- Germany

- /

- Entertainment

- /

- XTRA:SPM

Is Splendid Medien AG (ETR:SPM) Excessively Paying Its CEO?

Andreas Klein is the CEO of Splendid Medien AG (ETR:SPM). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Splendid Medien

How Does Andreas Klein's Compensation Compare With Similar Sized Companies?

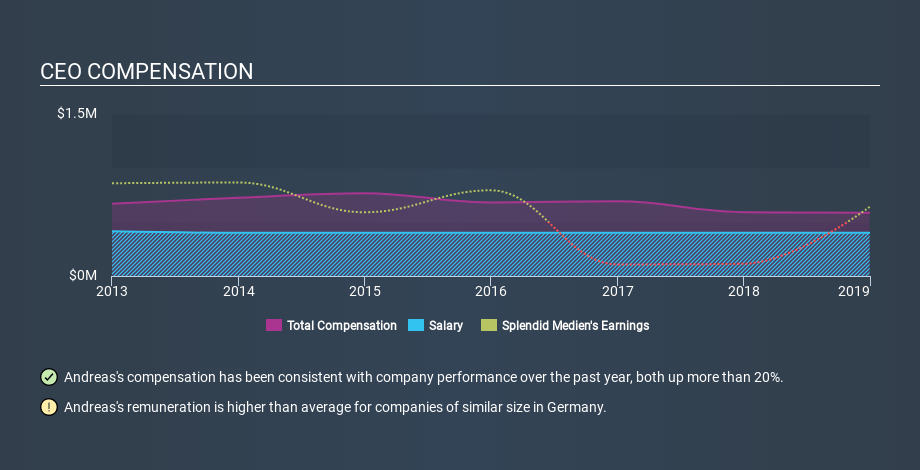

Our data indicates that Splendid Medien AG is worth €8.0m, and total annual CEO compensation was reported as €586k for the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at €400k. We examined a group of similar sized companies, with market capitalizations of below €180m. The median CEO total compensation in that group is €194k.

As you can see, Andreas Klein is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Splendid Medien AG is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see a visual representation of the CEO compensation at Splendid Medien, below.

Is Splendid Medien AG Growing?

On average over the last three years, Splendid Medien AG has shrunk earnings per share by 24% each year (measured with a line of best fit). Its revenue is down 3.0% over last year.

Few shareholders would be pleased to read that earnings per share are lower over three years. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Splendid Medien AG Been A Good Investment?

With a three year total loss of 59%, Splendid Medien AG would certainly have some dissatisfied shareholders. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

We compared total CEO remuneration at Splendid Medien AG with the amount paid at companies with a similar market capitalization. Our data suggests that it pays above the median CEO pay within that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us. Just as bad, share price gains for investors have failed to materialize, over the same period. Some might well form the view that the CEO is paid too generously! Shareholders may want to check for free if Splendid Medien insiders are buying or selling shares.

If you want to buy a stock that is better than Splendid Medien, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:SPM

Splendid Medien

Provides various services for the film and television industries in Germany, rest of Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.