Stock Analysis

- Hong Kong

- /

- Consumer Services

- /

- SEHK:1082

Investors Interested In Bradaverse Education (Int'l) Investments Group Limited's (HKG:1082) Revenues

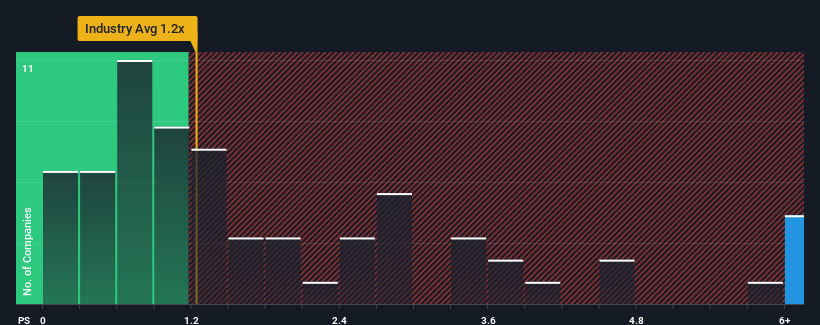

When you see that almost half of the companies in the Consumer Services industry in Hong Kong have price-to-sales ratios (or "P/S") below 1.2x, Bradaverse Education (Int'l) Investments Group Limited (HKG:1082) looks to be giving off strong sell signals with its 7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bradaverse Education (Int'l) Investments Group

How Bradaverse Education (Int'l) Investments Group Has Been Performing

Recent times have been quite advantageous for Bradaverse Education (Int'l) Investments Group as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bradaverse Education (Int'l) Investments Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Bradaverse Education (Int'l) Investments Group would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The latest three year period has also seen an excellent 295% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 20% shows it's noticeably more attractive.

With this information, we can see why Bradaverse Education (Int'l) Investments Group is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Bradaverse Education (Int'l) Investments Group's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bradaverse Education (Int'l) Investments Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Bradaverse Education (Int'l) Investments Group with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Bradaverse Education (Int'l) Investments Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1082

Bradaverse Education (Int'l) Investments Group

Bradaverse Education (Int'l) Investments Group Limited, an investment holding company, provides private educational services in Hong Kong.

Excellent balance sheet with weak fundamentals.