- United States

- /

- Household Products

- /

- NYSE:PG

Is The Procter & Gamble Company's (NYSE:PG) ROE Of 20% Impressive?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. By way of learning-by-doing, we'll look at ROE to gain a better understanding of The Procter & Gamble Company (NYSE:PG).

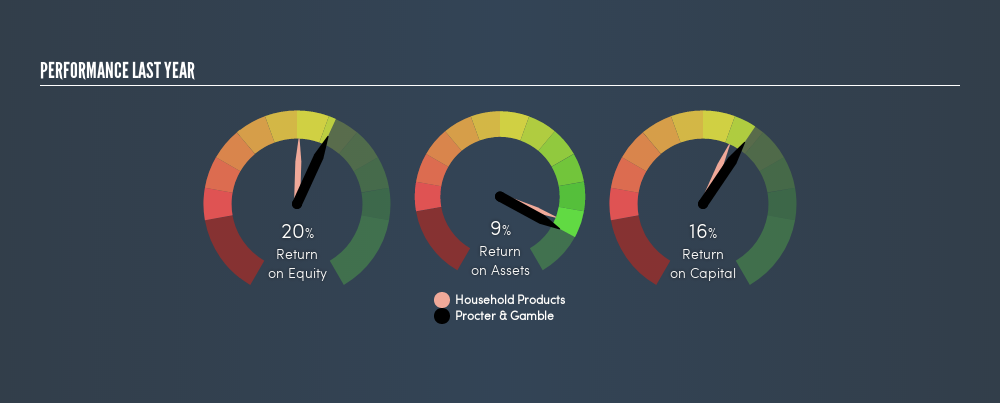

Our data shows Procter & Gamble has a return on equity of 20% for the last year. Another way to think of that is that for every $1 worth of equity in the company, it was able to earn $0.20.

Check out our latest analysis for Procter & Gamble

How Do I Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit ÷ Shareholders' Equity

Or for Procter & Gamble:

20% = 10523 ÷ US$54b (Based on the trailing twelve months to December 2018.)

Most readers would understand what net profit is, but it’s worth explaining the concept of shareholders’ equity. It is all earnings retained by the company, plus any capital paid in by shareholders. You can calculate shareholders' equity by subtracting the company's total liabilities from its total assets.

What Does Return On Equity Mean?

Return on Equity measures a company's profitability against the profit it has kept for the business (plus any capital injections). The 'return' is the profit over the last twelve months. A higher profit will lead to a higher ROE. So, all else equal, investors should like a high ROE. That means ROE can be used to compare two businesses.

Does Procter & Gamble Have A Good ROE?

By comparing a company's ROE with its industry average, we can get a quick measure of how good it is. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As you can see in the graphic below, Procter & Gamble has a higher ROE than the average (16%) in the Household Products industry.

That's what I like to see. I usually take a closer look when a company has a better ROE than industry peers. One data point to check is if insiders have bought shares recently.

Why You Should Consider Debt When Looking At ROE

Companies usually need to invest money to grow their profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the use of debt will improve the returns, but will not change the equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking.

Combining Procter & Gamble's Debt And Its 20% Return On Equity

Procter & Gamble has a debt to equity ratio of 0.62, which is far from excessive. The combination of modest debt and a very respectable ROE suggests this is a business worth watching. Judicious use of debt to improve returns can certainly be a good thing, although it does elevate risk slightly and reduce future optionality.

The Key Takeaway

Return on equity is useful for comparing the quality of different businesses. Companies that can achieve high returns on equity without too much debt are generally of good quality. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to check this FREE visualization of analyst forecasts for the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:PG

Procter & Gamble

Engages in the provision of branded consumer packaged goods worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives