Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:EQX

Equinox Gold Corp. (TSE:EQX) Stock Rockets 38% But Many Are Still Ignoring The Company

Equinox Gold Corp. (TSE:EQX) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 7.8% isn't as impressive.

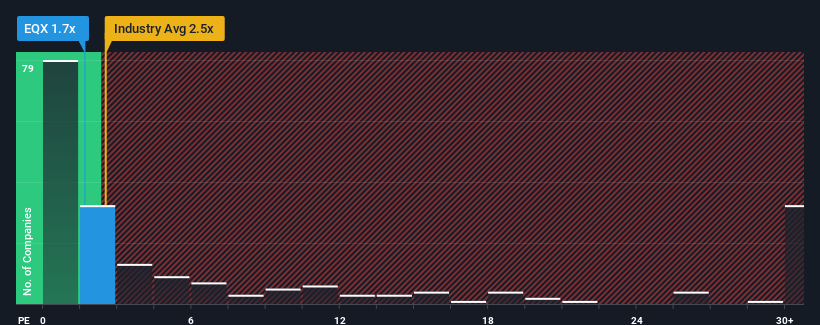

Although its price has surged higher, Equinox Gold may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.7x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.5x and even P/S higher than 15x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Equinox Gold

How Has Equinox Gold Performed Recently?

Recent times have been advantageous for Equinox Gold as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Equinox Gold.Is There Any Revenue Growth Forecasted For Equinox Gold?

Equinox Gold's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 17% per year during the coming three years according to the five analysts following the company. With the industry only predicted to deliver 7.8% per year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Equinox Gold is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does Equinox Gold's P/S Mean For Investors?

Despite Equinox Gold's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Equinox Gold currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Equinox Gold has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Equinox Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:EQX

Equinox Gold

Equinox Gold Corp. engages in the exploration, acquisition, development, and operation of mineral properties in the Americas.

Reasonable growth potential with adequate balance sheet.