Is Now The Time To Put Akzo Nobel India (NSE:AKZOINDIA) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Akzo Nobel India (NSE:AKZOINDIA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Akzo Nobel India

How Fast Is Akzo Nobel India Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that Akzo Nobel India's EPS have grown from ₹45.99 to ₹52.13 over twelve months. That's a 13% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While Akzo Nobel India may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

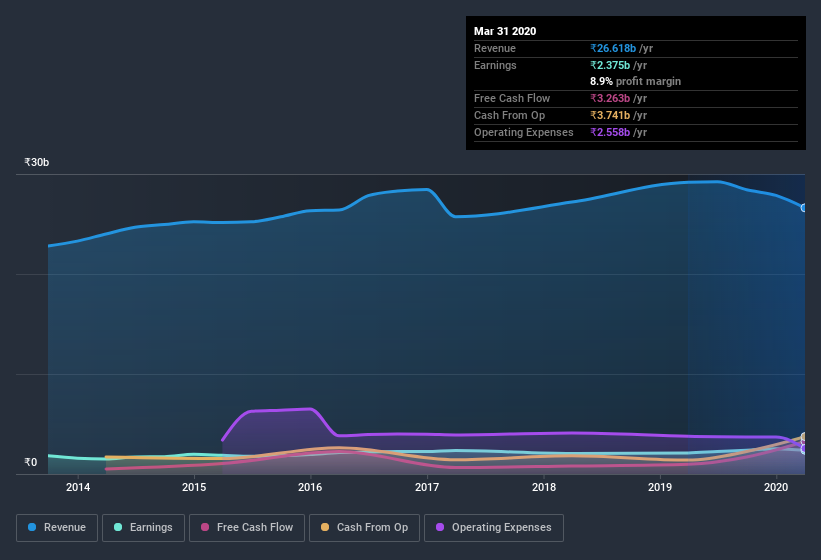

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Akzo Nobel India Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Akzo Nobel India with market caps between ₹30b and ₹119b is about ₹28m.

The CEO of Akzo Nobel India only received ₹11m in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Akzo Nobel India To Your Watchlist?

One important encouraging feature of Akzo Nobel India is that it is growing profits. Not only that, but the CEO is paid quite reasonably, which makes me feel more trusting of the board of directors. So I do think the stock deserves further research, if not instant addition to your watchlist. It is worth noting though that we have found 1 warning sign for Akzo Nobel India that you need to take into consideration.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Akzo Nobel India, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:AKZOINDIA

Akzo Nobel India

Manufactures, distributes, and sells paints and coatings in India and internationally.

Outstanding track record with excellent balance sheet.