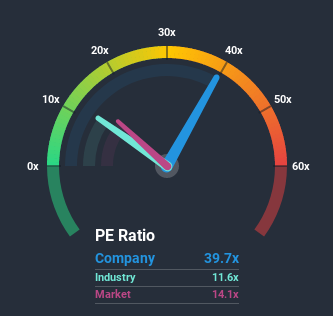

With a price-to-earnings (or "P/E") ratio of 39.7x KBJ S.A. (WSE:KBJ) may be sending very bearish signals at the moment, given that almost half of all companies in Poland have P/E ratios under 14x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at KBJ over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for KBJ

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like KBJ's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 61% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 78% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to shrink 2.4% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised earnings results.

In light of this, it's odd that KBJ's P/E sits above the majority of other companies. In general, when earnings shrink rapidly the P/E premium often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On KBJ's P/E

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that KBJ currently trades on a much higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware KBJ is showing 4 warning signs in our investment analysis, and 2 of those are potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you’re looking to trade KBJ, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KBJ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:KBJ

KBJ

Provides IT services to large and medium sized companies in Poland and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives