- Hong Kong

- /

- Transportation

- /

- SEHK:77

Some AMS Public Transport Holdings (HKG:77) Shareholders Are Down 35%

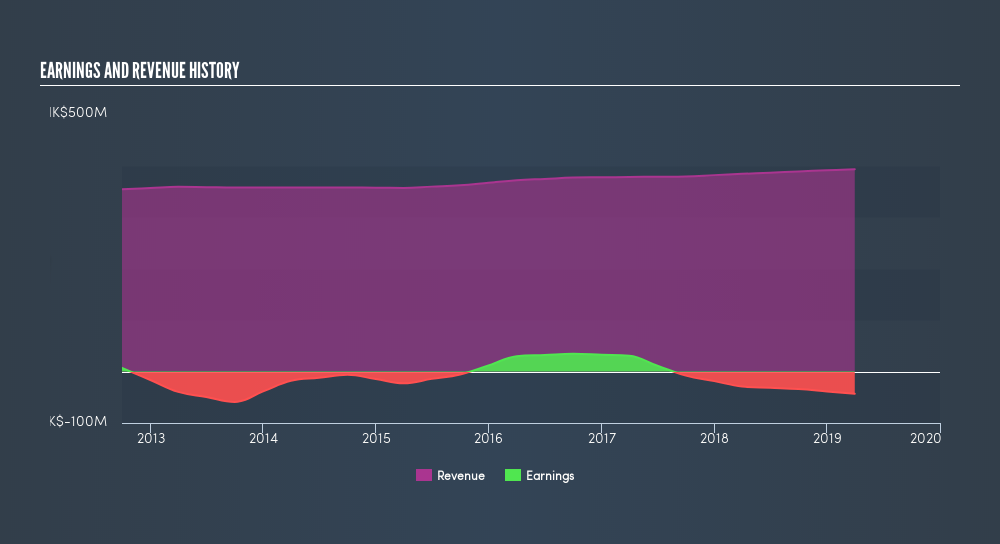

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term AMS Public Transport Holdings Limited (HKG:77) shareholders have had that experience, with the share price dropping 35% in three years, versus a market return of about 13%. It's down 2.1% in the last seven days.

See our latest analysis for AMS Public Transport Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

We know that AMS Public Transport Holdings has been profitable in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

We note that the dividend has declined - a likely contributor to the share price drop. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

If you are thinking of buying or selling AMS Public Transport Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of AMS Public Transport Holdings, it has a TSR of -22% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 9.0% in the twelve months, AMS Public Transport Holdings shareholders did even worse, losing 17% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2.3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research AMS Public Transport Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course AMS Public Transport Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:77

AMS Public Transport Holdings

An investment holding company, provides franchised public light bus (PLB) and residents’ bus transportation services in Hong Kong.

Fair value low.

Market Insights

Community Narratives