Stock Analysis

- United Kingdom

- /

- Software

- /

- AIM:ATQT

Some ATTRAQT Group (LON:ATQT) Shareholders Have Copped A Big 60% Share Price Drop

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example, after five long years the ATTRAQT Group plc (LON:ATQT) share price is a whole 60% lower. That is extremely sub-optimal, to say the least. Furthermore, it's down 38% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 18% decline in the broader market, throughout the period.

See our latest analysis for ATTRAQT Group

Because ATTRAQT Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, ATTRAQT Group grew its revenue at 44% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 17% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

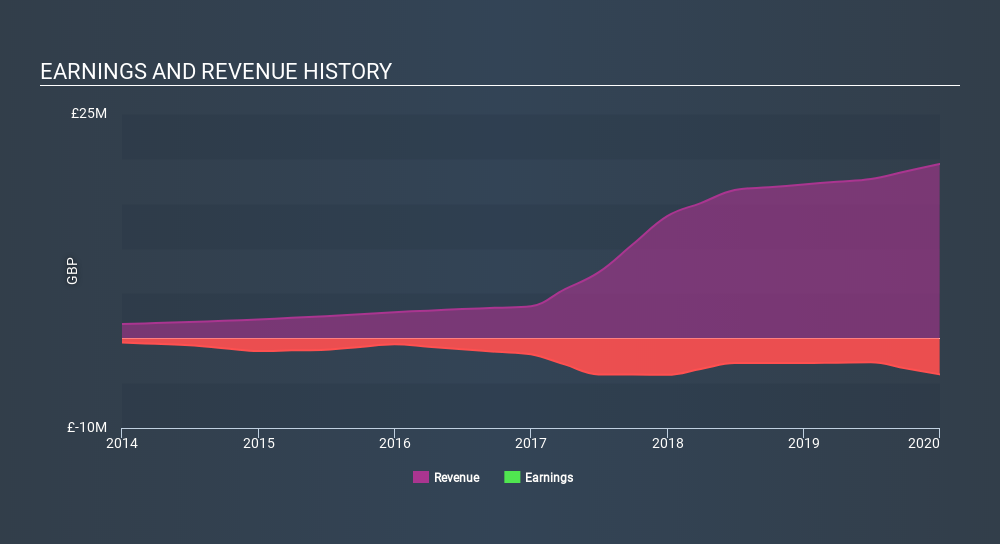

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at ATTRAQT Group's financial health with this free report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that ATTRAQT Group shares lost 7.5% throughout the year, that wasn't as bad as the market loss of 12%. Of far more concern is the 17% p.a. loss served to shareholders over the last five years. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with ATTRAQT Group (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

We will like ATTRAQT Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:ATQT

ATTRAQT Group

ATTRAQT Group plc, together with its subsidiaries, develops and provides e-commerce site search, merchandising, and product recommendation technology in the United Kingdom, France, the Netherlands, rest of Europe, and internationally.

Mediocre balance sheet and overvalued.