Stock Analysis

- India

- /

- Basic Materials

- /

- NSEI:ORIENTCEM

Orient Cement's (NSE:ORIENTCEM) Stock Price Has Reduced 65% In The Past Five Years

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. To wit, the Orient Cement Limited (NSE:ORIENTCEM) share price managed to fall 65% over five long years. That's an unpleasant experience for long term holders. We also note that the stock has performed poorly over the last year, with the share price down 30%.

See our latest analysis for Orient Cement

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

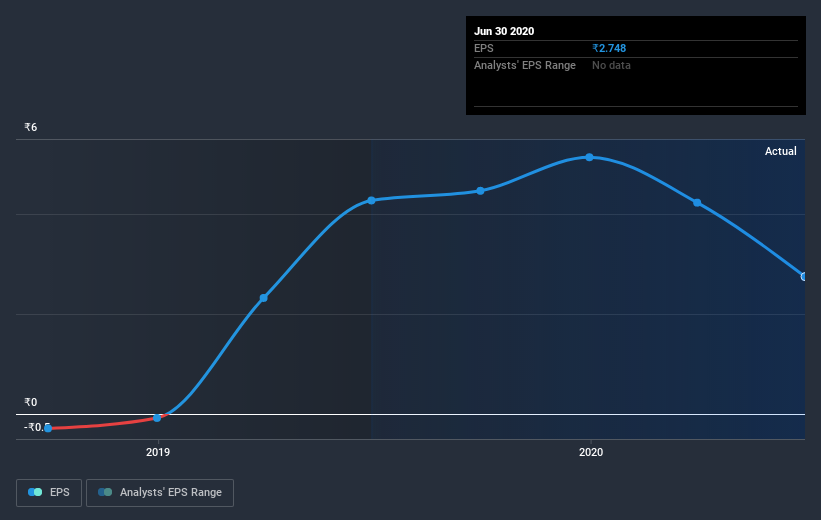

Looking back five years, both Orient Cement's share price and EPS declined; the latter at a rate of 21% per year. Notably, the share price has fallen at 19% per year, fairly close to the change in the EPS. This implies that the market has had a fairly steady view of the stock. So it's fair to say the share price has been responding to changes in EPS.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Investors in Orient Cement had a tough year, with a total loss of 29% (including dividends), against a market gain of about 7.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 10% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Orient Cement (2 are a bit unpleasant!) that you should be aware of before investing here.

But note: Orient Cement may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Orient Cement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Orient Cement is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ORIENTCEM

Flawless balance sheet with solid track record and pays a dividend.