Stock Analysis

- India

- /

- Infrastructure

- /

- NSEI:NAVKARCORP

Some Confidence Is Lacking In Navkar Corporation Limited's (NSE:NAVKARCORP) P/E

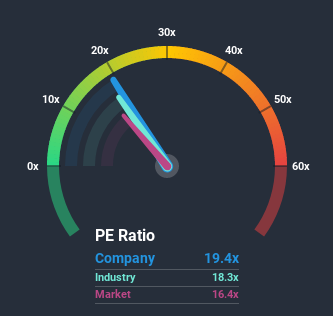

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 16x, you may consider Navkar Corporation Limited (NSE:NAVKARCORP) as a stock to potentially avoid with its 19.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's lofty.

For instance, Navkar's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Navkar

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Navkar's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 76% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 11% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Navkar is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Navkar's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Navkar revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Navkar (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Navkar, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Navkar is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:NAVKARCORP

Navkar

Provides container freight station, inland container depot, rail terminal, container train operator, and warehousing and other logistics solutions in India.

Excellent balance sheet with questionable track record.