- United Kingdom

- /

- Hospitality

- /

- AIM:SSTY

One Safestay plc (LON:SSTY) Analyst Just Slashed Their Estimates By A Consequential 22%

The latest analyst coverage could presage a bad day for Safestay plc (LON:SSTY), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. Bidders are definitely seeing a different story, with the stock price of UK£0.15 reflecting a 11% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

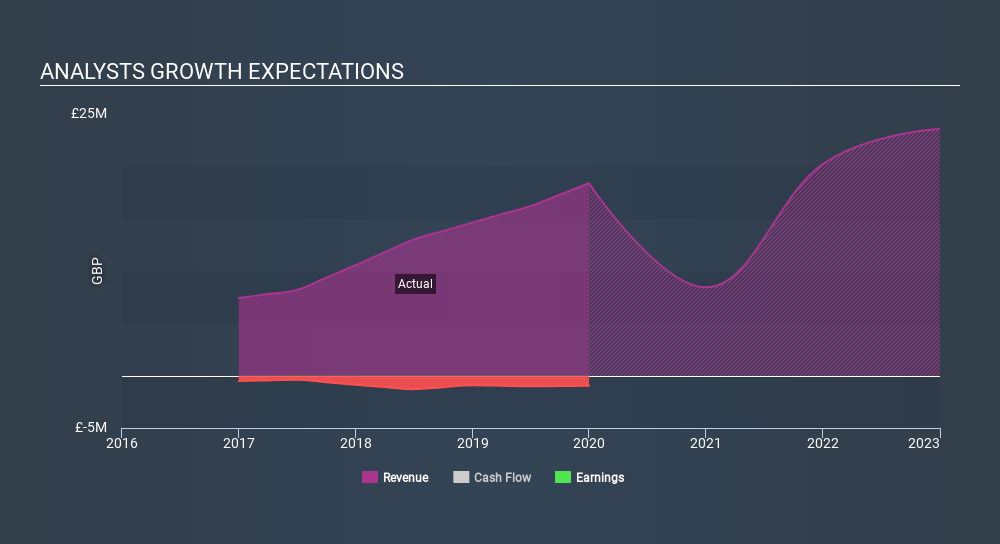

After the downgrade, the consensus from Safestay's solo analyst is for revenues of UK£8.4m in 2020, which would reflect a concerning 54% decline in sales compared to the last year of performance. Before the latest update, the analyst was foreseeing UK£11m of revenue in 2020. It looks like forecasts have become a fair bit less optimistic on Safestay, given the pretty serious reduction to revenue estimates.

View our latest analysis for Safestay

The consensus price target fell 13% to UK£0.35, with the analyst clearly less optimistic about Safestay's valuation following this update.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 54%, a significant reduction from annual growth of 34% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.3% next year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Safestay is expected to lag the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Safestay this year. They're also anticipating slower revenue growth than the wider market. The consensus price target fell measurably, with the analyst seemingly not reassured by recent business developments, leading to a lower estimate of Safestay's future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Safestay after today.

Hungry for more information? One Safestay broker/analyst has provided estimates out to 2022, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About AIM:SSTY

Safestay

Develops and operates hostels under the Safestay brand in the United Kingdom, Spain, and the rest of Europe.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Transformational Merger

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.