Should Kraken Robotics (CVE:PNG) Be Disappointed With Their 68% Profit?

Some Kraken Robotics Inc. (CVE:PNG) shareholders are probably rather concerned to see the share price fall 46% over the last three months. Looking further back, the stock has generated good profits over five years. It has returned a market beating 68% in that time. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 64% drop, in the last year.

See our latest analysis for Kraken Robotics

Kraken Robotics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Kraken Robotics saw its revenue grow at 37% per year. That's well above most pre-profit companies. It's good to see that the stock has 11%, but not entirely surprising given revenue shows strong growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Opportunity lies where the market hasn't fully priced growth in the underlying business.

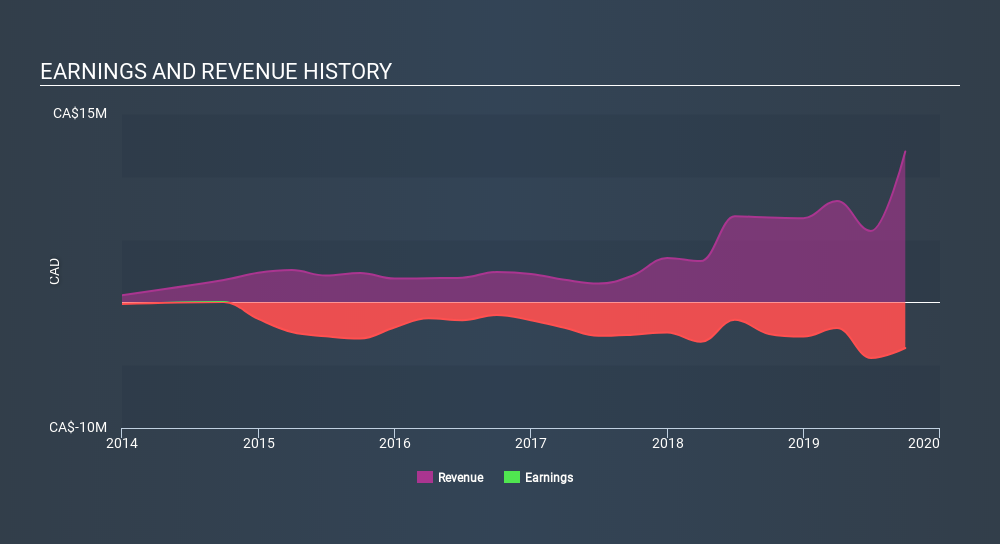

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market lost about 29% in the twelve months, Kraken Robotics shareholders did even worse, losing 64%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 11%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 6 warning signs for Kraken Robotics (2 shouldn't be ignored) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSXV:PNG

Kraken Robotics

A marine technology company, engages in the design, manufacture, and sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications in Canada, the Asia Pacific, Europe, the Middle East, Africa, North America, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives