- Finland

- /

- Metals and Mining

- /

- HLSE:PAMPALO

June 2025 European Stocks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As inflation slows and the European Central Bank eases monetary policy, the pan-European STOXX Europe 600 Index has seen a rise, reflecting a positive sentiment in the region's markets. With this economic backdrop, investors might be on the lookout for stocks that are potentially undervalued, offering opportunities to capitalize on companies whose market prices may not fully reflect their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN516.00 | PLN1020.43 | 49.4% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.27 | RON8.44 | 49.4% |

| Trøndelag Sparebank (OB:TRSB) | NOK114.00 | NOK223.41 | 49% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK362.62 | 49.4% |

| Montana Aerospace (SWX:AERO) | CHF19.70 | CHF38.70 | 49.1% |

| Lectra (ENXTPA:LSS) | €23.75 | €46.59 | 49% |

| doValue (BIT:DOV) | €2.212 | €4.41 | 49.9% |

| Airbus (ENXTPA:AIR) | €162.80 | €324.82 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK210.00 | SEK415.92 | 49.5% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €37.20 | €73.22 | 49.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

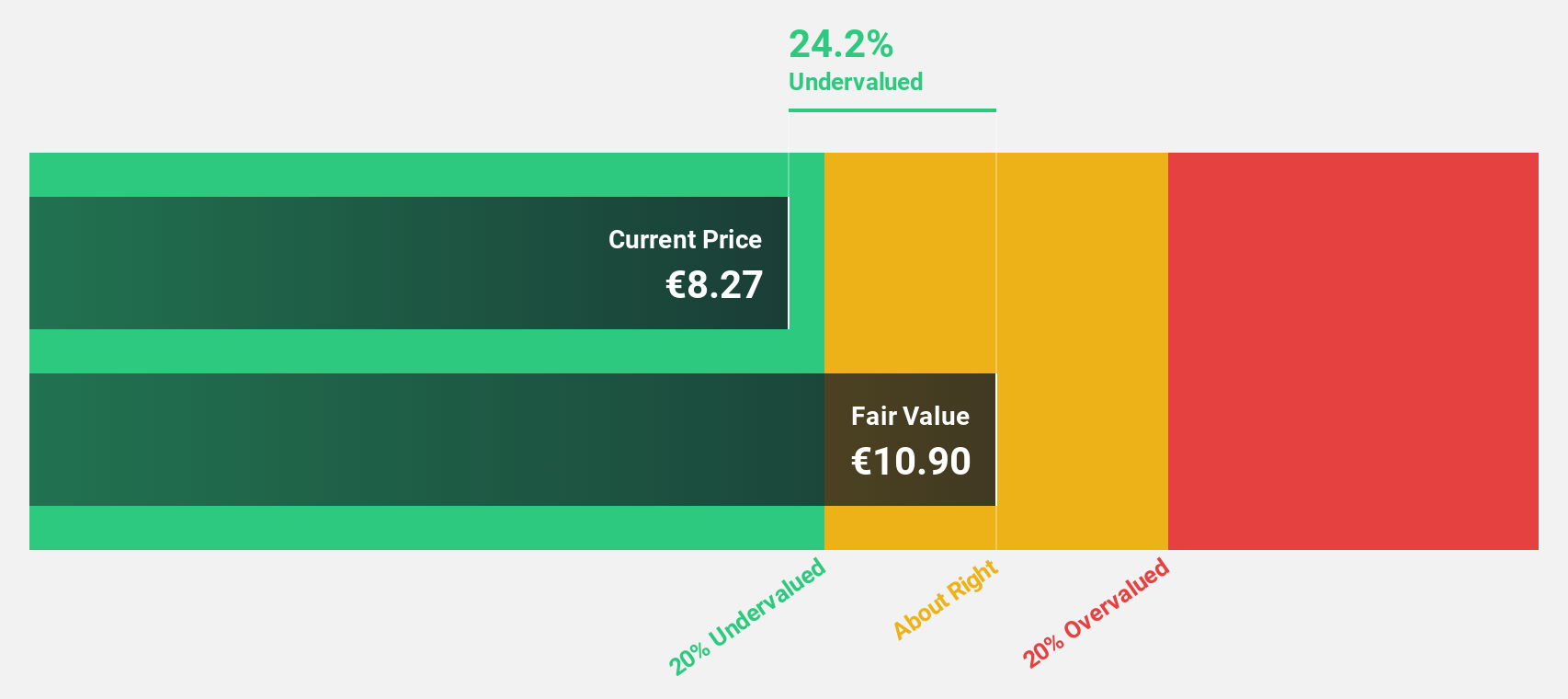

Bénéteau (ENXTPA:BEN)

Overview: Bénéteau S.A. is a company that designs, manufactures, and sells boats and leisure homes both in France and internationally, with a market cap of €691.17 million.

Operations: The company's revenue is primarily derived from its boat segment, which accounts for €1.03 billion.

Estimated Discount To Fair Value: 21.4%

Bénéteau is trading at €8.59, below its estimated fair value of €10.92, suggesting undervaluation based on cash flows. Despite a volatile share price and a lower net profit margin compared to last year, earnings are forecast to grow significantly at 25.33% annually over the next three years, outpacing the French market's growth rate. However, its dividend track record remains unstable and return on equity is projected to be modest in three years.

- Our comprehensive growth report raises the possibility that Bénéteau is poised for substantial financial growth.

- Navigate through the intricacies of Bénéteau with our comprehensive financial health report here.

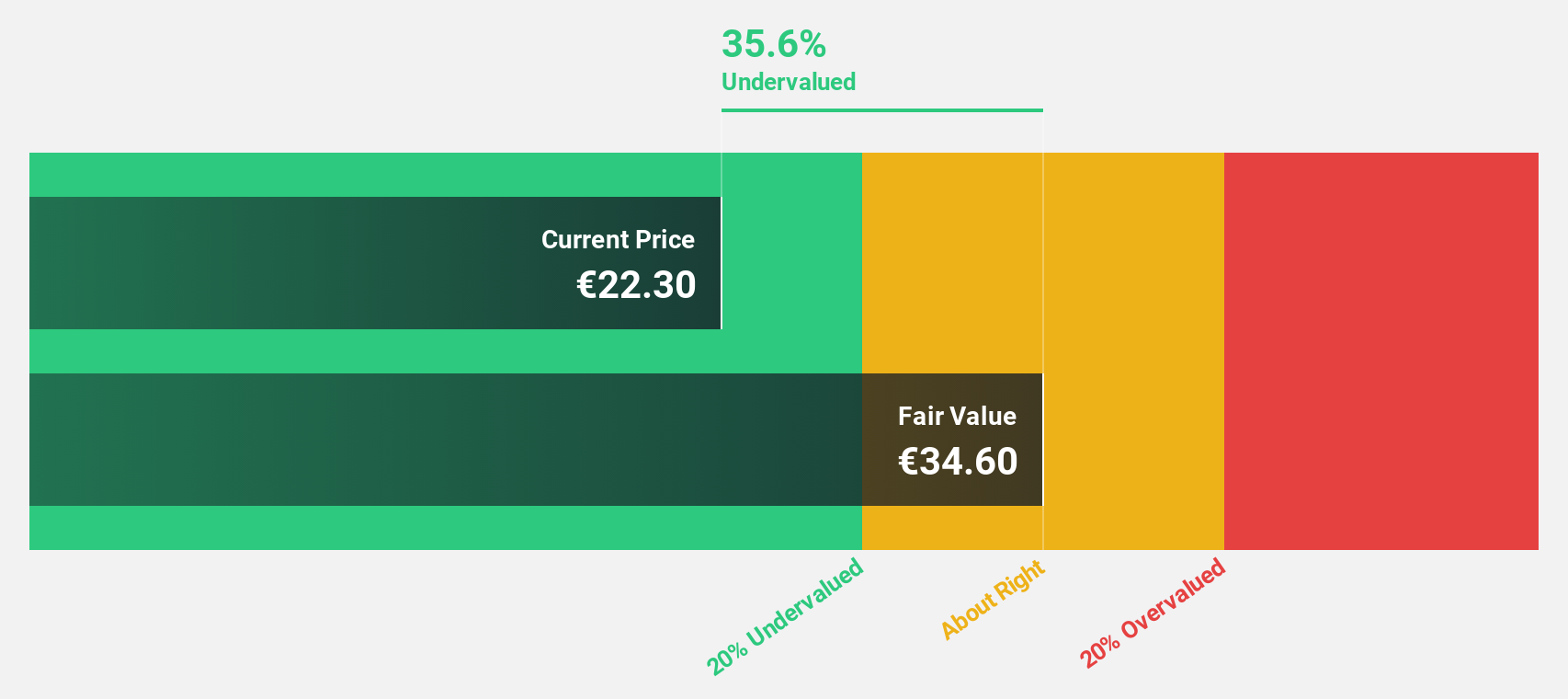

Endomines Finland Oyj (HLSE:PAMPALO)

Overview: Endomines Finland Oyj is involved in the mining and exploration of gold deposits in Finland and the United States, with a market cap of €241.27 million.

Operations: The company generates revenue primarily from Pampalo Production, amounting to €28.70 million.

Estimated Discount To Fair Value: 36.5%

Endomines Finland Oyj is trading at €21.9, below its estimated fair value of €34.49, highlighting potential undervaluation based on cash flows. Its earnings are projected to grow significantly at 32.47% annually over the next three years, surpassing Finnish market growth rates. Despite high share price volatility recently, the company has become profitable this year and reported promising gold discoveries in the Karelian Gold Line that could enhance future revenue streams.

- In light of our recent growth report, it seems possible that Endomines Finland Oyj's financial performance will exceed current levels.

- Get an in-depth perspective on Endomines Finland Oyj's balance sheet by reading our health report here.

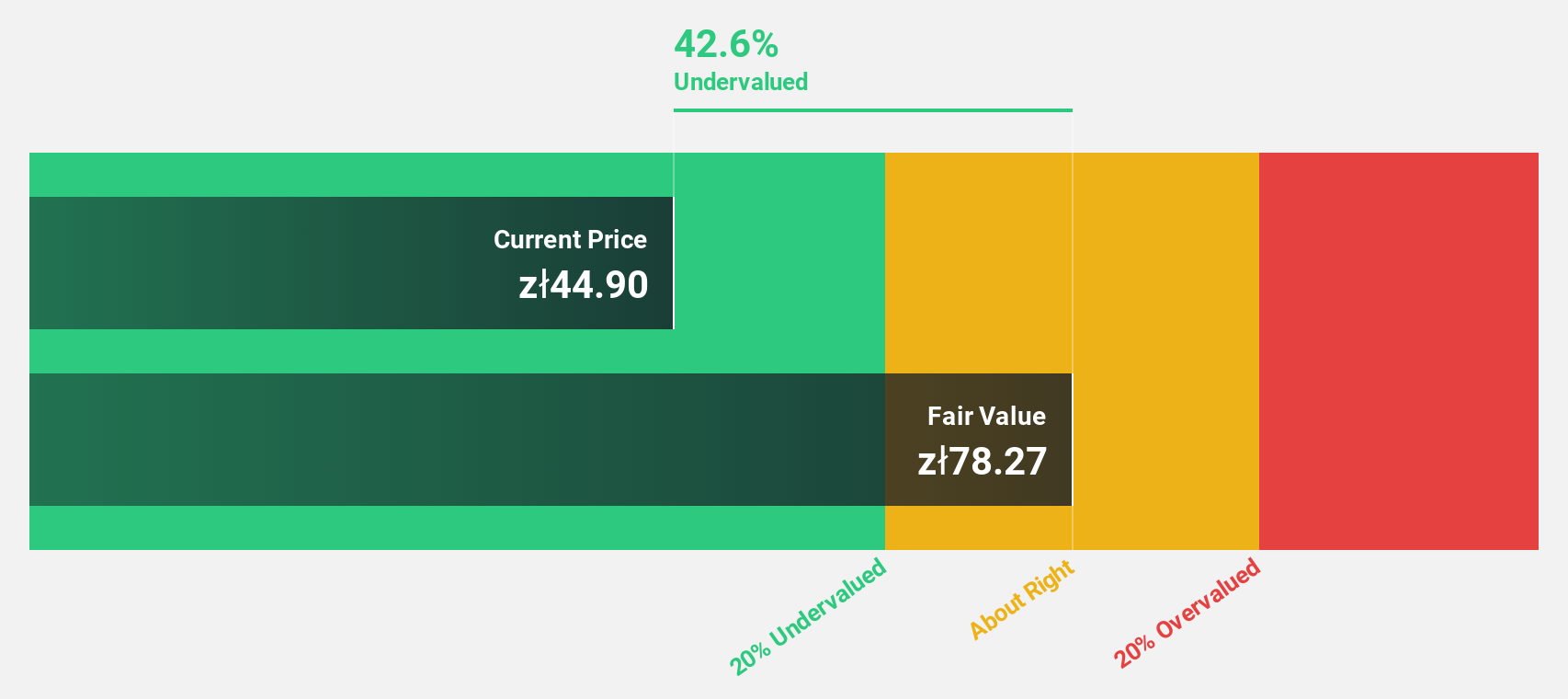

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland with a market capitalization of PLN2.59 billion.

Operations: The company's revenue segments include Supporting Companies with PLN254.23 million, Unclassified Activity in Lodz at PLN3.73 million, Cracow at PLN82.89 million, Poznan at PLN12.23 million, Warsaw at PLN42.43 million, and Wroclaw generating PLN307.53 million.

Estimated Discount To Fair Value: 43.3%

Archicom is trading at PLN 44.3, significantly below its estimated fair value of PLN 78.17, suggesting undervaluation based on cash flows. Despite a challenging first quarter with a net loss of PLN 32.22 million, its earnings are forecast to grow substantially at 65.46% annually over the next three years, outpacing the Polish market's growth rate. However, dividend sustainability remains questionable due to insufficient free cash flow coverage and interest payments not well supported by earnings.

- Our expertly prepared growth report on Archicom implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Archicom.

Summing It All Up

- Gain an insight into the universe of 174 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Endomines Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PAMPALO

Endomines Finland Oyj

Engages in the mining and exploration of gold deposits in Finland and the United States.

High growth potential with acceptable track record.

Market Insights

Community Narratives