- United States

- /

- Chemicals

- /

- NYSE:TROX

Some Tronox Holdings (NYSE:TROX) Shareholders Have Copped A Big 53% Share Price Drop

While not a mind-blowing move, it is good to see that the Tronox Holdings plc (NYSE:TROX) share price has gained 14% in the last three months. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 53% in that half decade.

View our latest analysis for Tronox Holdings

Tronox Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Tronox Holdings grew its revenue at 2.6% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 14% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in Tronox Holdings. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

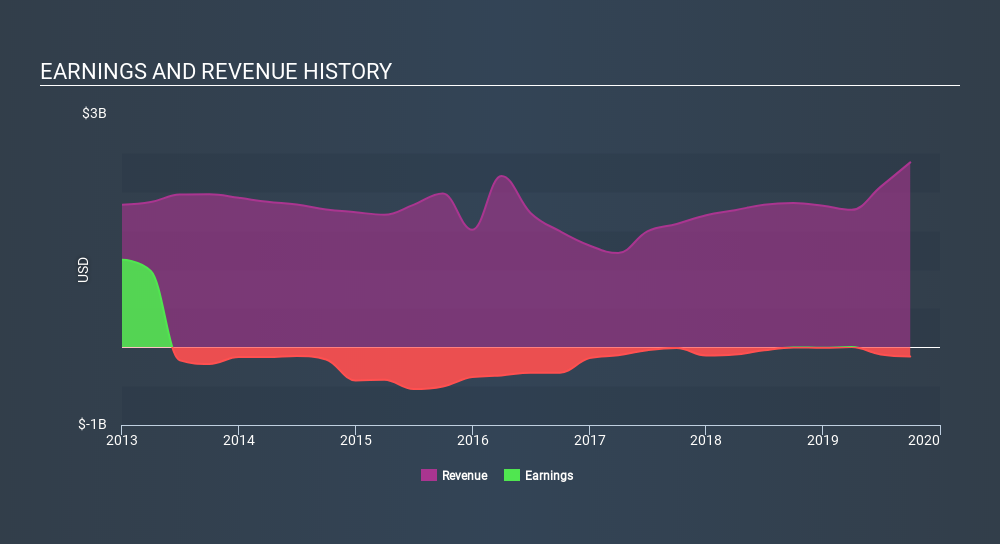

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Tronox Holdings in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Tronox Holdings's TSR for the last 5 years was -42%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Tronox Holdings shareholders have received a total shareholder return of 45% over one year. Of course, that includes the dividend. Notably the five-year annualised TSR loss of 10% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Tronox Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:TROX

Tronox Holdings

Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives