- United States

- /

- Biotech

- /

- NasdaqCM:GNLX

June 2025's Promising Penny Stocks For Savvy Investors

Reviewed by Simply Wall St

As the U.S. markets navigate a landscape marked by geopolitical tensions and fluctuating oil prices, investors are keenly observing shifts in major indices like the Dow Jones and S&P 500. For those interested in exploring beyond established giants, penny stocks—often representing smaller or emerging companies—remain an intriguing investment area despite their somewhat outdated moniker. By focusing on financially robust penny stocks, investors can uncover potential opportunities that balance risk with promising growth prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.37 | $115.98M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.87 | $58.69M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.34 | $484.63M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.00 | $34.79M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.02 | $171.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.82 | $185.36M | ✅ 4 ⚠️ 0 View Analysis > |

| Flexible Solutions International (FSI) | $4.25 | $53.75M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84 | $6.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.71 | $83.16M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.48 | $463.09M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 724 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Genelux (GNLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genelux Corporation is a clinical-stage biopharmaceutical company specializing in the development of oncolytic viral immunotherapies for challenging solid tumors, with a market cap of $114.14 million.

Operations: Genelux Corporation has not reported any revenue segments.

Market Cap: $114.14M

Genelux Corporation, a clinical-stage biopharmaceutical company with a market cap of US$114.14 million, remains pre-revenue with no substantial revenue streams reported. Despite having sufficient cash runway for over a year and being debt-free, the company faces significant challenges including recent auditor doubts about its ability to continue as a going concern. The stock has experienced high volatility and significant insider selling recently. Genelux's most advanced product candidate, Olvi-Vec, is undergoing multiple trials but the company remains unprofitable with losses increasing by 25.6% annually over the past five years.

- Jump into the full analysis health report here for a deeper understanding of Genelux.

- Learn about Genelux's future growth trajectory here.

Quince Therapeutics (QNCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quince Therapeutics, Inc. is a biopharmaceutical company dedicated to acquiring, developing, and commercializing therapeutics for patients with debilitating and rare diseases, with a market cap of $65.02 million.

Operations: Quince Therapeutics, Inc. does not have any reported revenue segments.

Market Cap: $65.02M

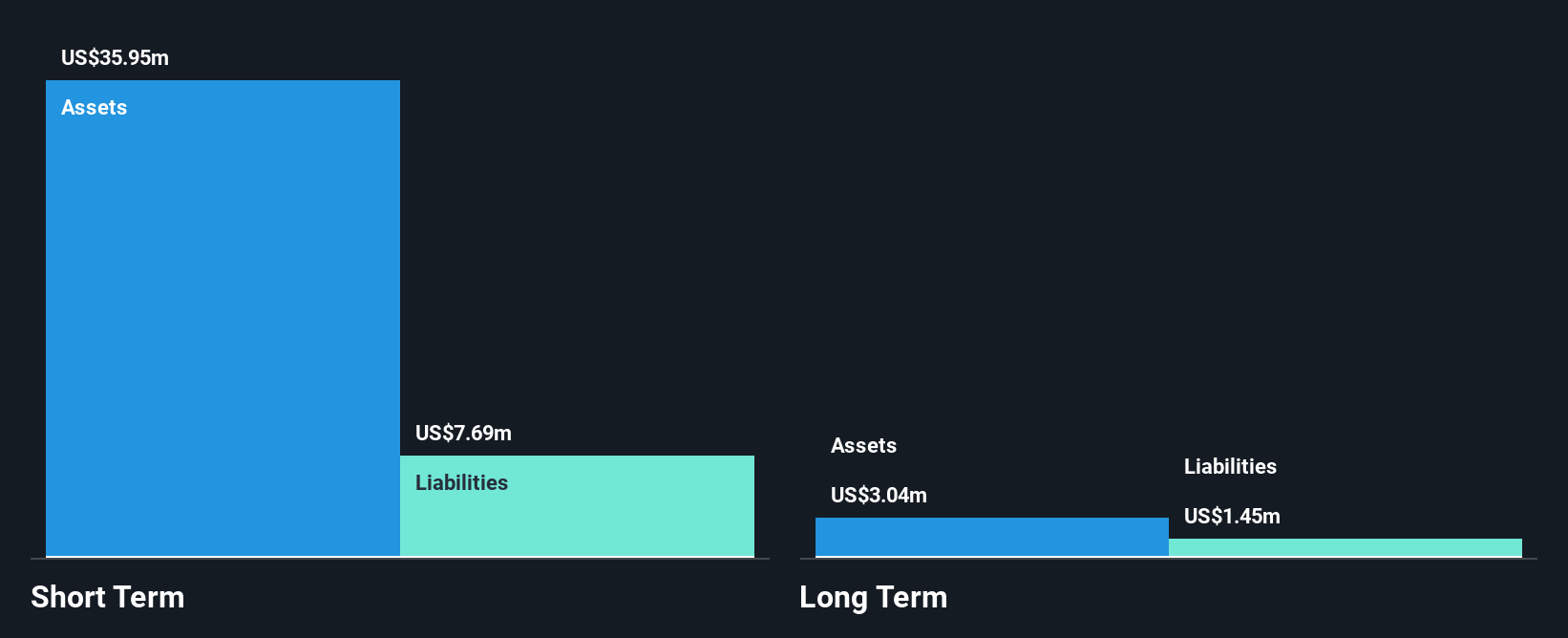

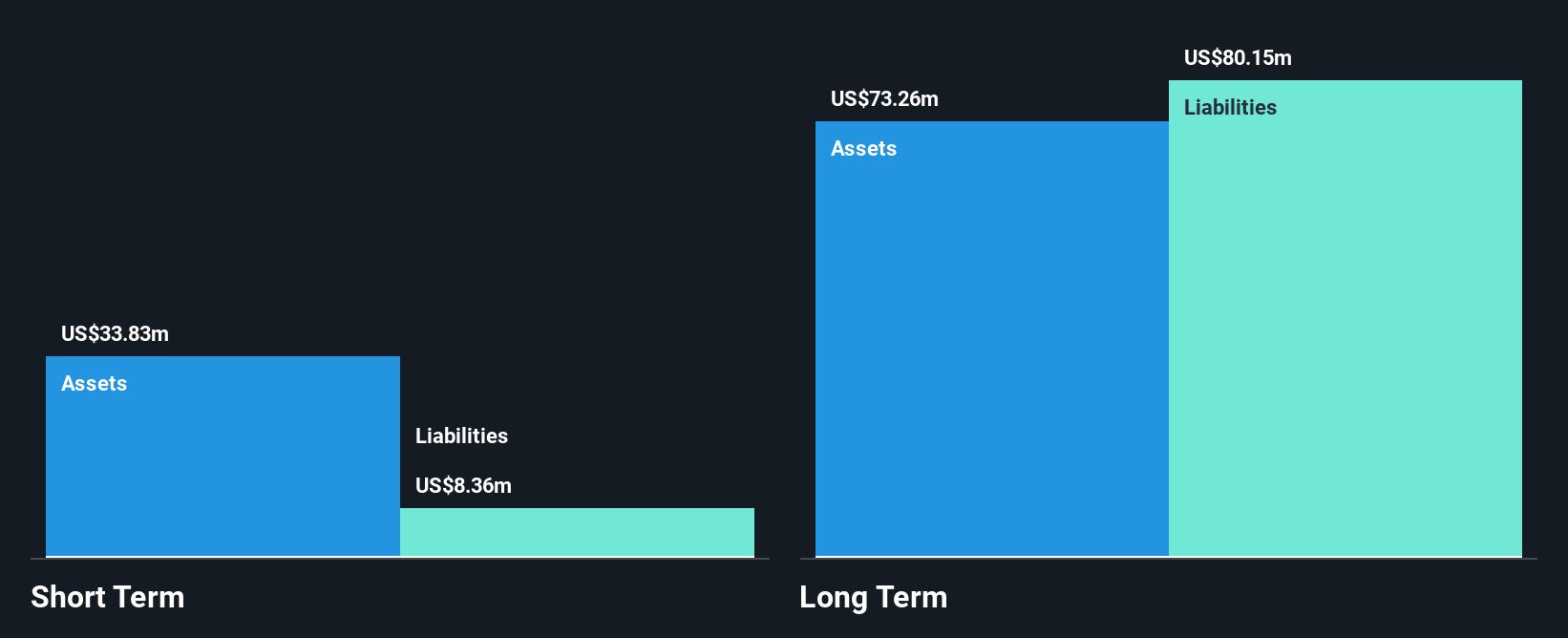

Quince Therapeutics, Inc., with a market cap of US$65.02 million, is pre-revenue and currently unprofitable. Despite reducing losses by 11.1% annually over five years, the company faces financial challenges as short-term assets do not cover long-term liabilities of US$80.2 million. Recently, Quince raised over US$11 million through private placements to extend its cash runway beyond 11 months. The company is progressing in its Phase 3 NEAT trial for Ataxia-Telangiectasia treatment with plans to submit an NDA in 2026 if results are positive, though auditor doubts about its going concern status persist amidst high volatility and increased debt levels.

- Get an in-depth perspective on Quince Therapeutics' performance by reading our balance sheet health report here.

- Evaluate Quince Therapeutics' prospects by accessing our earnings growth report.

Safe Bulkers (SB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Safe Bulkers, Inc., along with its subsidiaries, offers marine drybulk transportation services on an international scale and has a market cap of $396.96 million.

Operations: The company generates revenue of $290.31 million from its marine drybulk transportation services.

Market Cap: $396.96M

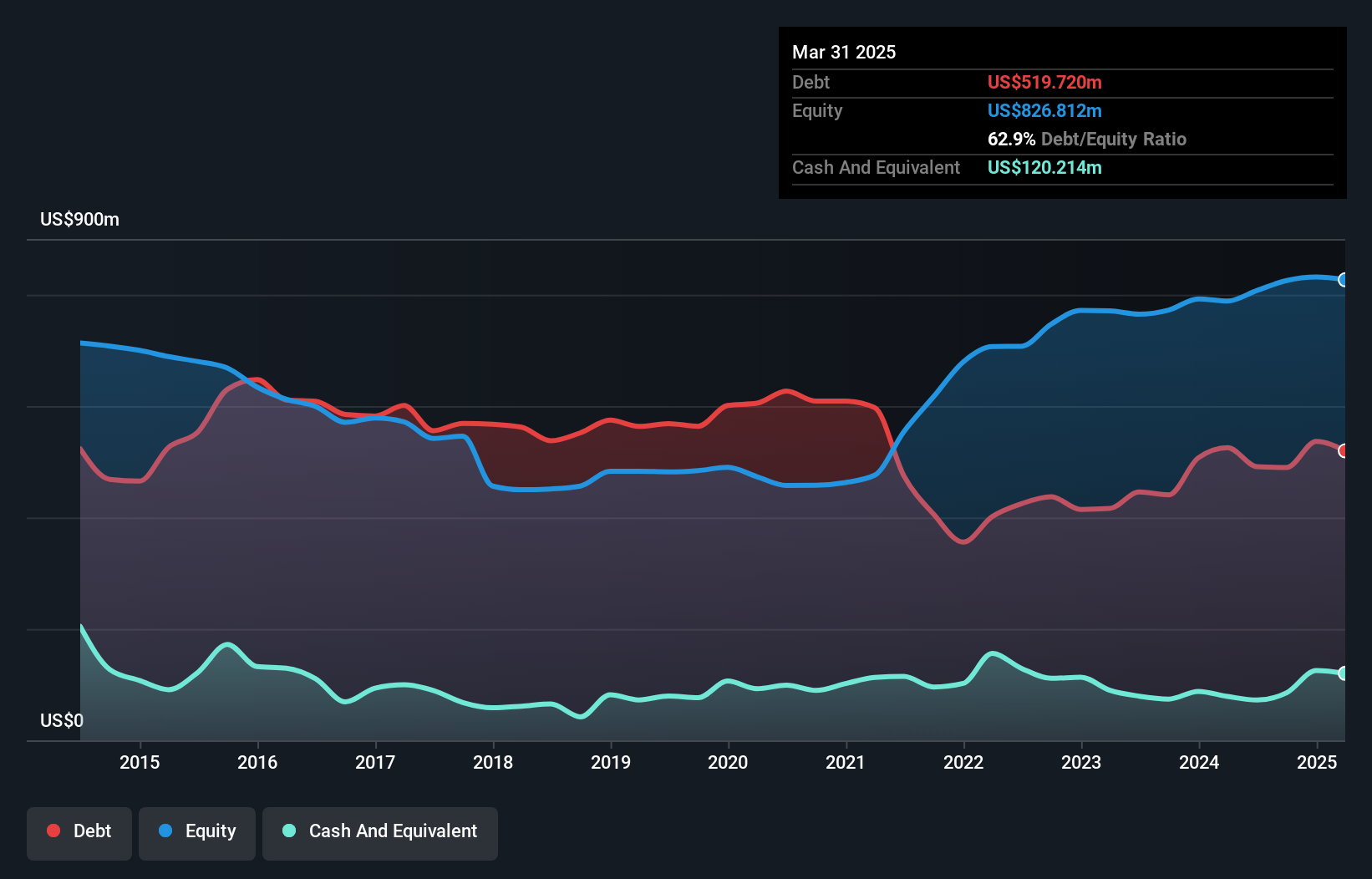

Safe Bulkers, Inc., with a market cap of US$396.96 million, operates within the marine drybulk transportation sector. Despite experiencing a decline in earnings growth over the past year, the company has demonstrated financial resilience by reducing its debt-to-equity ratio from 127.9% to 62.9% over five years and maintaining strong operating cash flow coverage of its debt at 23.9%. Recent activities include completing a share buyback program worth US$10.72 million and declaring dividends on both common and preferred shares, reflecting management's commitment to returning value to shareholders despite facing revenue challenges in Q1 2025 compared to the prior year.

- Click here to discover the nuances of Safe Bulkers with our detailed analytical financial health report.

- Assess Safe Bulkers' future earnings estimates with our detailed growth reports.

Summing It All Up

- Discover the full array of 724 US Penny Stocks right here.

- Curious About Other Options? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GNLX

Genelux

A clinical-stage biopharmaceutical company, focuses on developing oncolytic viral immunotherapies for patients suffering from aggressive and/or difficult-to-treat solid tumor types.

Flawless balance sheet slight.

Market Insights

Community Narratives