Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Lifespot Health Ltd (ASX:LSH) share price is down 31% in the last year. That's disappointing when you consider the market returned 22%. Lifespot Health hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

Check out our latest analysis for Lifespot Health

With just AU$198,244 worth of revenue in twelve months, we don't think the market considers Lifespot Health to have proven its business plan. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. Investors will be hoping that Lifespot Health can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

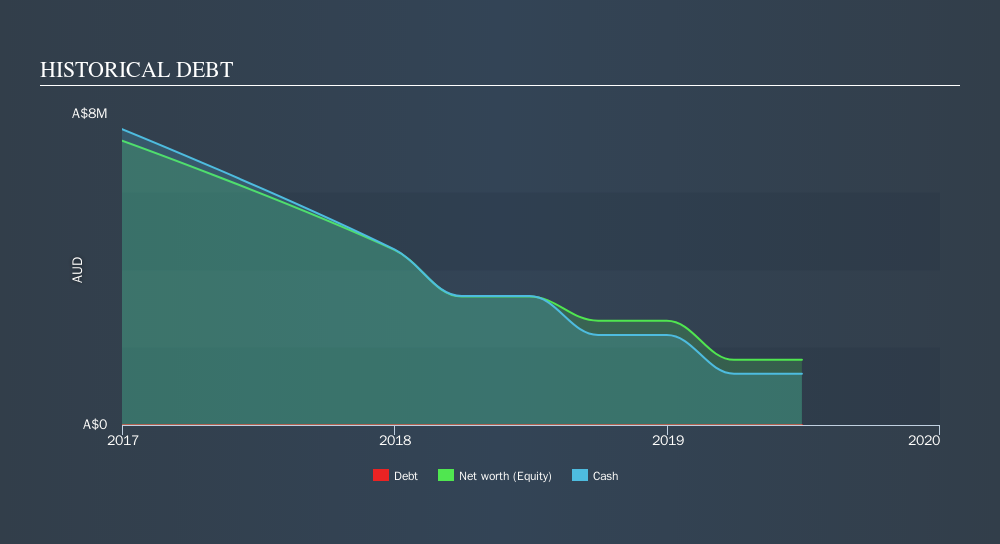

Lifespot Health had cash in excess of all liabilities of just AU$975k when it last reported (June 2019). So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. That probably explains why the share price is down 31% in the last year . You can click on the image below to see (in greater detail) how Lifespot Health's cash levels have changed over time. You can see in the image below, how Lifespot Health's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? It would bother me, that's for sure. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

A Different Perspective

While Lifespot Health shareholders are down 31% for the year, the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 28%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. If you would like to research Lifespot Health in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:IRX

InhaleRx

A biotechnology company, develops and sells registrable inhaled drug-device combinations in Australia.

Slight with weak fundamentals.

Market Insights

Community Narratives