Stock Analysis

Kopran Limited's (NSE:KOPRAN) Shares Not Telling The Full Story

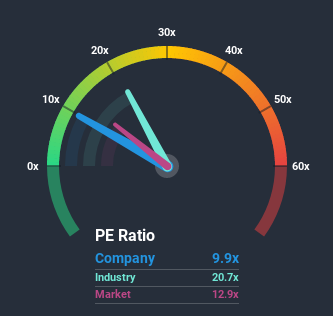

Kopran Limited's (NSE:KOPRAN) price-to-earnings (or "P/E") ratio of 9.9x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 13x and even P/E's above 31x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that Kopran's financial performance has been poor lately as it's earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Kopran

How Is Kopran's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Kopran's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 13%. Regardless, EPS has managed to lift by a handy 5.6% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 0.6% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Kopran's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Bottom Line On Kopran's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Kopran revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. We think potential risks might be placing significant pressure on the P/E ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. It appears many are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Kopran that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

When trading Kopran or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Kopran is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KOPRAN

Kopran

An integrated pharmaceutical company, manufactures and sells active pharmaceutical ingredients and finished dosage forms in India and internationally.

Flawless balance sheet with solid track record.