- United States

- /

- Media

- /

- NasdaqCM:DALN

Some A.H. Belo (NYSE:AHC) Shareholders Have Copped A Big 67% Share Price Drop

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in A.H. Belo Corporation (NYSE:AHC), since the last five years saw the share price fall 67%. On the other hand the share price has bounced 6.8% over the last week.

Check out our latest analysis for A.H. Belo

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

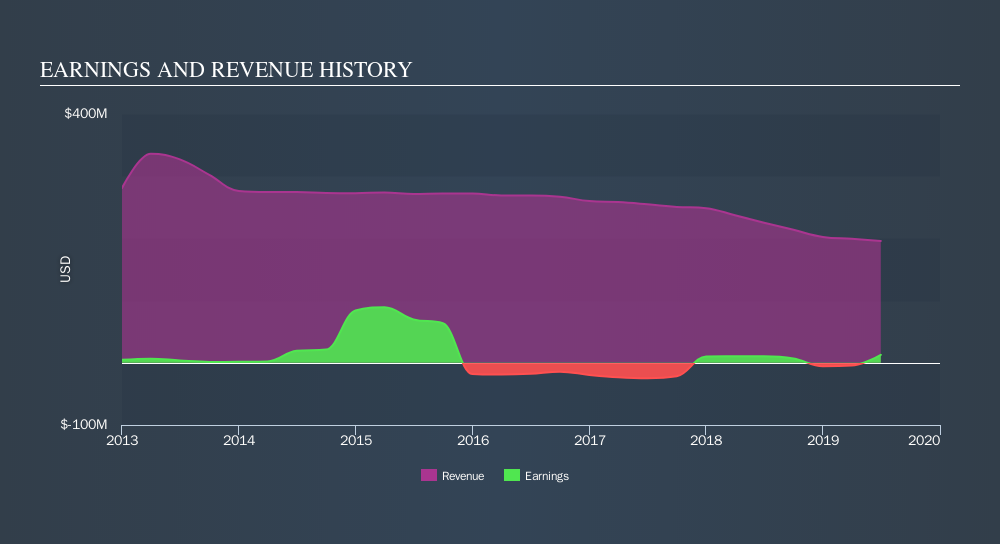

A.H. Belo became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. However, revenue has declined at a compound annual rate of 6.4% per year. With dividends up, but revenue down, some investors might be concluding that the company is no longer growing.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on A.H. Belo's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, A.H. Belo's TSR for the last 5 years was -45%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

A.H. Belo shareholders are down 9.6% for the year (even including dividends) , but the market itself is up 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

A.H. Belo is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:DALN

DallasNews

DallasNews Corporation, together with its subsidiaries, publishes and sells newspapers in Texas.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives