- India

- /

- Trade Distributors

- /

- NSEI:SANGHVIMOV

Is Sanghvi Movers (NSE:SANGHVIMOV) Shrinking?

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. And from a first read, things don't look too good at Sanghvi Movers (NSE:SANGHVIMOV), so let's see why.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Sanghvi Movers, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.017 = ₹163m ÷ (₹11b - ₹1.4b) (Based on the trailing twelve months to March 2020).

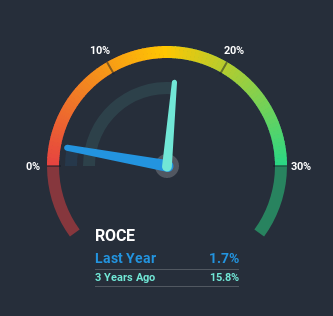

Thus, Sanghvi Movers has an ROCE of 1.7%. In absolute terms, that's a low return and it also under-performs the Trade Distributors industry average of 7.0%.

See our latest analysis for Sanghvi Movers

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sanghvi Movers' ROCE against it's prior returns. If you're interested in investigating Sanghvi Movers' past further, check out this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

In terms of Sanghvi Movers' historical ROCE movements, the trend doesn't inspire confidence. About five years ago, returns on capital were 6.3%, however they're now substantially lower than that as we saw above. Meanwhile, capital employed in the business has stayed roughly the flat over the period. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Sanghvi Movers becoming one if things continue as they have.

In Conclusion...

In summary, it's unfortunate that Sanghvi Movers is generating lower returns from the same amount of capital. We expect this has contributed to the stock plummeting 80% during the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you'd like to know more about Sanghvi Movers, we've spotted 4 warning signs, and 2 of them are significant.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade Sanghvi Movers, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SANGHVIMOV

Sanghvi Movers

Operates as a crane rental company in India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The NVIDIA Phenomenon

Take Two Interactive Software TTWO Valuation Analysis

Recursion Pharmaceuticals! WTH is going on?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion