- United States

- /

- Commercial Services

- /

- NasdaqCM:YIBO

Planet Image International And 2 More Compelling Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the market has remained flat, though it is up 9.8% over the past year with earnings forecasted to grow by 15% annually. In such conditions, identifying stocks that can offer both value and growth becomes crucial for investors looking for opportunities beyond well-known names. Penny stocks, while often associated with smaller or newer companies, can still present compelling investment opportunities when they are supported by strong financials and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.56 | $117.01M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.76 | $57.75M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.31 | $473.78M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.14 | $36.53M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.04 | $176.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.03 | $210.83M | ✅ 3 ⚠️ 0 View Analysis > |

| Flexible Solutions International (FSI) | $4.36 | $55.02M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8331 | $6.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.87 | $90.78M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.85 | $472.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Planet Image International (YIBO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Planet Image International Limited, with a market cap of $72.20 million, manufactures and sells compatible toner cartridges under its own brands and third-party labels across North America, Europe, and other international markets.

Operations: The company's revenue primarily comes from its Printers & Related Products segment, generating $149.83 million.

Market Cap: $72.2M

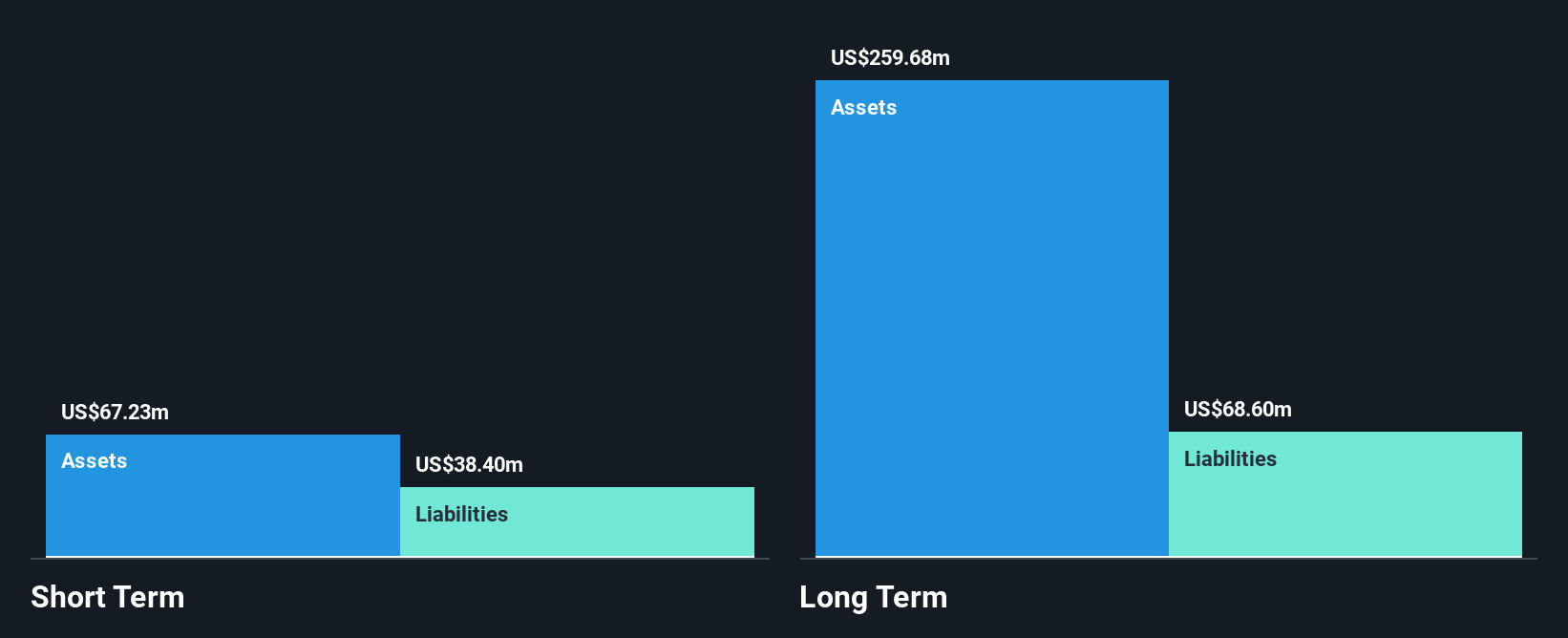

Planet Image International, with a market cap of US$72.20 million, primarily generates revenue from its Printers & Related Products segment, totaling US$149.83 million. The company has seen a reduction in its debt-to-equity ratio from 435.7% to 65.4% over five years and maintains more cash than total debt, though operating cash flow remains negative. Recent volatility in share price is notable despite assets covering liabilities well and interest payments being well covered by EBIT (39.4x). The company's recent shelf registration filings suggest potential capital raising activities ahead, while board changes introduce Mr. Tan Kwong Hun as an experienced director and audit committee chairperson.

- Click here and access our complete financial health analysis report to understand the dynamics of Planet Image International.

- Gain insights into Planet Image International's historical outcomes by reviewing our past performance report.

Smart Sand (SND)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Smart Sand, Inc. offers proppant supply and logistics solutions for frac sand customers, with a market cap of $93.02 million.

Operations: The company's revenue is derived from two segments: Sand, which generated $288.34 million, and Smartsystems, contributing $5.54 million.

Market Cap: $93.02M

Smart Sand, Inc., with a market cap of US$93.02 million, derives its revenue primarily from the Sand segment (US$288.34 million) and Smartsystems (US$5.54 million). Despite trading significantly below estimated fair value and having a satisfactory net debt to equity ratio of 2.9%, the company remains unprofitable with increasing losses over five years at 23.3% annually. Recent earnings reported a net loss of US$24.23 million for Q1 2025, compared to a smaller loss last year, highlighting ongoing financial challenges despite stable weekly volatility and experienced management and board teams guiding operations.

- Take a closer look at Smart Sand's potential here in our financial health report.

- Assess Smart Sand's previous results with our detailed historical performance reports.

Taboola.com (TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.16 billion.

Operations: The company generates its revenue primarily from its advertising segment, which amounts to $1.78 billion.

Market Cap: $1.16B

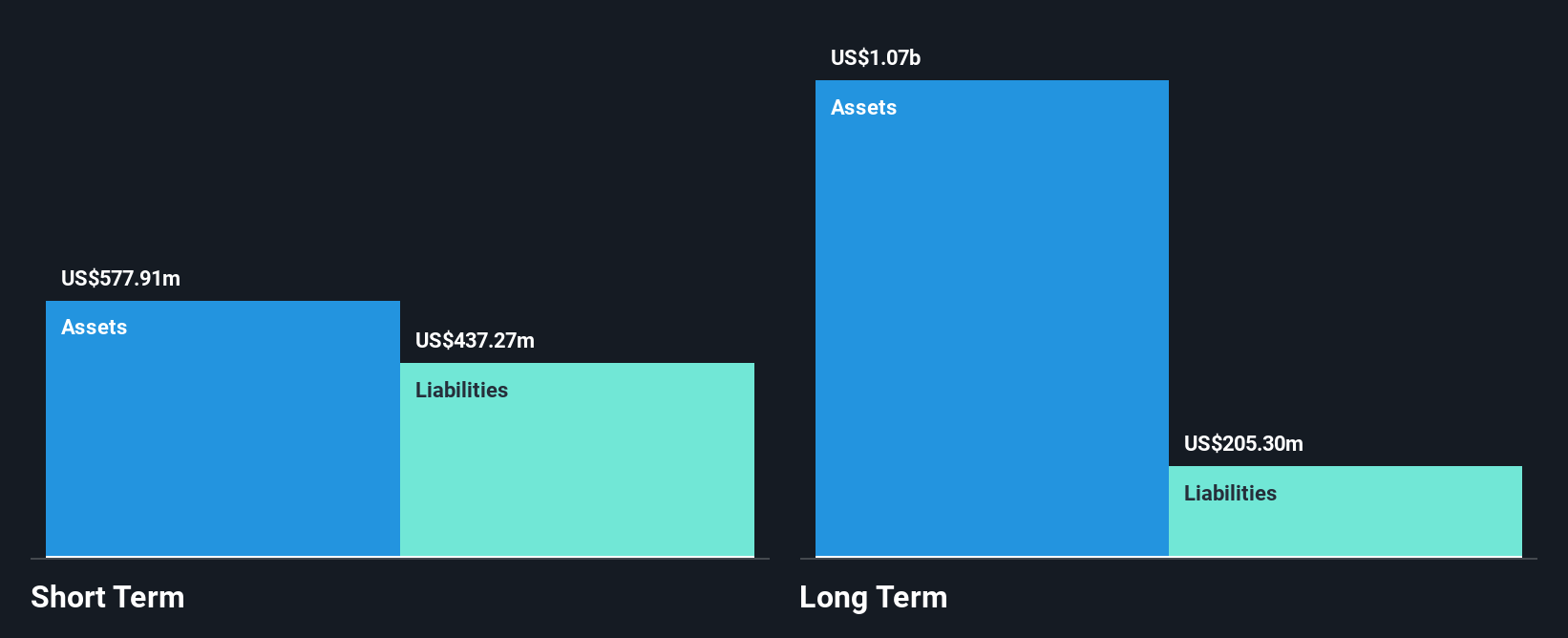

Taboola.com Ltd., with a market cap of US$1.16 billion, has shown resilience in the penny stock arena through strategic partnerships and innovative product launches. Recently, it introduced DeeperDive, an AI-powered engine on USA TODAY’s platform, enhancing user engagement and creating new monetization avenues via high-intent advertising. Financially stable with short-term assets exceeding liabilities and debt well-covered by cash flow, Taboola's recent profitability marks a shift from historical losses despite low return on equity at 1.4%. Its seasoned board and management team continue to navigate growth opportunities in the competitive digital advertising landscape.

- Navigate through the intricacies of Taboola.com with our comprehensive balance sheet health report here.

- Evaluate Taboola.com's prospects by accessing our earnings growth report.

Where To Now?

- Click here to access our complete index of 720 US Penny Stocks.

- Looking For Alternative Opportunities? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YIBO

Planet Image International

Through its subsidiaries, manufactures and sells compatible toner cartridges on a white-label or third-party brand basis or under its self-owned brands in North America, Europe, and internationally.

Excellent balance sheet low.

Market Insights

Community Narratives