Some China Aerospace International Holdings (HKG:31) Shareholders Have Copped A Big 51% Share Price Drop

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term China Aerospace International Holdings Limited (HKG:31) shareholders have had that experience, with the share price dropping 51% in three years, versus a market return of about 28%.

View 2 warning signs we detected for China Aerospace International Holdings

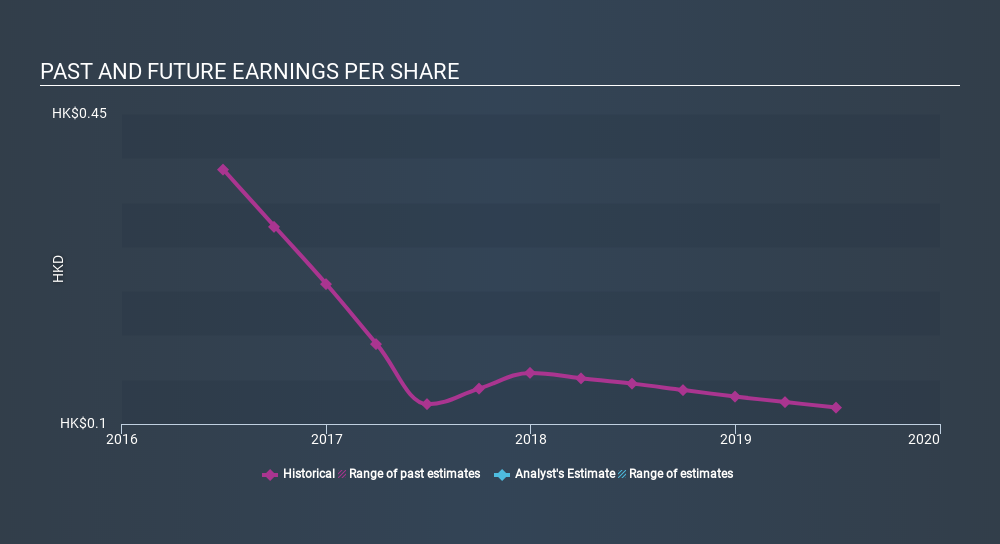

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the three years that the share price fell, China Aerospace International Holdings's earnings per share (EPS) dropped by 33% each year. This fall in the EPS is worse than the 21% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on China Aerospace International Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for China Aerospace International Holdings the TSR over the last 3 years was -47%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

China Aerospace International Holdings shareholders gained a total return of 1.0% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand China Aerospace International Holdings better, we need to consider many other factors. For example, we've discovered 2 warning signs for China Aerospace International Holdings (of which 1 is major) which any shareholder or potential investor should be aware of.

We will like China Aerospace International Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:31

China Aerospace International Holdings

An investment holding company, operates hi-tech manufacturing and aerospace service business in Hong Kong, the People’s Republic of China, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives