- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Is Kratos Defense & Security Solutions (NASDAQ:KTOS) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Kratos Defense & Security Solutions

What Is Kratos Defense & Security Solutions's Net Debt?

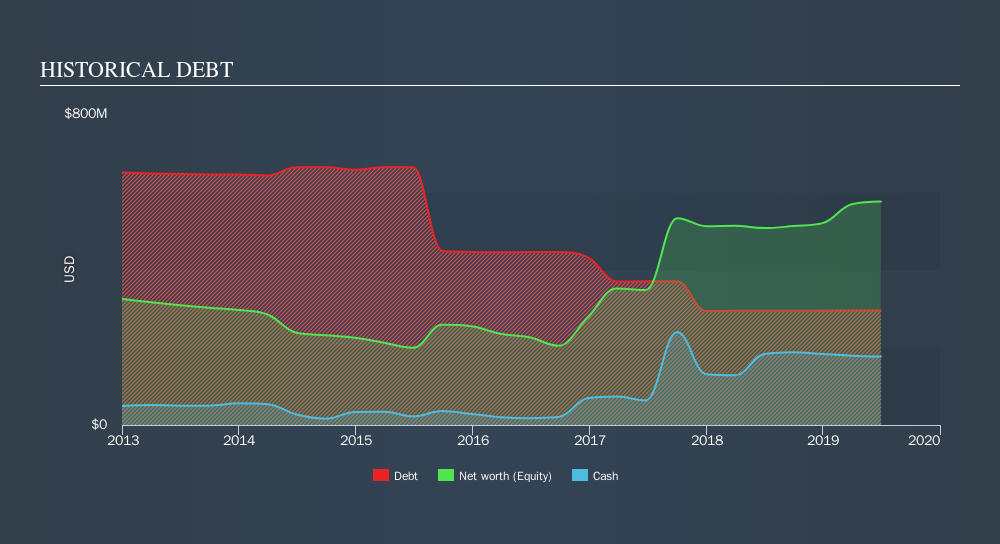

As you can see below, Kratos Defense & Security Solutions had US$294.6m of debt, at June 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$176.2m, its net debt is less, at about US$118.4m.

How Strong Is Kratos Defense & Security Solutions's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kratos Defense & Security Solutions had liabilities of US$188.9m due within 12 months and liabilities of US$409.8m due beyond that. Offsetting this, it had US$176.2m in cash and US$236.9m in receivables that were due within 12 months. So its liabilities total US$185.6m more than the combination of its cash and short-term receivables.

Given Kratos Defense & Security Solutions has a market capitalization of US$1.98b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Even though Kratos Defense & Security Solutions's debt is only 2.0, its interest cover is really very low at 2.0. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. It is well worth noting that Kratos Defense & Security Solutions's EBIT shot up like bamboo after rain, gaining 83% in the last twelve months. That'll make it easier to manage its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Kratos Defense & Security Solutions can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last two years, Kratos Defense & Security Solutions burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We weren't impressed with Kratos Defense & Security Solutions's interest cover, and its conversion of EBIT to free cash flow made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble growing its EBIT. When we consider all the factors mentioned above, we do feel a bit cautious about Kratos Defense & Security Solutions's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Kratos Defense & Security Solutions insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives