Is Fosun Tourism Group (HKG:1992) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

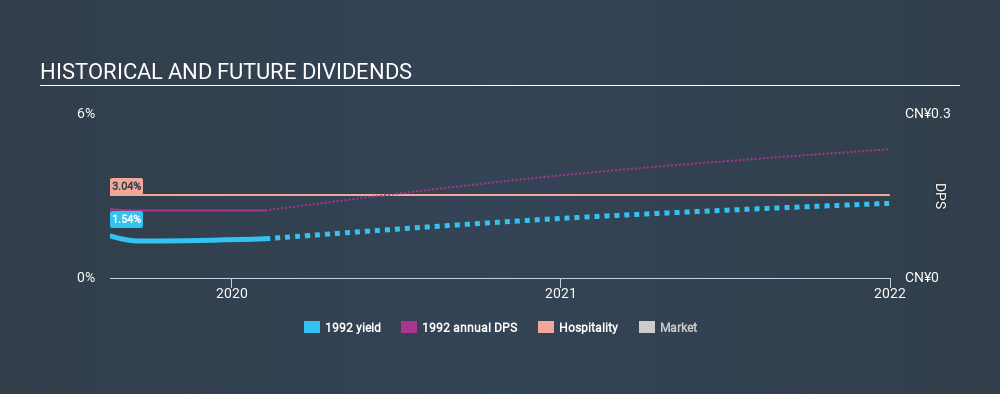

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Fosun Tourism Group paid out 6.6% of its profit as dividends, over the trailing twelve month period. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

We update our data on Fosun Tourism Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Fosun Tourism Group's earnings per share are up 340% on last year. We're glad to see EPS up on last year, but we're conscious that growth rates typically slow as companies increase in size. Earnings per share have grown rapidly, and the company is retaining a majority of its earnings. We think this is ideal from an investment perspective, if the company is able to reinvest these earnings effectively. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

We'd also point out that Fosun Tourism Group issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see Fosun Tourism Group has a low payout ratio, as this suggests earnings are being reinvested in the business. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. Fosun Tourism Group fits all of our criteria, and we think it's an attractive dividend idea that would warrant further investigation.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Fosun Tourism Group stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1992

Fosun Tourism Group

An investment holding company, provides tourism and leisure solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives