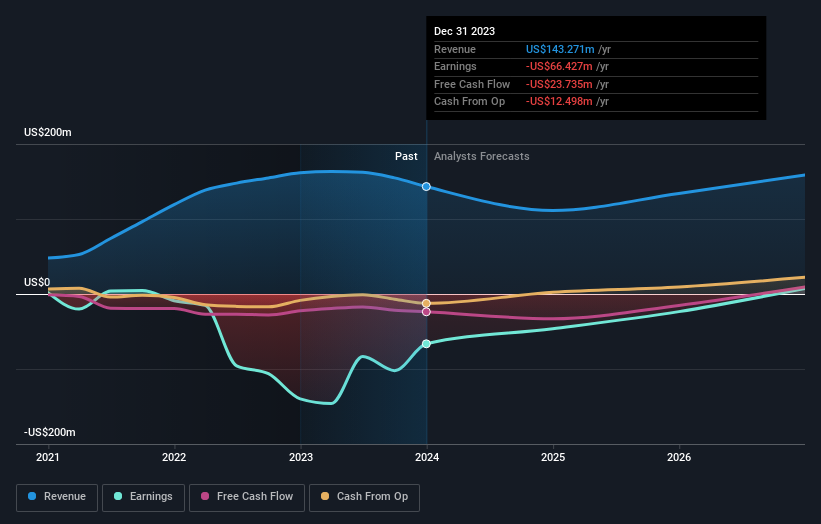

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on BioLife Solutions' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 22% in the last year, BioLife Solutions shareholders lost 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that BioLife Solutions is showing 2 warning signs in our investment analysis , you should know about...

Of course BioLife Solutions may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether BioLife Solutions is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BLFS

BioLife Solutions

BioLife Solutions, Inc. develops, manufactures, and markets bioproduction tools and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Good value with reasonable growth potential.