- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (NYSE:JNJ) Faces US$8 Million Verdict Over Talcum Powder Cancer Case

Reviewed by Simply Wall St

Johnson & Johnson (NYSE:JNJ) recently faced significant legal challenges resulting in an $8 million jury award related to its talcum powder products, which may have contributed to its 1% decline over the past month. Despite this legal development, the company remains active in its clinical trials, showing promising results in various areas of oncology. While these positive strides in product development may have added weight to market optimism, the legal setback likely countered broader market trends, which exhibited a 9.9% increase over the past year, contrasting with J&J's flat performance.

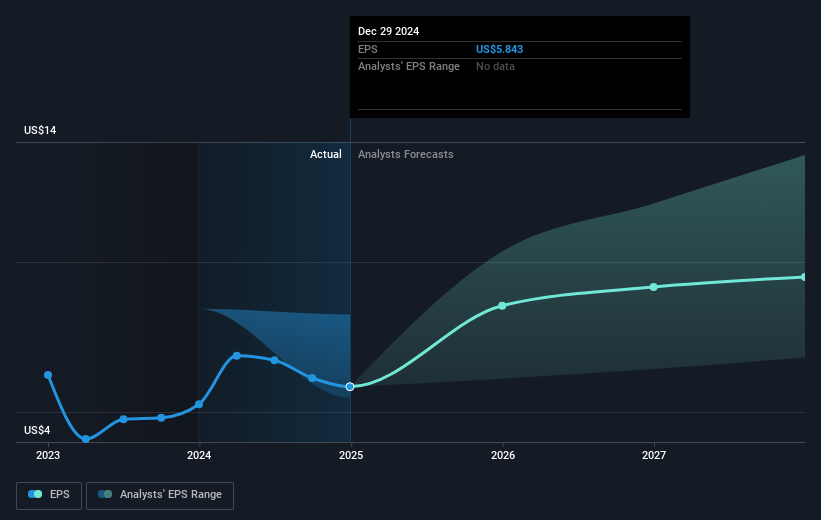

Johnson & Johnson's recent legal challenges, specifically the $8 million jury award related to talcum powder products, have raised concerns about potential impacts on its financial narrative. While the company shows strength in its clinical trials, ongoing litigation and its associated costs could pressure revenue and earnings forecasts. Analysts remain divided, with a range of expectations for the company's performance, highlighting the legal uncertainties as a crucial factor affecting these projections.

Over the last five years, Johnson & Johnson's total shareholder return, which includes both share price appreciation and dividends, was 24.25%. This performance contrasts with the broader market return of 9.9% over the past year, during which J&J's share price remained primarily flat. While the company outperformed the Pharmaceuticals industry over the same period, recording a loss for the industry, it lagged behind the overall market's gains.

The current share price, showing a discount to the consensus analyst price target of US$169.18, suggests market skepticism about achieving those projected earnings and revenue growth due to ongoing legal and market pressures. As such, it is crucial for investors to assess whether these challenges may constrain Johnson & Johnson’s ability to reach or surpass analyst expectations in the near term.

Evaluate Johnson & Johnson's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives