- United States

- /

- Household Products

- /

- NYSE:PG

Procter & Gamble (NYSE:PG) Debuts Limited-Edition Summer Fizz Collection With Olay And Secret

Reviewed by Simply Wall St

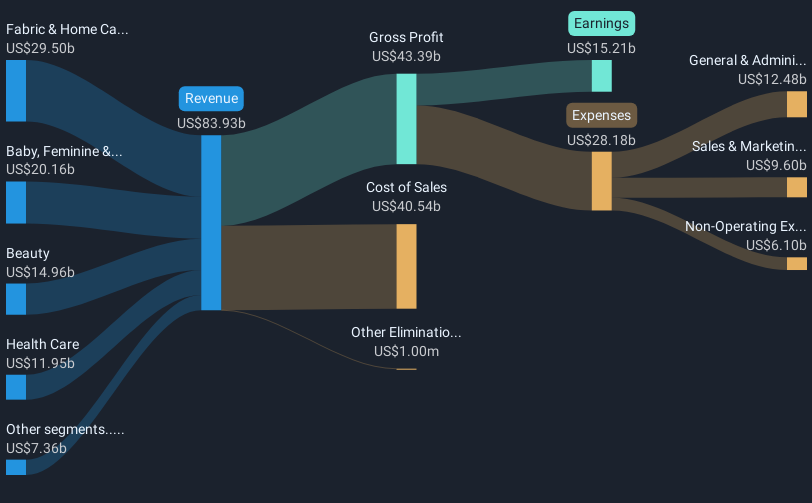

Procter & Gamble (NYSE:PG) introduced its Summer Fizz Scent collection through its Olay and Secret brands, potentially influencing its stock price movement of 2.8% last month. This introduction emphasized innovative, hydrating formulations catering to summer needs. Meanwhile, the broader market saw a 1.6% increase, with oil price surges and geopolitical tensions affecting global stocks. The company's performance amidst these market fluctuations suggests its strategic product launches may have added weight to its stock stability, contrasting with prevailing market volatility driven by external factors.

Be aware that Procter & Gamble is showing 1 risk in our investment analysis.

The recent launch of Procter & Gamble's Summer Fizz Scent collection, through its Olay and Secret brands, could potentially enhance the company's narrative of revenue and earnings growth amid varying market conditions. With a recent 2.8% increase in share price last month, this product rollout appears to support Procter & Gamble's strategy of innovation, possibly bolstering future revenue streams. Over the past five years, Procter & Gamble has experienced a total shareholder return of 54.73%, demonstrating substantial growth compared to the recent 2.7% decline of the US Household Products industry over the past year.

The introduction of this collection may further influence Procter & Gamble's revenue and earnings forecasts, as analysts project revenue growth of 3.1% annually over the next three years with a rise in net margins. The company's current share price stands at US$159.25, which is roughly 7.1% below the consensus analyst price target of US$171.51. This indicates that analysts, on average, view Procter & Gamble as reasonably priced, factoring in the potential impacts of product innovations like the Summer Fizz Scent collection. Hence, continued product investments and consumer confidence could potentially steer Procter & Gamble toward achieving its earnings growth target of US$18 billion by May 2028.

Take a closer look at Procter & Gamble's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives