Stock Analysis

- Australia

- /

- Oil and Gas

- /

- ASX:ALD

Exploring Ampol Among Three Noteworthy Australian Dividend Stocks

Reviewed by Kshitija Bhandaru

The Australian market has been experiencing some interesting dynamics recently, with the ASX200 closing up just under half a per cent and materials leading the rally. However, not all sectors followed suit as communication and healthcare lagged behind. Amid these market conditions, dividend stocks such as Ampol become particularly noteworthy for investors seeking regular income streams. A good dividend stock is typically characterized by its consistent ability to generate profits and distribute a portion of these earnings back to shareholders, which can be especially appealing in an unpredictable market environment.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Nick Scali (ASX:NCK) | 4.95% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.99% | ★★★★★☆ |

| Joyce (ASX:JYC) | 6.82% | ★★★★★☆ |

| Korvest (ASX:KOV) | 6.61% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.57% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.59% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.67% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.24% | ★★★★★☆ |

| PRL Global (ASX:PRG) | 6.25% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.23% | ★★★★★☆ |

Click here to see the full list of 44 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Ampol (ASX:ALD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, with a market cap of A$9.22 billion, operates as a petroleum product company in Australia, New Zealand, Singapore and the United States where it purchases, refines and markets these products.

Operations: Ampol Limited, a global petroleum products company, generates its revenue through three main segments: Z Energy which brings in A$5.51 billion, Convenience Retail with earnings of A$5.99 billion and Fuels and Infrastructure contributing the most at A$33.63 billion.

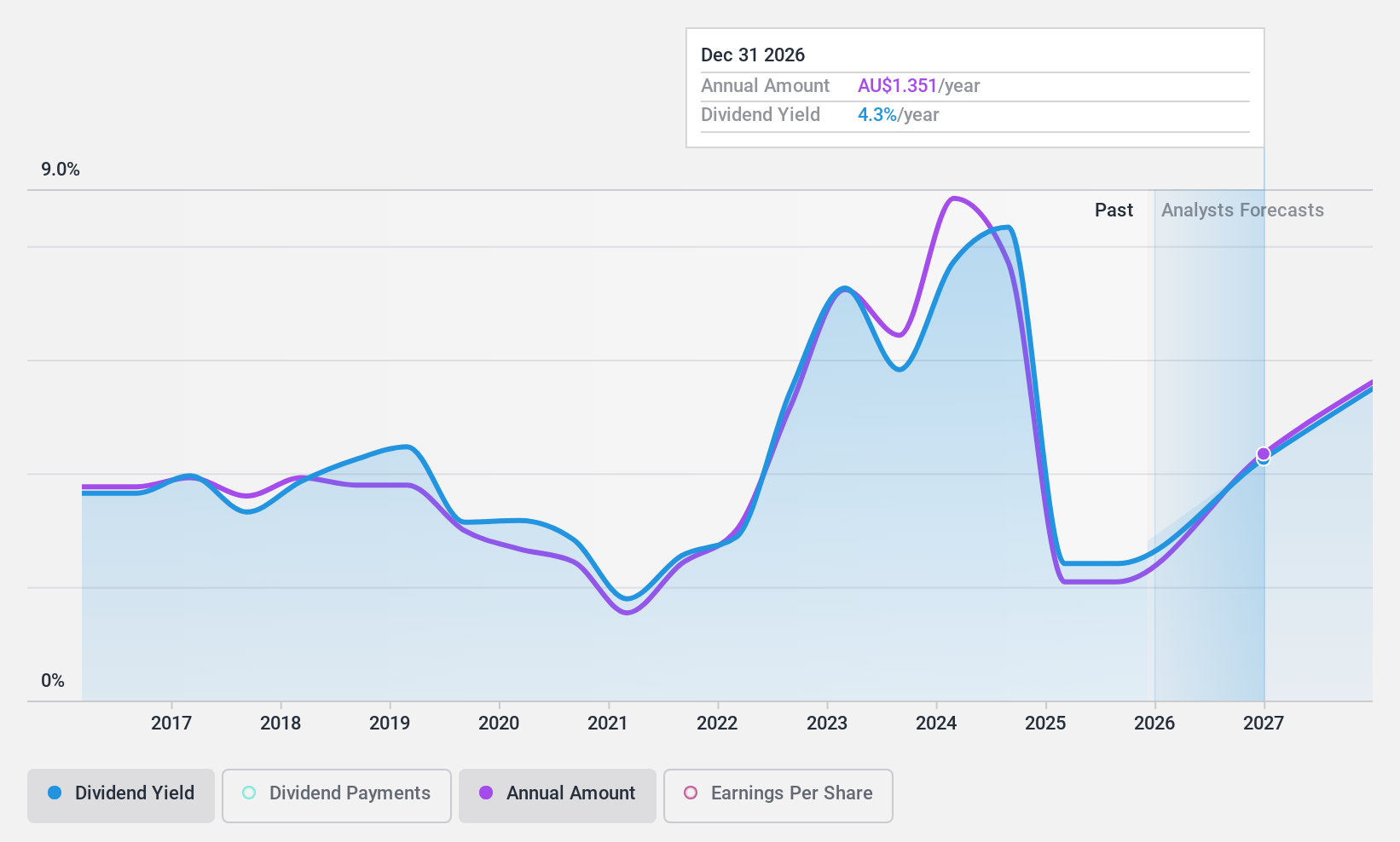

Dividend Yield: 7.0%

Ampol's dividend yield of 7.01% places it in the top 25% of Australian market dividend payers. While its payments have been volatile over the past decade, they have seen an overall increase. Despite a high payout ratio of 93.3%, cash flows cover these dividends with a reasonable cash payout ratio of 68.6%. However, Ampol carries a high level of debt and recent earnings results show net income dropping to A$549.1 million from A$795.9 million the previous year.

Fenix Resources (ASX:FEX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fenix Resources Limited, with a market cap of A$194.49 million, is involved in the exploration, development, and mining of mineral tenements in Western Australia.

Operations: Fenix Resources Limited, valued at A$194.49 million, generates its revenue primarily through the exploration, development and mining of mineral tenements in Western Australia.

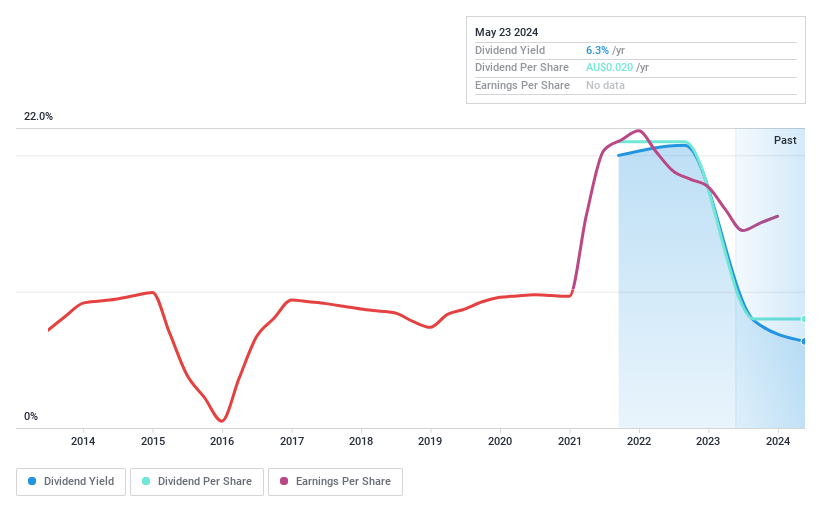

Dividend Yield: 7.0%

Fenix Resources' dividend yield of 7.02% ranks in the top quartile of Australian market payers. The company's dividends are well-covered by both earnings (Payout Ratio: 31.5%) and cash flows (Cash Payout Ratio: 34.2%), indicating sustainability despite a volatile track record over the past three years. Fenix is trading at significant value, being 60.5% below estimated fair value, and forecasts suggest an annual earnings growth of 5.85%. Recent half-year results reveal A$126.93 million sales and A$22.05 million net income.

Fiducian Group (ASX:FID)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fiducian Group Ltd is an Australian company that, via its subsidiaries, offers financial services and has a market capitalisation of A$236.08 million.

Operations: Fiducian Group Ltd generates its revenue in Australia through several segments, including Funds Management which brings in A$20.49 million, Corporate Services earning A$12.06 million, Financial Planning with A$28.95 million, and Platform Administration contributing A$15.38 million.

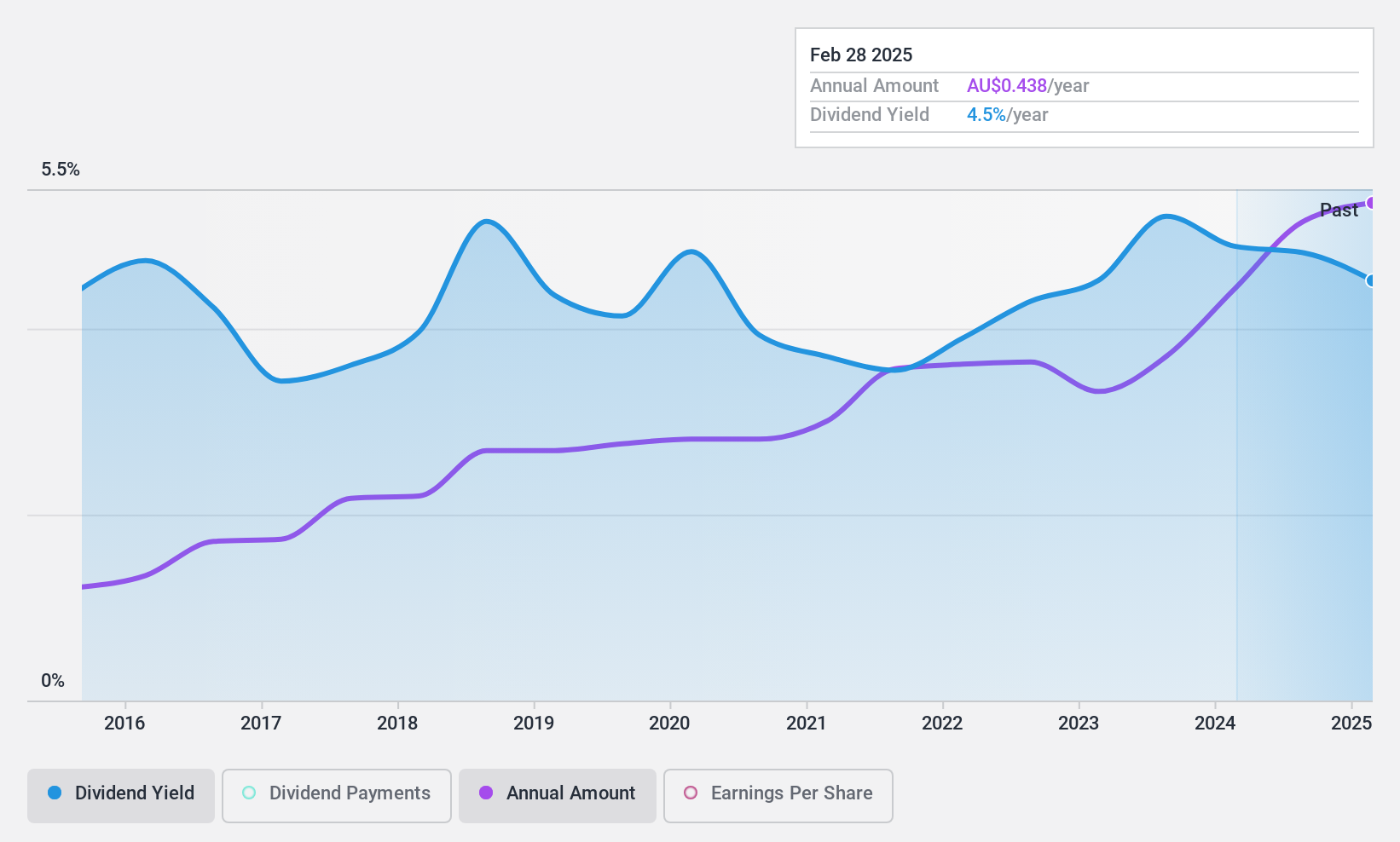

Dividend Yield: 4%

Fiducian Group's earnings have grown by 12% over the past year, with recent half-year results showing A$39 million sales and A$6.84 million net income. The company pays a reliable dividend of 3.99%, covered by both earnings (Payout Ratio: 83.7%) and cash flows (Cash Payout Ratio: 60.5%). Despite being lower than the top quartile of Australian market payers, FID's dividends are stable and have increased over the past decade, offering potential for consistent income in a portfolio.

Next Steps

- Reveal the 44 hidden gems among our Top Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Ampol is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALD

Ampol

Ampol Limited purchases, refines, distributes, and markets petroleum products in Australia, New Zealand, Singapore, and the United States.

Adequate balance sheet average dividend payer.