Stock Analysis

Here's Why Volvo Car AB (publ.) (STO:VOLCAR B) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Volvo Car AB (publ.) (STO:VOLCAR B) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Volvo Car AB (publ.)

What Is Volvo Car AB (publ.)'s Net Debt?

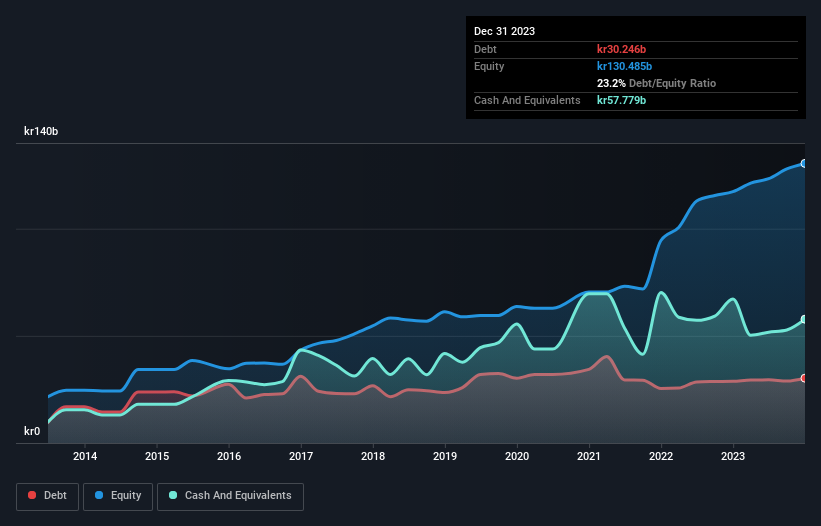

You can click the graphic below for the historical numbers, but it shows that as of December 2023 Volvo Car AB (publ.) had kr30.2b of debt, an increase on kr28.8b, over one year. But on the other hand it also has kr57.8b in cash, leading to a kr27.5b net cash position.

A Look At Volvo Car AB (publ.)'s Liabilities

The latest balance sheet data shows that Volvo Car AB (publ.) had liabilities of kr161.0b due within a year, and liabilities of kr64.9b falling due after that. Offsetting this, it had kr57.8b in cash and kr29.8b in receivables that were due within 12 months. So it has liabilities totalling kr138.3b more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's huge kr120.7b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Given that Volvo Car AB (publ.) has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

In addition to that, we're happy to report that Volvo Car AB (publ.) has boosted its EBIT by 59%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Volvo Car AB (publ.)'s ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Volvo Car AB (publ.) may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Volvo Car AB (publ.) reported free cash flow worth 18% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

Although Volvo Car AB (publ.)'s balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of kr27.5b. And we liked the look of last year's 59% year-on-year EBIT growth. So we are not troubled with Volvo Car AB (publ.)'s debt use. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Volvo Car AB (publ.) has 2 warning signs we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether Volvo Car AB (publ.) is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VOLCAR B

Volvo Car AB (publ.)

Volvo Car AB (publ.) designs, develops, manufactures, assembles, and sells passenger cars in Sweden and internationally.

Undervalued with excellent balance sheet.