- Turkey

- /

- Retail REITs

- /

- IBSE:PAGYO

Middle Eastern Dividend Stocks To Watch In June 2025

Reviewed by Simply Wall St

As Middle Eastern markets experience gains amid optimism surrounding U.S.-China trade talks, investors are closely monitoring the region's indices for further advancements. In this context, dividend stocks present an attractive option for those seeking stable returns, as they often reflect strong financial health and resilience in fluctuating market conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.77% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.84% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.19% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.46% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.27% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.46% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.55% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.78% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.04% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.75% | ★★★★★☆ |

Click here to see the full list of 73 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

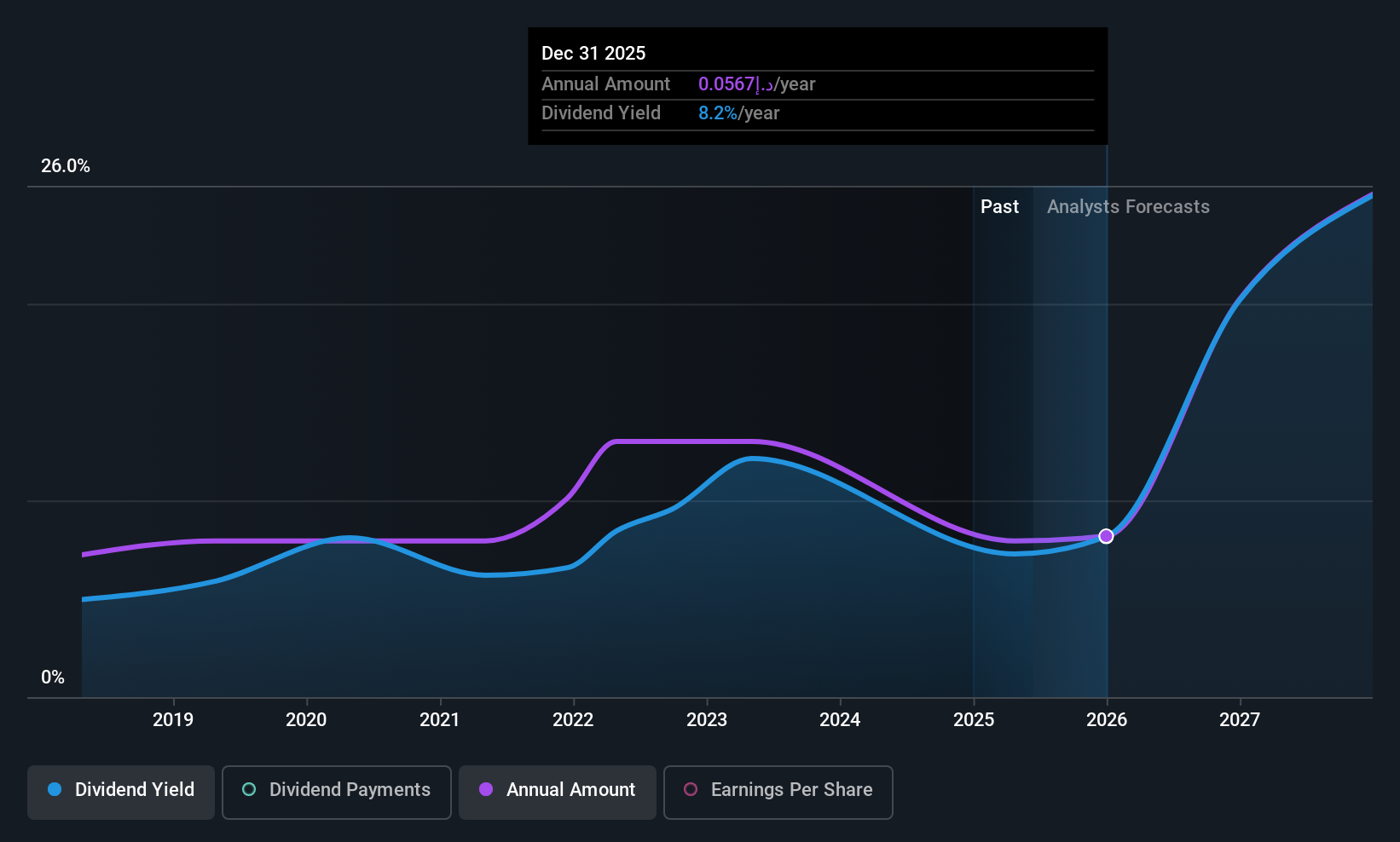

Dana Gas PJSC (ADX:DANA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dana Gas PJSC, with a market cap of AED5.09 billion, operates in the exploration, production, transportation, and sale of natural gas and petroleum products across the United Arab Emirates, Iraq, and Egypt.

Operations: Dana Gas PJSC generates revenue primarily from its Oil & Gas - Integrated segment, which amounted to $332 million.

Dividend Yield: 7.6%

Dana Gas PJSC offers a high dividend yield, ranking in the top 25% of payers in the AE market. Despite this, its dividend history is marked by volatility and less than ten years of consistent payments. Recent earnings growth supports its payout ratio of 67.1%, indicating dividends are covered by earnings and cash flows (55.7%). However, the company's track record suggests caution for those seeking stable income streams despite trading at a significant discount to estimated fair value.

- Navigate through the intricacies of Dana Gas PJSC with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Dana Gas PJSC is priced lower than what may be justified by its financials.

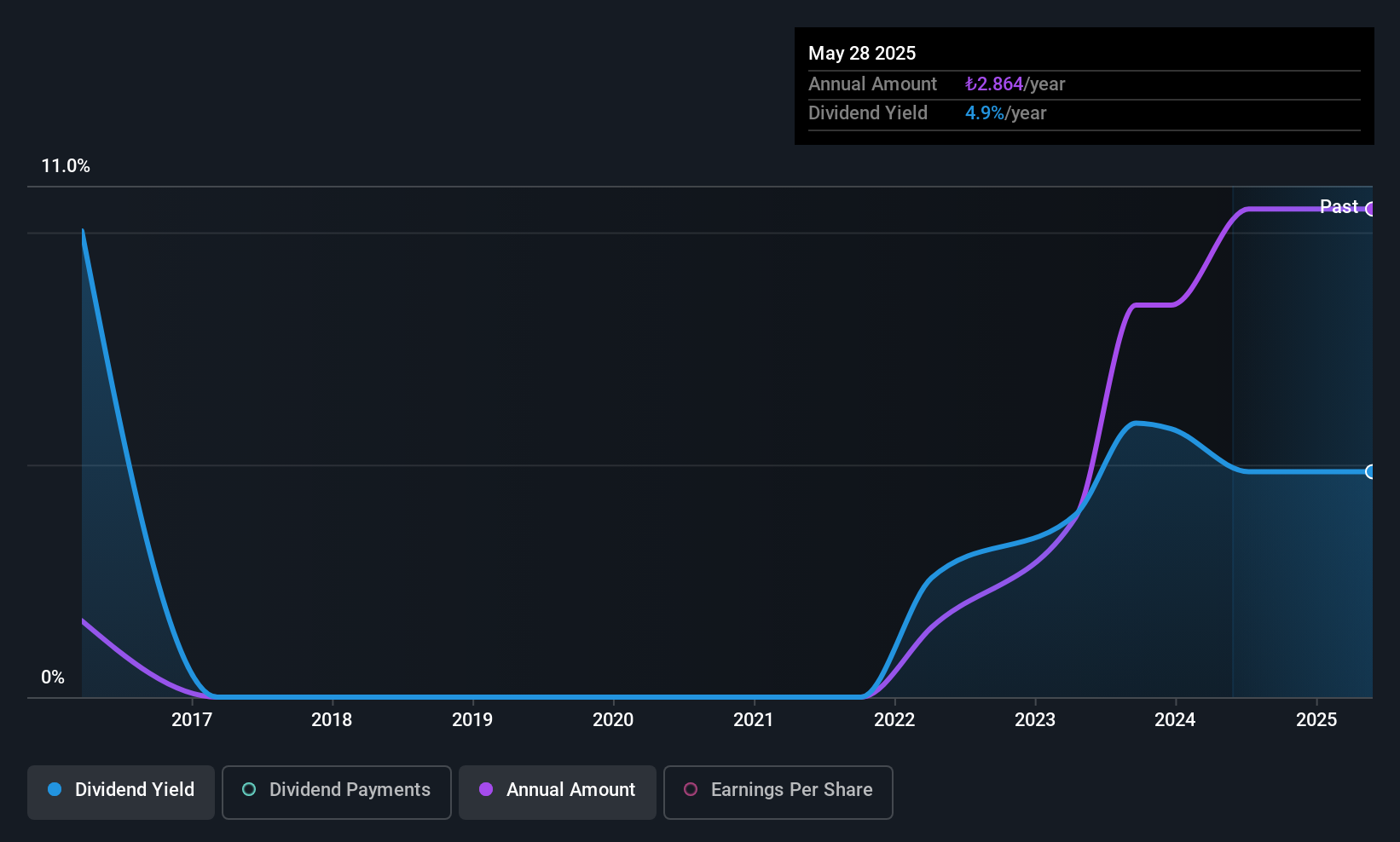

Panora Gayrimenkul Yatirim Ortakligi (IBSE:PAGYO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Panora Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector and has a market capitalization of TRY6.35 billion.

Operations: Panora Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from its REIT - Commercial segment, which amounts to TRY786 million.

Dividend Yield: 3.9%

Panora Gayrimenkul Yatirim Ortakligi A.S. ranks among the top 25% of dividend payers in Turkey with a yield of 3.92%. Despite this, its dividend history is volatile and unstable, with a high payout ratio of 97.7%, indicating coverage by earnings and cash flows (87.2%). Recent earnings showed decreased net income despite increased sales, influenced by large one-off items, suggesting caution for investors seeking reliable dividends.

- Click here to discover the nuances of Panora Gayrimenkul Yatirim Ortakligi with our detailed analytical dividend report.

- Our expertly prepared valuation report Panora Gayrimenkul Yatirim Ortakligi implies its share price may be too high.

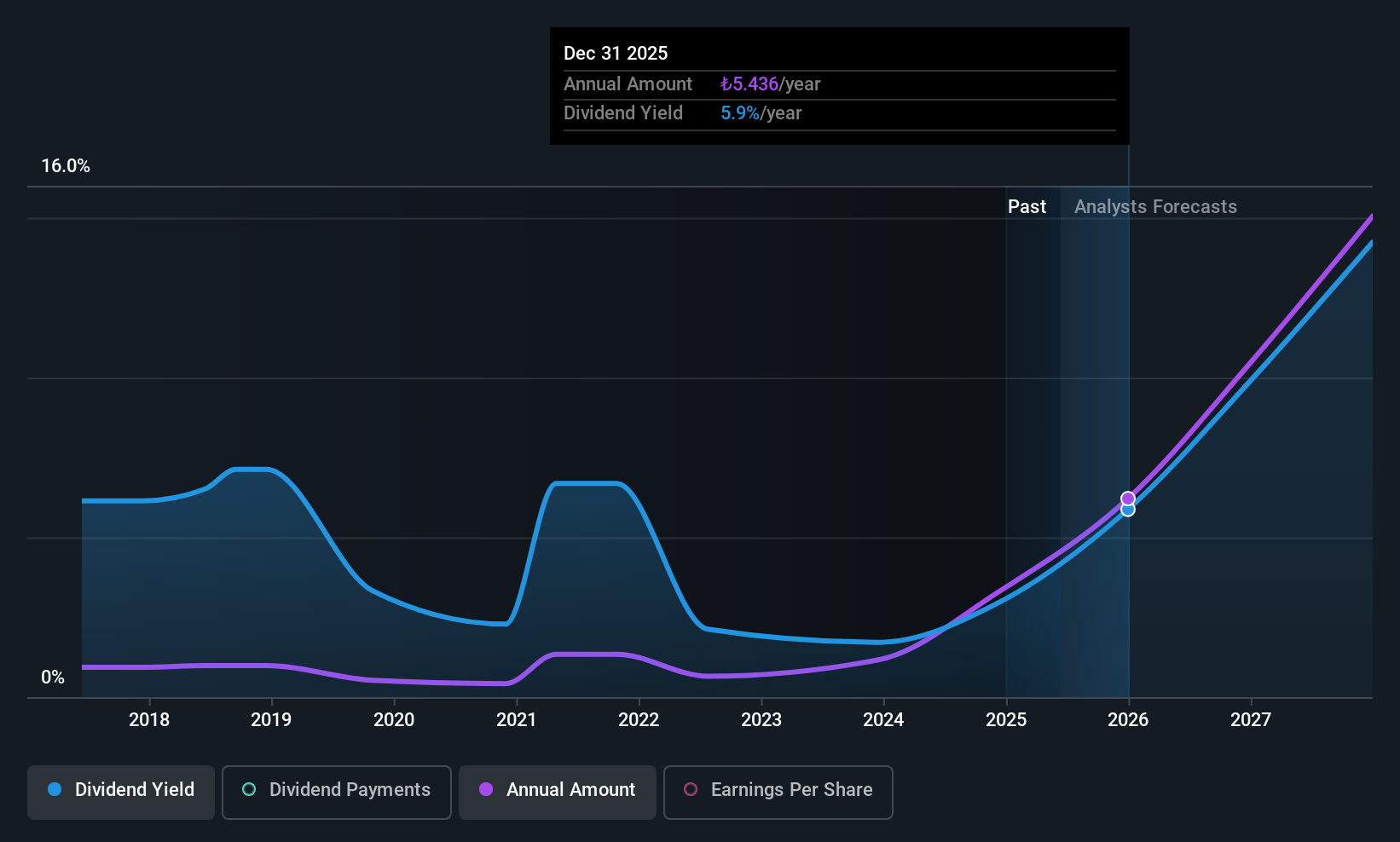

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S. offers digital services across Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands with a market cap of TRY211.54 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily from its Turkcell Turkey segment, which accounts for TRY148.31 billion, and its Techfin segment, contributing TRY9.29 billion.

Dividend Yield: 3.7%

Turkcell Iletisim Hizmetleri offers a dividend yield of 3.75%, placing it in the top 25% of Turkish dividend payers, though its history shows volatility. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 70.3% and 27.5%, respectively. Recent strategic alliances, such as the collaboration with Huawei for advanced wireless technology, underscore its commitment to growth and infrastructure development, supported by diverse financing like USD 150 million from Dubai Islamic Bank PJSC.

- Click to explore a detailed breakdown of our findings in Turkcell Iletisim Hizmetleri's dividend report.

- Our valuation report unveils the possibility Turkcell Iletisim Hizmetleri's shares may be trading at a discount.

Summing It All Up

- Unlock more gems! Our Top Middle Eastern Dividend Stocks screener has unearthed 70 more companies for you to explore.Click here to unveil our expertly curated list of 73 Top Middle Eastern Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:PAGYO

Panora Gayrimenkul Yatirim Ortakligi

Panora Gayrimenkul Yatirim Ortakligi A.S.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives